- Ripple price started a decent upward move and broke the $0.2960 resistance against the US dollar.

- Both

- Ripple price started a decent upward move and broke the $0.2960 resistance against the US dollar.

- Both bitcoin and Ethereum recovered and gained more than 2.5%.

- There is a short term breakout pattern forming with resistance near $0.3085 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair could continue higher and it is likely to test the $0.3175 and $0.3200 resistance levels.

Ripple price starts a decent rebound against the US Dollar, along with bitcoin. XRP is currently trading with a positive bias and looks set to test the $0.3200 barrier.

Ripple Price Analysis

After a major drop, ripple price formed a strong support above the $0.2850 level against the US Dollar. The XRP/USD pair slowly climbed above the $0.2880 and $0.2900 resistance levels. Later, there was a close above the $0.2920 resistance level and the 100 hourly simple moving average. Besides, the price cleared the 61.8% Fib retracement level of the drop from the $0.3082 high to $0.2798 low. It opened the doors for more gains and the price spiked above the $0.3080 level.

A high was formed near the $0.3088 level and the price is currently consolidating gains. Furthermore, there is a short term breakout pattern forming with resistance near $0.3085 on the hourly chart of the XRP/USD pair. Below the triangle support, the 23.6% Fib retracement level of the recent wave from the $0.2836 low to $0.3088 high might act as a support. The next key support is near the $0.2960 level. The 50% Fib retracement level of the recent wave from the $0.2836 low to $0.3088 high is also near the $0.2960 level.

On the upside, a break above the $0.3085 and $0.3100 levels is likely to open the doors for more gains. The next key resistance is near the $0.3160 and $0.3175 levels. Above these, the price is likely to grind further higher towards the $0.3200 resistance level.

Looking at the chart, ripple price clearly climbed higher and it is currently consolidating gains above $0.3000. In the short term, there could be a downside correction towards $0.3000 or $0.2960. There is also a connecting bullish trend line in place with support near the $0.2960 level on the same chart. Therefore, dips remain well supported close to the $0.2960 level. To the topside, the main target for the bulls could be $0.3200 or even the $0.3220 pivot level.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is slowly moving back in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is currently correcting lower towards the 60 and 55 levels.

Major Support Levels – $0.3020, $0.3000 and $0.2960.

Major Resistance Levels – $0.3085, $0.3160 and $0.3175.

The post Ripple (XRP) Price Poised for Further Appreciation: BTC, ETH Jumps appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/ripple-xrp-price-poised-for-further-appreciation-btc-eth-jumps-5cc927d05e27663e7ced63bf

Tuesday 30 April 2019

Ripple (XRP) Price Poised for Further Appreciation: BTC, ETH Jumps @newsbtc #Analysis #Technical #Ripple #xrp

XRP Index Added On NASDAQ, Constituent Exchanges Include Bitfinex, Bitstamp, Kraken And Coinbase Added In The Next Review @iiblockchain #Cryptocurrencies & Platforms #News #nasdaq #Ripple #XRP

After having recently listed indices for Bitcoin (BTC) and Ethereum (ETH), Nasdaq is now adding an index for Ripple’s…

The post XRP Index Added On NASDAQ, Constituent Exchanges Include Bitfinex, Bitstamp, Kraken And Coinbase Added In The Next Review appeared first on Invest In Blockchain.

source https://www.tokentalk.co/IIB/xrp-index-added-on-nasdaq-constituent-exchanges-include-bitfinex-bitstamp-kraken-and-coinbase-added-in-the-next-review-5cc925015e27663e7ced63be

Deloitte Migrates Its Clients From Ethereum To VeChain, Records More Transactions Over The Weekend Than Bitcoin @iiblockchain #Cryptocurrencies & Platforms #Ethereum #News #deloitte #ethereum #VeChain #VeChain Thor

Deloitte has made good on its promise to migrate from the Ethereum blockchain to the VeChainThor blockchain, after it…

The post Deloitte Migrates Its Clients From Ethereum To VeChain, Records More Transactions Over The Weekend Than Bitcoin appeared first on Invest In Blockchain.

source https://www.tokentalk.co/IIB/deloitte-migrates-its-clients-from-ethereum-to-vechain-records-more-transactions-over-the-weekend-than-bitcoin-5cc922315e27663e7ced63bd

No Cash For Sale: In World First ‘Bitcoin’ City @bitcoinist #Altcoins #Bitcoin #Bitcoin Acceptance #Bitcoin Businesses #News #News teaser #crypto city #Malaysia #Melaka Straits City

The UK’s Sun newspaper is touting the ‘World’s first Bitcoin city’ today, where all cash is banned. Backers of the venture hope that Melaka Straits City in Malaysia will attract 3 million crypto-tourists per year.

