Friday 31 May 2019

Why All Bitcoin and Crypto Investors Should Consider U2F Security Keys @newsbtc #Bitcoin #Crypto #bitcoin #bitgo #coinbase #crypto #u2f

The Chief Information Security Officer at Coinbase, Philip Martin, has revealed that the firm has enabled its Coinbase and Coinbase Pro a...

The Chief Information Security Officer at Coinbase, Philip Martin, has revealed that the firm has enabled its Coinbase and Coinbase Pro accounts to support securing Bitcoin and other crypto assets using U2F Security Keys – a safer, and somewhat ironclad alternative to SMS-based two-factor protection of accounts.

With SIM-based hacks picking up in pace and severity, and with crypto being so attractive to cyber criminals due to the pseudo-anonymity and general unfamiliarity associated with it, U2F protection via Security Keys are likely to become a necessary investment for any and all crypto investors who care about the safety of their assets.

Coinbase: Secure Your Bitcoin With U2F Security Keys

This week, San Francisco-based crypto giant Coinbase revealed that its customers can now secure their crypto assets and Bitcoin using Security Keys and WebAuthN.

Coinbase now supports security keys! Really excited to get this out the door and in the hands of our customers. https://t.co/4fpEb0z3WW

— Philip Martin (@SecurityGuyPhil) May 30, 2019

In a blog post shared by Chief Information Security Officer Philip Martin, the firm revealed that support for U2F (Universal 2nd Factor) has now been enabled. The completely optional feature arms crypto investors with the highest level of personal asset security – far safer and secure than traditional SMS-based two-factor authentication, and even safer than authenticator apps like Google Authenticator or Authy.

Related Reading | Google U2F Security Expert: Crypto is Like Catnip for Cyber Criminals

Coinbase calls Security Keys the “gold standard of modern account security,” and recommends users secure additional accounts using Security Keys, such as Twitter, Dropbox, Youtube, Instagram or Gmail – which oftentimes is tied to the login of crypto exchange accounts and acts as another backdoor for cyber criminals to access.

Why Crypto Investors Need To Consider U2F Security Keys

The emergence of Bitcoin ten years ago brought with it the creation of an entire new asset class in crypto. The young, budding financial technology has the potential to completely transform money as we know it. Bitcoin and most cryptocurrencies that came after it were designed to be decentralized, and borderless, with no controlling party that can intervene in transactions, freeze assets, and more the same way governments can govern the fiat currencies held by its citizens. But putting complete control, ownership, and therefore responsibility over significant wealth in the hands of the average person, is a recipe for disaster.

Even Coinbase concludes the”vast majority of theft is due to human error.”

In a recent Medium post entitled The Most Expensive Lesson Of My Life: Details of SIM Port Hack, the author, Sean Coonce, Engineering Leadership at BitGo – the self-proclaimed “leader in the storage of digital assets” – details an account where the developer had his entire crypto accounts drained in a SIM port hack.

Related Reading | Pro League of Legends Gamer Robbed of $200K in Crypto in Sim-Hack

SIM port hacks are an emerging trend where cyber criminals gain unauthorized access to a user’s phone number, which is then used to receive SMS-based two-factor codes allowing the hackers to access sensitive financial accounts and steal all of the crypto assets held there.

In this example, even a crypto industry developer working for the “leader” in the storage of crypto had his assets stolen right out from under his nose while he slept – it’s foolish to think it couldn’t happen to you.

By investing in a U2F Security Key, cyber criminals would need access to the physical Security Key to be able to access accounts secured using this method, bringing the highest level of protection possible. The downside is that the user will experience a minor inconvenience each time they need to log into an account, or may be locked out themselves if they don’t have immediate physical access to the Security Key. But it’s an inconvenience worth experiencing for the added safety and security.

Pro tip: The Ledger Nano S doubles as a security key, and can be used to secure even Gmail accounts.

The post Why All Bitcoin and Crypto Investors Should Consider U2F Security Keys appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/why-all-bitcoin-and-crypto-investors-should-consider-u2f-security-keys-5cf1ce1125e47a2259b2776f

Bitcoin (BTC) Price Recovers Sharply: Can Bulls Overcome Hurdles? @newsbtc #Analysis #Technical #bitcoin #btc

- Bitcoin price declined heavily and tested the $8,000 support area against the US Dollar.

- The price recovered nicely and traded above the $8,300 and $8,450 resistance levels.

- There is a rising cha...

- Bitcoin price declined heavily and tested the $8,000 support area against the US Dollar.

- The price recovered nicely and traded above the $8,300 and $8,450 resistance levels.

- There is a rising channel forming with support near $8,450 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair is facing a solid resistance near the $8,600 area and the 100 hourly simple moving average.

Bitcoin price is currently recovering above $8,450 against the US Dollar. BTC needs to surpass the $8,600 barrier to move back in a positive zone and climb further higher.

Bitcoin Price Analysis

Recently, bitcoin price declined sharply after pumping to a new 2019 high at $9,091 against the US Dollar. The BTC/USD pair collapsed below the $8,800 and $8,600 support levels. The decline was strong and gained pace below the $8,450 support plus the 100 hourly simple moving average. Moreover, there was a clear break below the $8,300 support and the $8,220 pivot level. The price traded close to the $8,000 level, where the bulls protected further losses.

A swing low was formed near $7,999 before the price started a strong recovery. There was a pump above the $8,300 level and the 23.6% Fib retracement level of the recent decline from the $9,091 high to $7,999 low. More importantly, the price traded above the $8,450 resistance. At the moment, the price is trading above the 50% Fib retracement level of the recent decline from the $9,091 high to $7,999 low. Besides, there is a rising channel forming with support near $8,450 on the hourly chart of the BTC/USD pair.

On the downside, there is a strong support forming near the $8,450 level. If there is a downside break below $8,450, the price might restart its decline towards the $8,300 level. The next key supports are near the $8,220 and $8,150 levels. On the upside, the main resistance is near the $8,600 level and the 100 hourly SMA. The 61.8% Fib retracement level of the recent decline from the $9,091 high to $7,999 low is also near the $8,670 level. Therefore, a successful break above the $8,600 and $8,670 levels is needed for more gains in the near term.

Looking at the chart, bitcoin price recovered nicely above $8,450 and it is currently showing positive zone. If the bulls remain in action and push the price above $8,600, there are chances of bullish continuation.

Technical indicators:

Hourly MACD – The MACD is back in the bullish zone, with positive signs.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD climbed back above the 50 level, with a positive angle.

Major Support Levels – $8,450 followed by $8,300.

Major Resistance Levels – $8,600, $8,670 and $8,800.

The post Bitcoin (BTC) Price Recovers Sharply: Can Bulls Overcome Hurdles? appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/bitcoin-btc-price-recovers-sharply-can-bulls-overcome-hurdles-5cf1fa2125e47a2259b27773

Get Ready For Lightning Tether USDT @securitiesio #Security Token News #Bitfinex #Lightning Network #stable coin #Tether

Tether (USDT) upped-the-ante in the battle to become the top stable coin this week after announcing plans to issue on the Lightning Network in the coming months. The news comes at a time of peak Lightning Network adoption and many see the news as ...

Tether (USDT) upped-the-ante in the battle to become the top stable coin this week after announcing plans to issue on the Lightning Network in the coming months. The news comes at a time of peak Lightning Network adoption and many see the news as a good sign for both projects moving forward.

Tether – A Long Time Coming

Interestingly, Bitfinex discussed Lightning Network integration as far back as April 2017. In this Tether update post, the company laid out its future strategies. These strategies included issuing Tether on multiple blockchains such as Ethereum, Litecoin, and the Lightning Network.

Interestingly the post discusses plans to issue other tokens on the Tether network as well. Notably, it was at this time that Tether first issued its EURO counterpart, a stable token called EURT. Just like USDT, EURT is backed by fiat. Today EURT is issued on the Stellar Lumens network and is a major stable coin in the EU market.

Tether Data via CoinMarketCap

Multiple Blockchains

Nowadays, Tether issues on a number of blockchains including EOS, Omni Layer, TRON, ETH, LTC and starting in two weeks, Blockstream’s Liquid. Issuing USDT on these blockchains strengthens the company’s positioning in the market. Additionally, it can add functionality as is the case with the Lightning Network.

Discussing the concept, Tether’s chief technology officer, Paolo Ardoino explained the benefits of the integration. Using the Lightning Network for small, low-cost transactions increases Tethers usability and transaction speed.

Tether is a First

Tether would be the first major asset launched on the Lightning Network. Not surprisingly, the Bitfinex/Tether camp is a big supporter of this upending technology. So much so, the firm joined RGB. RGB is a cooperation of firms seeking to put more assets onto the Lightning Network.

Bitfinex in The News

Bitfinex continues to see heavy media coverage regarding its current legal battle with the New York Attorney General, Letitia James. James claims to have evidence that proves Bitfinex and Tether conspired to cover up to $850 million in losses. In response, Bitfinex claims no wrongdoing. Also, this week the firm obtained a Stay of Demands from the NY Supreme Court.

A Stay of Demands halts the Attorney Generals full document requests in order to first establish if the company falls under NY jurisdiction. The company’s lawyers argued that the firm has no offices in NY and hasn’t harmed any of the state’s investors. Therefore, NY has no legal jurisdiction over the company. Now, Bitfinex only has to supply the required paperwork to support their argument.

A Smart Strategy

Despite these recent road bumps, Bitfinex continually finds new and innovative ways to issue USDT. This strategy increases the value of the token in terms of notoriety. It also locks Tether in with all the major players in the crypto market. The more blockchains the token can issue upon, the more users, promotions, and functions, Tether achieves.

Lightning Network Goes Mainstream

The Lightning Network continues to expand in all directions. This latest announcement is sure to drive further adoption. Additionally, Tether should see a boost in use as their transaction times and fees reduce when on the Lightning Network. Together, these projects are ready to shape the future cryptomarket.

The post Get Ready For Lightning Tether USDT appeared first on .

source https://www.tokentalk.co/Securities/get-ready-for-lightning-tether-usdt-5cf1bb51bc1c535854e6eab9

Coinbase president and COO Asiff Hirji departs the firm @TheBlock__ #Companies #Exchanges #coinbase #CTO #exit

The president and chief operating officer of cryptocurrency exchange Coinbase has departed the firm, the latest major exit from the San Francisco company, according to a source familiar with the situation.

Asiff Hirji joined the company i...

The president and chief operating officer of cryptocurrency exchange Coinbase has departed the firm, the latest major exit from the San Francisco company, according to a source familiar with the situation.

Asiff Hirji joined the company in December 2017 to help drive the firm's entrance into new markets, including Coinbase Custody. His exit was announced this afternoon at a company all-hands, according to a source.

Hirji exit closely follows that of Coinbase's chief technology officer Balaji Srinivasan, who left at the beginning of the month, as well as its former head of institutions Dan Romero, who left the company earlier this year.

The firm has undergone a number of notable changes since the beginning of 2019. For instance, the firm has been de-emphasizing its focus on luring larger institutional firms to its marketplace, axing a project in Chicago to build-out a matching engine to meet the needs of high-frequency traders and winding down its plans to build out a full-scale prime broker.

Still, the firm has witnessed growth in other areas, including Coinbase Custody and over-the-counter trading, according to its CEO Brian Armstrong. Its OTC business, which was launched in Q4 2018, has grown 100% quarter-over-quarter. Its custody business has grown to $700M in two quarters.

The firm, which was last valued at $8 billion, gatecrashed new corners of the crypto market, including staking. Through its custody business, Coinbase provides services that allow hedge funds to stake certain cryptocurrencies, offering additional yield on them.

In total, the firm staffs over 800 people.

Hirji joined the firm from Andreessen Horowitz, the venture capital firm. He also was the president and COO of TD Ameritrade, the world's largest broker. He also held positions at TPG Capital and Bain Capital.

source https://www.tokentalk.co/The Block/coinbase-president-and-coo-asiff-hirji-departs-the-firm-5cf1c78025e47a2259b2776e

Wall Street Veterans Introduce Innovative Volatility Product to Digital Asset Space @EtherWorldNews #Cryptocurrency #NEWS

With global policy development and adoption underway, the trading volume of digital assets has been steadily rising especially as the Bitcoin price recovers last several months. Different from traditional stock market that is limited by trading hours and circuit breakers, digital asset trading runs continuously 24*7 across all geographic regions with fewer regulations in place and less institutional participation. Therefore, the volatility has been noticeably higher than most of the traditional assets making it riskier as a mid-term investment product but more of short-term trading vehicle. As the market further matures and expands, there is an increasing need for the development of more derivative products, especially volatility product that traders can trade off on price fluctuation. With such observation of market requirement, BitMax.io, a leading next generation digital asset trading platform, introduces its first volatility-linked derivative product: Volatility Card, a simple yet elegant way to trade on the price movement of underlying digital asset.

ⅰ. Volatility Product: Risk Mitigation and / or Momentum Trading

In the traditional finance industry, diversified volatility derivative products are readily available for traders to capitalize upon the short-term trading momentum and/or use as risk hedging mechanism, such as Index-linked (such as VIX) options, futures and ETFs across major asset classes. Those products usually require the traders to “pay” premium as part of cost structure for optionality. Such derivatives can be used for both hedging and speculation. However, most of such derivatives have not been introduced to the space of digital asset trading, except for a few “leveraged” products which by design increase risk exposure instead of mitigating it. So current market calls for new types of volatility products for global users to gain exposure to the increasing volatility from both trading and risk management perspectives.

ⅱ. Breakthrough in Digital Asset Trading: A Simple yet Effective Product to Extract the Essential Value of Volatility

For traditional asset classes, volatility derivatives, such as option, set a series of strikes and expiry time, and each combination forms a new tradable “asset” that demands liquidity. The liquidity of all these options are hard to maintain on the consistent basis. Even the most liquid asset may see sparse liquidity in options of strikes that are far away from spot price or expiration dates that are either too close or too far. And it even gets worse in the case of digital assets. Various issues from scarcity of liquidity to unresolved infrastructure issue like clearing and settlement has hindered the development of volatility derivatives products.

With lack of mature market structure and nascent development stage, the digital asset trading market has been highly volatile with many sharp price movements, especially recent months. There is no better time than now to introduce an entry-level volatility product for broad-based retail and institutional users. This new product is called Volatility Card, to be launched BitMax.io, a rising digital asset trading platform founded by a group of Wall Street quantitative trading veterans. The principle of simple yet effective design aims to extract the essential trading value of volatility.

ⅲ. First Volatility Card: Easy Way to Trade on Daily Price Movement of Bitcoin

BitMax.io announced its launch of the first volatility product, Volatility Card, named as Turtle Card and Bunny Card after the famous Aesop’s fable – the Tortoise and the Hare. Similar to short-term volatility products with quasi-option structure yet simple payout form, the card allows users to forecast and trade on 24hr-window (UTC 00:00 – 24:00) price fluctuation for the underlying trading pair.

Turtle Card represents a prediction of 24-hour price movement within certain percentage range; while Bunny Card represents a prediction of 24-hour price movement above certain percentage range. For instance, if user expects the 24-hour price change for BTC/USDT within +/- 3%, the user should purchase Turtle Card. Otherwise, the user can purchase Bunny Card for the prediction for BTC/USDT 24-hour price movement ≥ 3%. Each card has its notional value and sale price, denominated in either USDT or BTMX, the native token of BitMax.io platform. Users who can correctly predict the range of price movement at the end of 24-hour window will get payout equivalent to notional value of the card. Otherwise, the card will become invalid upon expiration.

To mitigate potential price deviation due to market volatility, BitMax.io uses composite reference price for the calculation of 24-hour price movement. The reference price is computed by taking an average of last trade price from five exchanges (upon availability at the time of computation).