Take Me Down To The Bitcoin City…

Visitors will be able to exchange their normal money for digital currency when they arrive.

proclaims The Sun. Or “just use the digital currency they already own,” you might suggest – but you’d be wrong.

Melaka isn’t so much a ‘Bitcoin City’, as a ‘Crypto City’, and a ‘One Horse Crypto City’ at that. The digital currency you will (be forced to) change your ‘normal money’ into, is the DMI coin. Through Android, iOS, and PC apps, tourists will use these to pay for public services with their phones and computers.

DMI is a company that provides mobile enterprise, business intelligence, and cybersecurity services. It collaborated on this project to develop the DMI platform and coin.

…where the Cash is Banned…

The Chinese government-backed development will convert 835 acres of the Malaysian state of Malacca into the ‘tourist blockchain-destination of the future’. As well as the 3 million annual tourists it hopes to attract, Melaka will host businesses and education services.

It is not the only project of this type currently in development, either as a new city or the implementation of a crypto-economy in and existing city. Amongst others, these include so-called libertarian city, Liberstad in southern Norway, although the changes aren’t always for tourism reasons.

…it’s a Bit Like Disney?

While a true ‘Crypto City’ could do wonders to demonstrate the Bitcoin economy working at a holistic level, this does not seem to be it. It is hard to see how this is any different to exchanging your cash for Disney Dollars to spend while in the resort.

It also seems interesting that the Chinese government is backing this venture, as they’ve been coming across as ever-so-slightly anti-crypto. Perhaps it’s just a case of ‘not in their own back yard’?

Will this new crypto city succeed? Share your thoughts below!

Images via Shutterstock

The post No Cash For Sale: In World First ‘Bitcoin’ City appeared first on Bitcoinist.com.

source https://www.tokentalk.co/Bitcoinist/no-cash-for-sale-in-world-first-bitcoin-city-5cc8ef915e27663e7ced63b7

Analysts Expect Crypto Markets to Continue Surging Despite Bitcoin’s Current Stability @newsbtc #Bitcoin #Crypto #bitcoin #btc #crypto

Although Bitcoin incurred some downwards pressure late last week after news surrounding the Tether-Bitfinex imbroglio surfaced, BTC now been able to tepidly advance higher, and has led the entire crypto markets to surge...

Although Bitcoin incurred some downwards pressure late last week after news surrounding the Tether-Bitfinex imbroglio surfaced, BTC now been able to tepidly advance higher, and has led the entire crypto markets to surge.

Despite finding stability in the lower-$5,000 region, analysts are now expressing somewhat cautiously bearish sentiments regarding the current state of BTC and expect altcoins to be the cryptos that incur further gains in the near future.

Bitcoin (BTC) Advances Above $5,300

At the time of writing, Bitcoin is trading up just under 2% at its current price of $5,330, up from 24-hour lows of $5,219.

Earlier this week, news broke surrounding the New York Attorney General’s public accusation of fraudulent activity being conducted by stable coin Tether (USDT) and related crypto exchange Bitfinex, which instantly send BTC’s price reeling downwards from highs of $5,650 to lows of $5,180.

Although the cryptocurrency’s recent price action certainly appears to be somewhat bullish, Mr. Anderson, a popular crypto analyst on Twitter, explained that in order for technical formations (like the recent golden cross) to be bullish, BTC’s price must actually respond bullishly.

“$BTC Daily: The 55 EMA will cross the 200 EMA. This is inevitable. These events are not simply BULLISH though. It is the reaction by Price when this occurs that determines its effect (Bullish/Bearish) and that effect usually is long-standing,” he explained in a recent tweet.

$BTC Daily

The 55 EMA will cross the 200 EMA. This is inevitable

These events are not simply BULLISH though

It is the reaction by Price when this occurs that determines its effect (Bullish/Bearish) and that effect usually is long-standing pic.twitter.com/8mPpYRECvU

— Mr. Anderson (@TrueCrypto28) April 30, 2019

Although BTC’s response to recently established bullish technical formations has been muted, it remains possible that the cryptocurrency is simply consolidating at the current time, and that a bullish surge is right around the corner.