Volatility Card is another great example demonstrating BitMax.io‘s deep understanding of the market and user need. This product is by design friendly to both experienced and new traders. First, there is preset of 24-hour window. Users only need to make decision on when to buy in, not the time of settlement. Second, user picks the card to predict only the range (absolute value) of price movement, not the direction (up or down). Third, the card sale price is subject to change based on real-time market condition, while the notional value for the card is also preset as fixed. This design, to some extent, would mitigate pricing risk due to the time difference.

ⅳ. Potential Risk Hedging Tool: Riding through Raging Volatility

As stated in the beginning, volatility products can be used to mitigate certain trading risks and cryptocurrency has much higher volatility than any other traditional asset classes. Last six months, Bitcoin has seen a wide ride from the crush down to winter lows of $3500 to recent price spike up to $9000. In those extreme scenarios, tail risks are hard to predict. When leverages are applied, the profit or loss would be magnified. As Volatility Cards on BitMax.io are irrelevant to the rise or fall of price, It may serve as a potential tool for partially risk hedging in the volatile market condition against outsized price swing.

v. Conclusion

In summary, Volatility Card is another move by BitMax.io to further expand its trading product suite for its global users leveraging their deep root in traditional finance and experience with financial product design . With its potential function to mitigate risks as well as trade on momentum, it helps attracting more users to the platform. Along with the margin trading and transaction mining launched earlier, this is definitely a step forward from product offering perspective to better serve the dynamic trading needs of users and encourage liquidity on the platform. Although the Volatility Card is largely simplified compared to the complex derivatives in the traditional financial space, BitMax.io has clearly established itself as a leading industry innovator in the highly competitive digital asset trading space through the introduction of this friendly new product. It is also a positive sign indicating the market is developing along the right direction.

The post Wall Street Veterans Introduce Innovative Volatility Product to Digital Asset Space appeared first on Ethereum World News.

source https://www.tokentalk.co/EWN/wall-street-veterans-introduce-innovative-volatility-product-to-digital-asset-space-5cf1bb50bc1c535854e6eab8

EOS Biggest Announcement Ever To Be Revealed Tomorrow @iiblockchain #Cryptocurrencies & Platforms #News #block.one #Dan Larimer #eps

After months of anticipation and speculation, tomorrow will reveal all! We have been waiting for this apparent “biggest announcement…

The post EOS Biggest Announcement Ever To Be Revealed Tomorrow appeared first on Invest In Blockchain.

source https://www.tokentalk.co/IIB/eos-biggest-announcement-ever-to-be-revealed-tomorrow-5cf12dc13f8913fb3997c438

James Altucher Amends Timeframe For $1 Million Bitcoin @bitcoinist #Bitcoin #Bitcoin Price #News #News teaser #Bitcoin price prediction

Former...

Former hedge-fund manager and author, James Altucher, confirmed his $1 million bitcoin prediction, but admitted the timeframe may have slipped.

Altucher explained the claim during an interview on Kitco news, a precious metals specialist.

$1 Million By 2020?

Self-help guru and LinkedIn influencer, Altucher, first made his prediction at the tail-end of 2017, when BTC was around $11k.

He told CNBC’s Squawk Alley,

I’ll say $1 million by 2020, as well, easily. There’s 15 million millionaires around the world. All their financial advisors are going to say, ‘Hey, buy a bitcoin. You need some exposure.

When questioned on this claim during the interview, Altucher was happy to go into more detail.

The valuation relies on Bitcoin replacing paper currency, although Altucher believes that Bitcoin’s superior qualities should see this happening either fully or partially in the long run.

There is an estimated $200 trillion dollars of existing paper currency, and only $200 billion dollars of cryptocurrency. Therefore, he explained:

that is 100,000 percent from here. So that could give bitcoin a price of $8 million dollars, so $1 million dollars is even a discount to where bitcoin could eventually go.

So When Does BTC Get To That $1 Million?

On that, Altucher wasn’t so sure, although he didn’t rule out his earlier prediction of 2020.

Will it be a million dollars in 2020? Maybe. Will it be 2021? 2022? Who knows.

However, he claimed that at some point a country’s currency will collapse, causing the population to move to Bitcoin. This kind of mass adoption, coupled with greater acceptance as payments, and eventual SEC approval, will be the catalyst.

We have already seen increasing adoption of Bitcoin as a hedge against economic uncertainty in places like Argentina, Iran, and Venezuela.

One person who is hoping Altucher’s original timeframe for the $1 million bitcoin doesn’t slip is John McAfee. After all, if bitcoin doesn’t hit that price by the end of 2020, he says he will wolf down his winkle on the telly.

Several other analysts have made predictions of Bitcoin going to $1 million. From IBM Exec, Jesse Lund, who simply said ‘sometime’, to Xapo CEO, Wences Casares, who two years ago predicted it would take 5-10 years.

Do you agree with Altucher’s bitcoin price prediction?

Images via Shutterstock

The post James Altucher Amends Timeframe For $1 Million Bitcoin appeared first on Bitcoinist.com.

source https://www.tokentalk.co/Bitcoinist/james-altucher-amends-timeframe-for-1-million-bitcoin-5cf125512f9352851246b57a

Australian regulator issues fresh guidance regarding ICOs and crypto assets, but gaps remain @TheBlock__ #Cryptocurrency #ASIC #Australia #ICOs #license #Regulations

The Australian Securities and Investments Commission (ASIC) has issued updated guidance</...

The Australian Securities and Investments Commission (ASIC) has issued updated guidance to local cryptocurrency companies conducting initial coin offerings (ICOs).

In short, if their tokens fall under the category of a financial product or involve financial products like a security, an Australian financial services (AFS) license is required and the issuer must comply with the Corporations Act.

According to ASIC Commissioner John Price, businesses should research whether they are in compliance with “all relevant Australian laws", including local Consumer Law, hoping to prevent users being misled as well as the issuance of unregulated securities. Price warned that "Australian laws will also apply even if the ICO or crypto-asset is promoted or sold to Australians from offshore."

The guidelines also outline requirements for crypto-asset intermediaries who offer advice or deal in crypto assets, miners, as well as exchanges and trading platforms. Meanwhile, wallets and custody service providers need to ensure they have appropriate custodial and depository authorisations.

Tazmania-based Alex Saunders has been working closely with the Australian government in recent months, hoping to soothe the government’s increasingly sceptical attitude towards crypto. However, he told The Block the laws mainly clarify "what we already knew" and that "the hard part is still determining a utility token vs what they want to classify as a security."

source https://www.tokentalk.co/The Block/australian-regulator-issues-fresh-guidance-regarding-icos-and-crypto-assets-but-gaps-remain-5cf11b012f9352851246b579

Trezor Model T Review: Buggy, odd UX but easy set up process @decryptmedia #Reviews #bitcoin #cryptocurrency wallet #dogecoin #hardware reviews #stellar #trezor model t

We can’t help but love the personalization options of the Trezor Model T but do they make up for the user experience?

The post Trezor Model T Review: Buggy, odd UX but ...

We can’t help but love the personalization options of the Trezor Model T but do they make up for the user experience?

The post Trezor Model T Review: Buggy, odd UX but easy set up process appeared first on Decrypt.

source https://www.tokentalk.co/Decrypt/trezor-model-t-review-buggy-odd-ux-but-easy-set-up-process-5cf109322f9352851246b572

Bitcoin Falls $1,000 on Futures Expiry @trustnodes #Bitcoin #News

Probable futures manipulation was on show last night in an almost identical repeat of Thursday, April 25th. Just as then bitcoin fell by about 10%, so too on Thursday May...

Probable futures manipulation was on show last night in an almost identical repeat of Thursday, April 25th. Just as then bitcoin fell by about 10%, so too on Thursday May...source https://www.tokentalk.co/Trustnodes/bitcoin-falls-1000-on-futures-expiry-5cf117482f9352851246b578

Are Chinese Capital Controls What’s Pushing Up Bitcoin Price? @bitcoinist #Bitcoin #Bitcoin Price #News #News teaser #bitcoin price #Chinese Capital Outflow Controls #US-China trade war

A ...

A former Chinese central bank advisor was denied transferring $20,000 abroad to pay for a vacation. Could increasing capital controls in China be driving Bitcoin price?

Chinese Capital Outflow Controls Are ‘Extreme’

Yu Yongding is a former advisor to the People’s Bank of China. He just tried to transfer $20,000 USD out of China to fund a visit to relatives living abroad. He was denied on the grounds that he was ‘too old’.

That’s actually illegal in China since, under Chinese law, all citizens are permitted foreign transfers of up to US$50,000 a year regardless of their age.

Yongding has always been an advocate for preventing capital flight from his country. But this recent incident has lead him to conclude that the latest crackdowns have become “extreme”. They also caused the South China Morning Post to comment that:

The case adds fresh evidence that China is tightening controls of personal purchases of US dollars despite a US$50,000 personal allowance each year

The Crackdown Is Hurting Foreign Exchange Deals

Quoted in Chinese news portal Sina.com, Mr. Yongding added:

Legal foreign exchange deals are being hindered

He expressed concerns that the latest controls had become too rigid and were hurting Chinese trade. Tightening Chinese capital outflow controls have historically been a good thing for Bitcoin price.

The State Administration of Foreign Exchange (SAFE), China’s FX regulator and capital controls gatekeeper, insists that no change has been made to the $50,000 annual amount. However, it denied comment on the SCMP’s questions regarding Yongding’s case.

China’s Clampdown Is Great News for Bitcoin Price

Yongding added that, while there were significant outflows in 2015 and 2016, he saw no clear signs currently, reinforcing that the latest clampdown is unnecessary.

However, Zerohedge notes two rather interesting and valid points. Firstly, if the controls in place are indeed as “extreme” as Yongding maintains, there would be no capital outflows. And secondly:

perhaps Yu was looking at the wrong place – if, as in 2016/2017 when Bitcoin exploded, the former central banker was instead looking at the price of cryptocurrencies he may observe some “clear signs” of outflows, those taking place via cryptocurrency.

Beijing appears to be scrambling to prevent a tidal wave of yuan selling and preserve its value against the dollar by making it “virtually impossible” to sell:

In effect fully isolating China from the global FX system. As a result, those who are desperate to transfer their funds offshore are forced to find creative alternatives.

In short? Just as they did in 2016 and 2017, the Chinese are turning to Bitcoin instead and driving Bitcoin price higher.

The drawn-out US-China trade war may be one of the best things to happen to Bitcoin. China’s total deposits dwarf Bitcoin’s $127 billion market cap by around 124 times–that’s a potentially massive sum coming on-ramp.

Are the Chinese pouring into bitcoin due to extreme capital controls? Share your thoughts below!

Images via Shutterstock, Tradingview.com

The post Are Chinese Capital Controls What’s Pushing Up Bitcoin Price? appeared first on Bitcoinist.com.

source https://www.tokentalk.co/Bitcoinist/are-chinese-capital-controls-whats-pushing-up-bitcoin-price-5cf109312f9352851246b571

G-20 Progressing on Registry for Cryptocurrency Exchanges to Stop Money Laundering @EtherWorldNews #NEWS #cryptocurrency exchanges #G-20 #regulations

The Group of 20 major economies grouped together as the G-20 is progressing with its aim to understand and find space for cryptocurrencies within the world economies. Their latest drive is a push for a registry for cryptocurrency exchanges to help curve potential money laundering.

It is expected that the G-20 will soon come to an agreement on this registry after formally recognising and taking head of the cryptocurrency market place only about a year or so ago.

Finance ministers and central bankers from the bloc will discuss challenges surrounding digital currencies, including money laundering and customer protection, at a meeting in the Japanese city of Fukuoka, Japan, in early June.

Concerns for central banks

There is no getting away from the fears that central banks have over digital currencies which operate decentralised and thus with no control point. They are borderless and mostly unregulated pushing those in the G-20 to try and get a regulatory framework in place for the exchanges.

It is also the anonymous nature, and the fact that the banks are cut out of knowing what transactions take place, that make digital currencies a potential hot bed for money laundering.

Japan, this year’s meet up host, has taken the lead in restricting these instruments trough their own controls of exchanges.. The country became the first to create a registry for cryptocurrency exchanges in April 2017, and it also has experience enforcing regulations, as it did after hackers stole over $500 million from Coincheck, and previously from the infamous Mt. Gox hack.

Meeting of the minds

Since cryptocurrencies and their related ecosystem has come under regulatory scrutiny there has been a swath of different approaches taken. Some, like China, have banned them out right and block access to exchanges.

This causes conflict as to how a body like the G-20 should regulate them, but also pushes further for an agreed upon standpoint as the banning of cryptocurrencies in China is an easy work around when other neighbouring companies have less stringent rules on how to operate the borderless digital currencies.

In order to help countries work together to curb illegal activities, the Financial Stability Board, an international body of financial regulators, published a directory of cryptocurrency regulators in April, which will be submitted to the G-20.

The Financial Action Task Force had said in October 2018 that virtual asset service providers ought to be subjected to anti-money laundering regulations.

“They should be licensed or registered and subject to monitoring to ensure compliance,” the policymaking body said.

The post G-20 Progressing on Registry for Cryptocurrency Exchanges to Stop Money Laundering appeared first on Ethereum World News.

source https://www.tokentalk.co/EWN/g20-progressing-on-registry-for-cryptocurrency-exchanges-to-stop-money-laundering-5cf115612f9352851246b577

Google to restrict ad blockers in Chrome @TheBlock__ #Technology #ad blocker #browsers #chrome #Google

Google Chrome is planning on curbing the use of ad-blocking extensions, limiting them only to enterprise customers, tech new-site 9to5google writes.

Google confirmed the move in an online forum, having first announced it was planning changes to its browser's extension system—Manifest V3—back in January. The plans also include redesigning the permissions system.

Non-enterprise Chrome users will instead get access to an alternative rule-based ad blocking system. This is not as effective as modern ad blockers, which tend to block commercials before they’re downloaded.

Google’s stance on ad blockers has long been known, saying they believe they pose risks to its revenues.

source https://www.tokentalk.co/The Block/google-to-restrict-ad-blockers-in-chrome-5cf0ea412f9352851246b56a

Insurers State Farm and USAA to test a blockchain solution to speed up insurance claims @TheBlock__ #Blockchain #Insurance #blockchain #State Farm #USAA

Insurance companies State Farm and USAA have announced they are testing whether a blockchain solution could speed up i...

Insurance companies State Farm and USAA have announced they are testing whether a blockchain solution could speed up insurance claims.

In particular, they are focusing on the auto claims subrogation process, which involves the recovery of costs from the at-fault party’s insurance company.

“In 2018 alone, the total amount of dollars demanded and issued through the subrogation process was over $9.6 billion for all insurance carriers,” said Mike Fields, Innovation Executive, State Farm. “You can imagine the time and resources required to complete these transactions.”

At the moment, the process is time-consuming and is done manually, often requiring mailing checks.

The tested blockchain will therefore be responsible for “compiling all subrogation payment amounts, netting the balance, and facilitating a single payment on a regular basis between insurers.” The transaction records would be verifiable.

source https://www.tokentalk.co/The Block/insurers-state-farm-and-usaa-to-test-a-blockchain-solution-to-speed-up-insurance-claims-5cf103912f9352851246b56e

Thursday 30 May 2019

Bitcoin (BTC) Price Nosedives: Is This The Start Of Major Correction? @newsbtc #Analysis #Technical #bitcoin #btc

- Bitcoin price spiked above the $8,950 and $9,000 levels, but failed to hold gains against the US Dollar.

- The price declined heavily and traded below the $8,720 and $8,440 support levels.

- There wa...

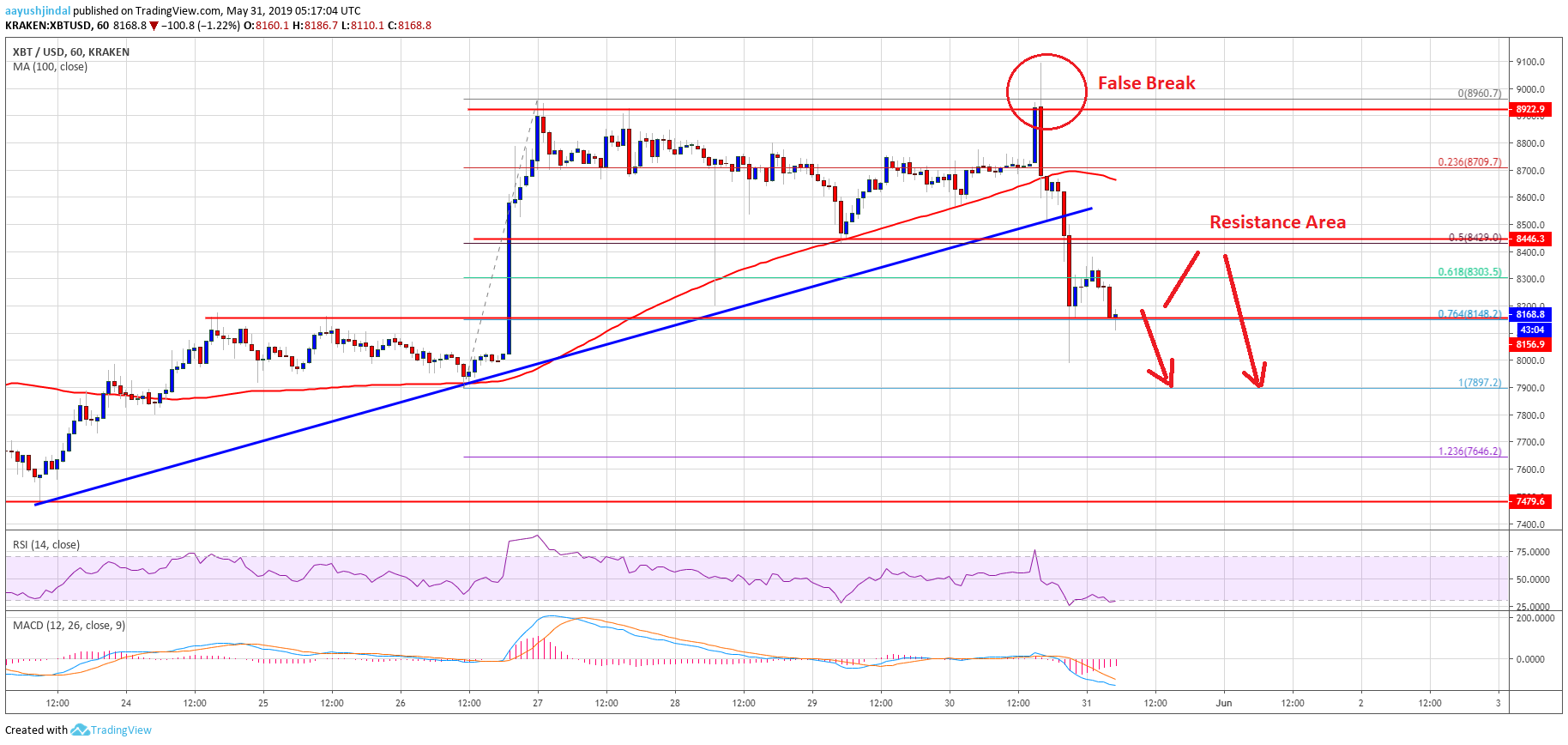

- Bitcoin price spiked above the $8,950 and $9,000 levels, but failed to hold gains against the US Dollar.

- The price declined heavily and traded below the $8,720 and $8,440 support levels.

- There was a break below a crucial bullish trend line with support at $8,560 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair is currently trading in a bearish zone below the $8,300 level and it could continue lower.

Bitcoin price failed near the $9,000 level and declined sharply against the US Dollar. BTC is currently trading in a bearish zone, with a risk of a drop towards the $7,880 support.

Bitcoin Price Analysis

Yesterday, there was an upside extension in bitcoin price above $8,800 against the US Dollar. The BTC/USD pair spiked above the $8,950 and $9,000 levels, but failed to hold gains. As a result, there was a major bearish reaction below the $8,800 level. The price declined heavily below the $8,600 support level and the 100 hourly simple moving average. Moreover, there was a clear break below the 50% Fib retracement level of the upward move from the $7,897 low to $8,960 swing high.

More importantly, there was a break below a crucial bullish trend line with support at $8,560 on the hourly chart of the BTC/USD pair. The pair is currently trading below the $8,200 level and recently tested the 76.4% Fib retracement level of the upward move from the $7,897 low to $8,960 swing high. If there is an upside correction, an initial resistance could be near the $8,400 level. The main resistance might be $8,440, above which the price could revisit the $8,700 level.

On the downside, an immediate support is at $8,000. If there is break below $8,000, the price could retest the $7,880 support area. If there are more losses, the next target for the bulls might be $7,646. It represents the 1.236 Fib extension level of the upward move from the $7,897 low to $8,960 swing high. The current price action is bearish and there is a risk of more losses below $8,000.

Looking at the chart, bitcoin price clearly started a major downside correction below $8,500. There could be range moves in the short term, but the price is likely to extend downsides below $8,100. Once the current correction is complete near $7,880 or $7,646, the price is likely to bounce back.

Technical indicators:

Hourly MACD – The MACD is slowly reducing its bearish slope, with no major positive sign.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD declined heavily and it is currently flat in the oversold zone.

Major Support Levels – $8,000 followed by $7,880.

Major Resistance Levels – $8,300, $8,440 and $8,500.

The post Bitcoin (BTC) Price Nosedives: Is This The Start Of Major Correction? appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/bitcoin-btc-price-nosedives-is-this-the-start-of-major-correction-5cf0c2e12f9352851246b563

Ethereum (ETH) Price Reversed Gains: Support Turned Resistance @newsbtc #Analysis #Technical #ETH #ethereum

- ETH price traded to a new 2019 high close to $290 and declined heavily against the US Dollar.

- The price reversed most its gains and traded below the $260 and $250 support levels.

- There was a brea...

- ETH price traded to a new 2019 high close to $290 and declined heavily against the US Dollar.

- The price reversed most its gains and traded below the $260 and $250 support levels.

- There was a break below a major bullish trend line with support at $266 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair tested the $240 level and it is currently correcting higher towards the $260 and $264 resistances.

Ethereum price declined heavily below $260 versus the US Dollar, but remained flat vs bitcoin. ETH price is currently correcting higher, but it could face a strong resistance near the $265 area.

Ethereum Price Analysis

Yesterday, there were further gains in Ethereum price above the $280 level against the US Dollar. The ETH/USD pair even broke the last swing high and traded to a new 2019 high near $290. However, the bulls failed to gain momentum and the price declined sharply below $280. There was a major downward move below the $270 and $265 support levels. The price even settled below the $265 level and the 100 hourly simple moving average.

Moreover, there was a break below a major bullish trend line with support at $266 on the hourly chart of ETH/USD. Finally, there was a spike below the $245 support level. A swing low was formed near $240 and the price is currently correcting higher. It moved above the 23.6% Fib retracement level of the recent decline from the $290 high to $240 low. However, there are many hurdles on the upside near the $262 and $265 levels (the recent support zones).

Besides, the 50% Fib retracement level of the recent decline from the $290 high to $240 low is also near the $264 level to prevent gains. The price is likely to struggle to surpass the $264 level and there is a risk of a fresh decline. On the downside, an immediate support is near the $252 level, below which the price might trade towards the $245 support area.

Looking at the chart, Ethereum price is clearly trading near a crucial juncture below $265. As long as there is no close above $265, there is a risk of another drop. On the downside, the main support is at $245, below which the price could even break the $240 level and trade further lows. The next main support is near the $232 level, where the bulls may emerge.

ETH Technical Indicators

Hourly MACD – The MACD for ETH/USD is slowly reducing its bearish slope, with many negative signs.

Hourly RSI – The RSI for ETH/USD is currently recovering from the oversold readings and remain well below the 50 level.

Major Support Level – $245

Major Resistance Level – $265

The post Ethereum (ETH) Price Reversed Gains: Support Turned Resistance appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/ethereum-eth-price-reversed-gains-support-turned-resistance-5cf09a912f9352851246b55d

Bitcoin Drops Below $8K After Hitting Yearly High, But for How Long? @bitcoinist #Bitcoin #Bitcoin Price #Markets and Prices #News #News teaser #bitcoin #bitcoin price #Cryptocurrency #Galaxy Digital #mike novogratz #Peter Brandt #Rhythmtrader

Bitcoin price finall...

Bitcoin price finally made it to $9,000. But the celebration was virtually over before anyone could celebrate. Investors are now curious how long they’ll have to wait before another $9k retest.

Bitcoin Drops 12% After Bursting Through $9k

After making a strong move above $9,000 and topping out at $9,090, Bitcoin price 00 was rejected strongly and tumbled as far as $7,980 before beginning what appears to be a slow recovery.

Bitcoin’s triumph over achieving a new 2019 high was short lived and as one would expect the crash reverberated throughout the market and led to other top coins like Ethereum, Litecoin, and Ripple declining sharply.

Overall the cryptocurrency market dropped $25 billion over the course of a few hours and at the time of writing the total market cap stands at $264 billion. While the correction came as a shock, many investors and analysts expected it as Bitcoin’s recent parabolic run meant that a pullback would need to occur at some point.

Veteran trader Peter Brandt appeared to be right on the money, given that late last week he tweeted a chart forecasting that Bitcoin would revisit $7,900 and today he playfully inquired whether the surprise correction shook FOMO investors out of their trees.

Given the recent bullishness throughout the market, it’s also not surprising that a handful of these same analysts are generally unmoved by today’s pullback and are calling for Bitcoin to blast through the $10k mark over the next week.

Rhythmtrader was among those feeling less than bothered by Bitcoin’s current state and he pointed out that Bitcoin’s path to 10K differs in 2019 as its fundamentals are significantly improved and multiple institutional players are deeply involved with the cryptocurrency market now.

$10K by Next Week?

To date, BTC/USD has gained more than 140% and on Thursday Galaxy Digital CEO Mike Novogratz told Bloomberg that Bitcoin is likely to consolidate between $7,000 and $10,000 and he explained that “trees don’t grow to the sky.” Novogratz also admitted that a surge in euphoria could quickly take Bitcoin higher and in early May he forecast it to reach $20,000 within 18 months.

Currently, BTC/USD has clawed back some territory and is attempting to overcome resistance at $3,400. The RSI shows that the top cryptocurrency is in oversold territory and a move above $3,400 is likely to increase buying volume and help Bitcoin rise to $8,600.

As Bitcoinist reported, blasting through the psychological $10,000 mark would spark ‘real FOMO’ according to Fundstrat’s research analyst, Tom Lee.

Do you think Bitcoin will retake $9k before the weekend? Share your thoughts in the comments below!

Images via Twitter, Shutterstock, Tradingview.com

The post Bitcoin Drops Below $8K After Hitting Yearly High, But for How Long? appeared first on Bitcoinist.com.

source https://www.tokentalk.co/Bitcoinist/bitcoin-drops-below-8k-after-hitting-yearly-high-but-for-how-long-5cf0b4d12f9352851246b561

Ripple (XRP) Price Crashes Below Key Support: More Losses Possible @newsbtc #Analysis #Technical #Ripple #xrp

- Ripple price traded to a new monthly high at $0.4777 and recently declined sharply against the US dollar.

- The price broke the key $0.4570 and $0.4400 support levels to enter a bearish zone.

- This ...

- Ripple price traded to a new monthly high at $0.4777 and recently declined sharply against the US dollar.

- The price broke the key $0.4570 and $0.4400 support levels to enter a bearish zone.

- This week’s crucial ascending channel was breached with support at $0.4500 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair traded as low as $0.3999 and it remains at a risk of more losses in the near term.

Ripple price declined sharply against the US Dollar, similar to bitcoin. XRP broke the $0.4400 support level, tested $0.4000, and it is currently correcting towards key resistance levels.

Ripple Price Analysis

Yesterday, we saw further gains above $0.4500 in ripple price against the US Dollar. The XRP/USD pair traded above the $0.4600 resistance even climbed above the last swing high. A new monthly high was formed at $0.4777 before the price started a major downside move. It broke many important supports, starting with $0.4550 and $0.4500. There was a sharp decline below the $0.4400 support and the 100 hourly simple moving average.

More importantly, this week’s crucial ascending channel was breached with support at $0.4500 on the hourly chart of the XRP/USD pair. The pair declined below the $0.4180 and $0.4100 support levels as well. It tested the $0.4000 support area and it is currently correcting losses. There was a recovery above the $0.4100 level, and the 23.6% Fib retracement level of the recent decline from the $0.4777 high to $0.3999 low. However, the $0.4240 level is currently acting as a resistance.

On the upside, there are many resistances near the $0.4300 and $0.4400 levels. The main resistance is near $0.4400 and the 100 hourly simple moving average. To start a fresh increase, the price must break the $0.4400 resistance area. Besides, the 50% Fib retracement level of the recent decline from the $0.4777 high to $0.3999 low is also near the $0.4388 level. On the downside, an initial support is near the $0.4050 level, below which there is a risk of more declines below the $0.4000 support area.

Looking at the chart, ripple price seems to be struggling below the $0.4240 and $0.4300 levels. There could be a minor upward move, but the bulls are likely to struggle near $0.4300 or $0.4400. Therefore, as long as the price is trading below the $0.4400 level and the 100 hourly SMA, there is a risk of more downsides.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is slowly reducing the recent bearish slope.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now well below the 40 level, with a negative angle.

Major Support Levels – $0.4100, $0.4050 and $0.4000.

Major Resistance Levels – $0.4240, $0.4300 and $0.4400.

The post Ripple (XRP) Price Crashes Below Key Support: More Losses Possible appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/ripple-xrp-price-crashes-below-key-support-more-losses-possible-5cf0a8a12f9352851246b55e

DutchX: An auction-based decentralized exchange protocol @TheBlock__ #DeFi #DEX #Ethereum #Genesis #Dutch Auction #DutchX #dxDAO #Front running #Gnosis #hft #price discovery #slippage

For many, Ethereum’s allure is derived from its potential to serve as a platform for experimentation in mechanism design. This experimentation manifests itself in a variety of forms, from games like PoW3D to inc...

For many, Ethereum’s allure is derived from its potential to serve as a platform for experimentation in mechanism design. This experimentation manifests itself in a variety of forms, from games like PoW3D to incentive compatible credit facilities like MakerDAO to prediction market models like Augur.

Over the past few months we have seen particularly high degrees of experimentation in the decentralized exchange design space, with protocols like 0x and Uniswap taking diverging approaches to price discovery with respect to user functionality, liquidity provision, and censorship resistance.

Front-running

Each DEX design has its own idiosyncratic trade-offs but, notably, both Uniswap and 0x structures are fundamentally exposed to front-running.

Join Genesis now and continue reading, DutchX: An auction-based decentralized exchange protocol!

source https://www.tokentalk.co/The Block/dutchx-an-auctionbased-decentralized-exchange-protocol-5cf06ac12f9352851246b557

BCNEX to launch its upcoming BTC session @iiblockchain #Bitcoin #Press Releases #bcnex #BTC #exchange

Bcnex is a user-oriented exchange platform that is taking over the crypto market by resolving the consensus barriers and…

The post B...

Bcnex is a user-oriented exchange platform that is taking over the crypto market by resolving the consensus barriers and…

The post BCNEX to launch its upcoming BTC session appeared first on Invest In Blockchain.

source https://www.tokentalk.co/IIB/bcnex-to-launch-its-upcoming-btc-session-5cf094012f9352851246b55b

Malaysian Prime Minister Proposes Gold-Backed Currency, But Why Not Bitcoin? @newsbtc #Bitcoin #Opinion #bitcoin #De-Dollarise #gold #malaysia

The Prime Minister of Malaysia has called for the formation of a new currency backed by

The Prime Minister of Malaysia has called for the formation of a new currency backed by gold. Dr Mahathir Mohamad believes that a single sound currency in East Asian would help protect economies from manipulation caused by Forex traders.

Mohamad also spoke about the influence of the US and how it was disadvantageous for the global market to be tied to the currency of a nation state. Such attitudes are spreading around the world and this presents an interesting opportunity for Bitcoin.

Nations Seek Alternatives to the Dollar as a Currency of Settlement, Could Bitcoin Benefit?

According to a report in domestic news publication Free Malaysia Today, the nation’s Prime Minister, Dr Mahathir Mohamad, is in favour of a single currency for the East Asian region. This new currency would be backed by gold and importantly would not be the national currency of any existing country.

He gave his address in Tokyo as part of the of a session at the 25th International Conference on The Future of Asia earlier today. He stated that the currency would be used for settlements between nations:

“We can make settlements using that currency. That currency must relate to the local currency as to the exchange rate, and that is something that can be related to the performance of that country. That way we know how much we owe and how much we have to pay in the special currency of East Asia.”

He went on to state that there is an issue with traders buying and selling foreign currency, which has a detrimental impact on the economies using those currencies:

“Currency trading is not something that is healthy because it is not about the performance of countries but about manipulation.”

He also attacked the US’s dominant position in the world, stating that it was not right for a single nation to be telling others how to do their business. This, according to Mahathir, is only going to create further division:

“You [the US] are not democratic. That is not for any single power to decide. If you want to live in a united world, a stable world, we must resort to sustainability through agreement between all nations that have a stake in that problem.”

The Prime Minister was then asked if the Japanese yen or Chinese yuan might serve the same purpose as the gold-backed digital currency he describes. He responded by stating that the promotion of one national currency over others would result in conflict and, for settlement trade, it was important that new currency was not one of an existing country.

Naturally, the seemingly perpetual gold bug Peter Schiff used the announcement of the Malaysian Prime Minister to shill the virtues of his favourite shiny metal at the expense of Bitcoin:

Attention crypto shoppers: Gold is the future of money, not Bitcoin!https://t.co/jENKDzsXll

— Peter Schiff (@PeterSchiff) May 30, 2019

Unfortunately, it does not appear that anyone was in Mahathir’s audience to ask him of the suitability of Bitcoin for the role of settlement currency. The qualities that make for a sound currency and one that is difficult to manipulate are all represented by Bitcoin – granted, there is price manipulation at present, but only due to the fact that the size of the market is so small relative to every other currency on the planet.

Once the Bitcoin market capitalisation increases to the point that billions of dollars entering or leaving the market no longer moves the price, Bitcoin could well serve as a much more suitable settlement currency for not just East Asian trade but the entire planet than any gold-backed currency ever could.

As we have covered many times previously here at NewsBTC, the only thing that gold really has over Bitcoin is a historical precedent. In just about every other way, Bitcoin performs better. It’s more divisible, easier to store, easier to transact, and is genuinely scarce. There is no telling how much gold there truly is in the universe so to say it is scarce isn’t telling the entire story. By contrast, Bitcoin has 21 million units total. There will never be more. This alone makes it a better store of value than gold and will likely be the reason why nations eventually adopt it as a settlement currency, as argued by Saifedean Ammous in his book, The Bitcoin Standard. Given enough time, it seems likely that nations will come round to this way of thinking, forced by their own peoples’ desire to use a genuinely sound unit of currency in favour of the manipulated bits of paper that currently pass for money.

Related Reading: Flipping Gold is “Inevitable” In Digital Age, Would Take Bitcoin Price to $350,000

Featured Image from Shutterstock.

The post Malaysian Prime Minister Proposes Gold-Backed Currency, But Why Not Bitcoin? appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/malaysian-prime-minister-proposes-goldbacked-currency-but-why-not-bitcoin-5cf060712f9352851246b554

Whales Could Pull Bitcoin Back To $20,000, Says Asset Manager @crypto_briefing #Analysis #News #Bitcoin #Markets

A small group of deep-pocketed traders has been able to exploit market sentiment and set the trajectory for crypto prices, according to one asset manager. Travis Kling, Founder and Chief Investment Officer at Iki...

A small group of deep-pocketed traders has been able to exploit market sentiment and set the trajectory for crypto prices, according to one asset manager. Travis Kling, Founder and Chief Investment Officer at Ikigai Asset Management, believes that there could be sufficient momentum to take Bitcoin (BTC) past its all-time high.

Based on information collected from his own analysis, as well from conversations with other institutional investors, Kling has hypothesizes that a small group of “risky whales” manufactured the recent market upswing.

“We believe a relatively small number of highly sophisticated, well-capitalized, highly risk tolerant market participants have been walking this crypto market higher over the last seven weeks,” Kling first wrote in a note published April 1st.

Through a series of coordinated buys executed at key moments, these risky whales could have reversed the market’s trajectory over the past four months, laying the foundations for the latest bullish sentiment.

Although sentiment is important in all markets, cryptocurrencies are especially susceptible. FUD and FOMO affect market price in a two-way feedback loop, Kling says: a concept George Soros originally referred to as ‘reflexivity.’

According to Kling, the initial recovery was first triggered by Jay Powell, Chair of the Federal Reserve. In late January, in response to considerable presidential pressure, Powell reversed the Federal Reserve’s commitment to end its decade-long policy of ‘quantitative easing.’

“There’s a good chance that Jay Powell put the bottom in crypto,” Kling told an audience at Ethereal Summit earlier this month. A dovish Fed allowed additional money to flow into the global economy, increasing investor appetite.

That appetite included digital assets. Anecdotally, Kling has observed a significant step-change, with crypto-specific as well as global macro funds buying bitcoin for a long-term hold.

The role of Bitcoin whales

According to Kling’s hypothesis, the Fed’s capitulation gave the ‘risky whales’ an opportunity to take the crypto market up to higher price levels.

“Reflexivity is strongly present in this asset class,” Kling explained to Crypto Briefing after the event. An “aggregate of good sentiment,” including Jack Dorsey’s explicit endorsement of Bitcoin, JPMorgan’s and Facebook’s blockchain initiatives as well as the rise of IEO platforms, could have laid the foundations for a market upswing.

The upswing began when low-liquidity coins started to pump with no news and little retracement. Litecoin (LTC), for example, managed to surge on unsubstantiated rumours that the project might be experimenting with the Mimblewimble privacy protocol.

The unexpected surge, and the $10bn sell-off a few days later, could have been caused by a single participant taking advantage of low liquidity, Kling says.

This brought Bitcoin closer to its resistance levels. “The market nestled closer up to $4,000, where there was considered to be all that resistance,” Kling explained. “Breaking past that boundary causes a series of liquidations.”

These liquidations culminated in April’s ‘bitcoin boom’, when a series of coordinated buys triggered mass liquidations on BitMEX and pushed prices even higher.

“The biggest part that risky whales played in reflexivity is turning a downward spiral into an upward trajectory,” Kling added.

Can Bitcoin Keep Flying?

Crypto markets closely resemble the U.S. stock market in the early 1900s, argues Kling. It’s closely influenced by a small number of large market participants, with sufficient heft to determine overall trajectories.

Kling refers to this type of activity as ‘chicanery,’ rather than market manipulation. Whereas manipulation implies criminal activity, the actions of the ‘risky whales’ aren’t necessarily illegal.

Kling’s not certain how long this trend will continue. If the momentum carries, it’s likely Bitcoin will hit $9,600, the next price level with significant resistance. It briefly managed to touch $9,000 today, according to data from CoinMarketCap.

“It’s not the entire market that needs to decide prices should be higher,” Kling observed in his April 1 note. “[J]ust one marginal buyer willing to have a slightly more bullish view on the everchanging value of Network Effect.”

Bitcoin could soon cross the $10,000 barrier. “This is not a linear market,” Kling said, and once that barrier is passed, Bitcoin could snowball to $20,000, or even $30,000, as euphoria sets in and reflexivity pushes prices still higher.

For the whales who started the trend, Kling believes most of them value Bitcoin in the hundreds of thousands, if not millions. After lifting Bitcoin from its December lows, it’s not certain whether they would take this opportunity to dump their coins, or continue trying to push prices higher.

The post Whales Could Pull Bitcoin Back To $20,000, Says Asset Manager appeared first on Crypto Briefing.

source https://www.tokentalk.co/Crypto Briefing/whales-could-pull-bitcoin-back-to-20000-says-asset-manager-5cf036412f9352851246b546

The story of Facebook’s first digital currency @TheBlock__ #Companies #Genesis #facebook

With the news that Facebook is getting closer to launching its “GlobalCoin” cryptocurrency, I wanted to take a quick historical dive into Facebook’s previous major foray into digital currencies: Credits.

In January 2011, Facebook officially launched Credits as a way to simplify payments on its platform. Credits enabled users to purchase items on applications built on Facebook. At that time $1 was equivalent to 10 Credits, with Credits purchasable in 15 different currencies.

Credits made sense for Facebook. The social media giant was looking at how much Apple and Google were making off their iOS and Google Play stores and wanted a piece of that for themselves.

Join Genesis now and continue reading, The story of Facebook’s first digital currency!

source https://www.tokentalk.co/The Block/the-story-of-facebooks-first-digital-currency-5cf032812f9352851246b545

Ethereum: He Paid $113K For Virtual Token of Formula 1 Race Car @iiblockchain #Ethereum #News #ETH #ethereum #f1 delta time #formula 1

In what seems to be an unbelievable purchase, a pseudonymous blockchain bidder named “09E282” has apparently paid over $113,000…

The post Ethereum: He Paid $113K For Virtual Token of Formula 1 Race Car appeared first on Invest In Blockchain.

source https://www.tokentalk.co/IIB/ethereum-he-paid-113k-for-virtual-token-of-formula-1-race-car-5cf03a022f9352851246b549

Cardano ADA Reaches 2019 Top Heights, $0.10 and Beyond On Horizon @iiblockchain #Cryptocurrencies & Platforms #News #ADA #Cardano

In today’s trading session, Cardano managed to climb by a total of 6% to reach a height of $0.09677,…

The post Cardano ADA Reaches 2019 Top Heights, $0.10 and Beyond On Horizon appeared first on Invest In Blockchain.

source https://www.tokentalk.co/IIB/cardano-ada-reaches-2019-top-heights-010-and-beyond-on-horizon-5cf037312f9352851246b548

XRP Hits Low Price Despite Ripple Having 200 Partners – Here Is Why @iiblockchain #Cryptocurrencies & Platforms #News #Ripple #XRP

Since the start of the year, Ripple’s XRP has failed to gain much momentum in terms of price while…

The post XRP Hits Low Price Despite Ripple Having 200 Partners – Here Is Why appeared first on Invest In Blockchain.

source https://www.tokentalk.co/IIB/xrp-hits-low-price-despite-ripple-having-200-partners-here-is-why-5cf02ce12f9352851246b543

Coinbase opens up EOS trading to all customers, except those in New York @decryptmedia #Cryptocurrencies #coinbase #cryptocurrency #eos #investing #money #Technology

EOS trading on the San Francisco-based crypto exchange Coinbase is no longer limited to Coinbase Pro users. But New Yorkers will still have to wait.

The post Coinbase opens up EOS trading to all customers, except those in New York appeared first on Decrypt.

source https://www.tokentalk.co/Decrypt/coinbase-opens-up-eos-trading-to-all-customers-except-those-in-new-york-5cf01ed22f9352851246b53c

Bitcoin momentarily crests $9,000 for the first time in a year @TheBlock__ #Bitcoin #Price #$BTC #bitcoin #price

Bitcoin, the largest cryptocurrency by market capitalization, briefly broke the $9,000 resistance level Thursday afternoon the first time since May 2018.

Soon after the cryptocurrency broke through $9,000, it shed $500 as per data provide...

Bitcoin, the largest cryptocurrency by market capitalization, briefly broke the $9,000 resistance level Thursday afternoon the first time since May 2018.

Soon after the cryptocurrency broke through $9,000, it shed $500 as per data provided by crypto exchange Coinbase. At last check, it was trading at $8,573 per coin.

The volatile asset has been on a tear since the beginning of the year, nearly tripling in value from its bottom below $3,200 at the end of 2018.

It's not exactly clear what has been behind bitcoin's impressive price action. Still, there have been some positive signs, including the entrance of larger players into the market, such as Fidelity and Intercontinental Exchange.

Options trading suggest the price of bitcoin could surge even higher. LedgerX co-founder Juthica Chou said in a tweet current trading of June $10,000 calls implies a "roughly 70% chance we touch $10k in the next 30 days."

source https://www.tokentalk.co/The Block/bitcoin-momentarily-crests-9000-for-the-first-time-in-a-year-5cf008512f9352851246b530

Huobi discourages wash trading, plans to update its policies @TheBlock__ #Bitcoin #trading #bitcoin #Bitwise #fake volumes #Huobi #Wash trading

Huobi Global claims the company does not take part in wash trading, CoinDesk writes. The company has rev...

Huobi Global claims the company does not take part in wash trading, CoinDesk writes. The company has reviewed its systems in response to Bitwise’s report regarding wash trading performed by cryptocurrency exchanges.

According to spokesperson speaking for Huobi Global CEO Livio Weng, Huobi “is not involved in any wash trading” as it contradicts its “core values.”

While Huobi says the review didn’t point to any systematic abuse, some markets might have been partaking in wash trading.

“We did identify a few of our market makers conducting what we suspect may have been wash trading for the sake of performance and marketing purposes,” the spokesperson said. “We have already communicated with these market makers and they have discontinued the strategies in question.”

In March, Bitwise reported that 95% of reported bitcoin trading volume had been artificially created by wash trading. It identified a number of exchanges that seemed to report genuine trade volumes; the list included Bitfinex, bitFlyer, Binance, Bitstamp, Bittrex, Coinbase, Gemini, itBit, Kraken and Poloniex.

source https://www.tokentalk.co/The Block/huobi-discourages-wash-trading-plans-to-update-its-policies-5cf001c12f9352851246b529

Bitcoin Explodes Beyond $9,000 In Minutes @iiblockchain #Bitcoin #News #BTC

The price of Bitcoin (BTC) just exploded beyond the $9,000 level in a matter of minutes. At 17:00 (UTC+1),…

The post Bitcoin Explodes...

The price of Bitcoin (BTC) just exploded beyond the $9,000 level in a matter of minutes. At 17:00 (UTC+1),…

The post Bitcoin Explodes Beyond $9,000 In Minutes appeared first on Invest In Blockchain.

source https://www.tokentalk.co/IIB/bitcoin-explodes-beyond-9000-in-minutes-5cf007612f9352851246b52f

This analyst says there’s a “high chance” Bitcoin may never fall under $5k again @cryptoslate #Analysis #Price Watch

Once Bitcoin (BTC) started to incur strong losses in the second half of 2019, analysts were once again making extremely low price prediction...

-

App-enabled cryptocurrency exchange and wallet provider, Zebpay, has announced that it is enabling Lightning Network payments for all its ...

-

The Indian Ministry of Commerce and Industry announced yesterday that the Coffee Board in the country is integrating blockchain into the cof...

-

The pharmaceutical industry is one of the world’s few (almost) trillion-dollar verticals, worth more than $900 billion annually, according t...