Crypto Markets Surge Despite BTC’s Stability

Because Bitcoin has remained stable in the low-$5,000 region and it remains unclear as to which direction the crypto is heading next, many traders are turning to altcoins to make profits.

Today, multiple major cryptocurrencies have posted decent gains, with XRP climbing over 5%, Bitcoin Cash surging over 6%, and Litecoin jumping over 8%.

Lucid TA, another popular cryptocurrency analyst on Twitter, explained in a recent thread of tweets that he believes long positions on altcoins currently make more sense than long positions on Bitcoin, as many are currently bouncing off of long-established support levels.

“Though $BTC looks questionable, I think longs make more sense on alts. Many are at support, and many reasonable trades can be found with high RR. Here are a few examples on different TF’s. There were better entries, though since I’m posting this late these are market entries,” he noted.

Though $BTC looks questionable, I think longs make more sense on alts. Many are at support, and many reasonable trades can be found with high RR.

Here are a few examples on different TF's. There were better entries, though since I'm posting this late these are market entries. pic.twitter.com/IMZyHhPAKz

— Lucid TA (@Lucid_TA) April 30, 2019

Lucid further noted that he does believe Bitcoin is currently flashing some bullish signals.

“A few further factors to consider. The fact that BTC swept the lows weakens the bear case and increases likelihood of a break up (‘bart’ pattern). Longs/shorts are bullish, though to be taken with a grain of salt…” he said.

A few further factors to consider.

The fact that BTC swept the lows weakens the bear case and increases likelihood of a break up ('bart' pattern).

Longs/shorts are bullish, though to be taken with a grain of salt (for reasons mentioned in an earlier post). pic.twitter.com/0vOWs3pfm6

— Lucid TA (@Lucid_TA) April 30, 2019

As the week continues on and Bitcoin further establishes whether or not it has enough support around its current price levels to climb higher, it is likely that altcoins will be able to maintain their upwards momentum and continue climbing higher.

Featured image from Shutterstock.

The post Analysts Expect Crypto Markets to Continue Surging Despite Bitcoin’s Current Stability appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/analysts-expect-crypto-markets-to-continue-surging-despite-bitcoins-current-stability-5cc8e1805e27663e7ced63b5

Report: crypto scammers made off with more than $1.2 billion in Q1 2019 alone @decryptmedia #Cryptocurrencies #bitcoin scam #Blockchain #business #cryptocurrencies #fraud #law #Technology

Crypto intelligence firm CipherTrace calls QuadrigaCX losses an “exit scam,” says Bitfinex/Tether “fraud” sends tally north of $1 billion in “visible losses.” Real number likely much bigger.

The post Report: crypto scammers made off with more than $1.2 billion in Q1 2019 alone appeared first on Decrypt.

source https://www.tokentalk.co/Decrypt/report-crypto-scammers-made-off-with-more-than-12-billion-in-q1-2019-alone-5cc902515e27663e7ced63ba

Crypto Traders Split 50/50 On Where Bitcoin Price Goes Next: $6K or $4200 @newsbtc #Bitcoin #Crypto #bitcoin #bitcoin price #crypto #poll #twitter

At the start of April, Bitcoin rallied over $1,000 in the matter of an hour, giving crypto investors their...

At the start of April, Bitcoin rallied over $1,000 in the matter of an hour, giving crypto investors their first taste of bullish momentum since the start of 2019. The rally was enough to cause traders and analysts alike to call the bottom as “in” and claim that a new uptrend was confirmed.

However, breaking news last week that the New York Attorney General’s office is accusing Bitfinex of using Tether reserves to hid a loss of $850 million has caused much panic across the crypto space. The same traders that were once calling for Bitcoin to test resistance at $6,000, are now also calling for a retest of resistance turned support at $4,200, back where the early April rally began. And according to a new poll, crypto investors are now equally split as to where Bitcoin might head next: $6,000 or $4,200.

Poll Results Reveal That Bitcoin Traders Are Equally Split on Bitcoin Price Targets

Read any crypto community forum, group, or social channel and there is no shortage of crypto traders genuinely confused about the current price action, and which direction Bitcoin will go next.

After the longest bear market on record, recent Bitcoin and crypto investors have taken a beating, and have been conditioned to anticipate a fall in price following a rally. The market sentiment is normal following a bubble burst, and confirms the market is in what’s called the “disbelief” phase.

Related Reading | Bitcoin and Crypto Investors Are Torn Over Using Bitfinex After Accusation

The uncertainty surrounding Tether and Bitfinex, which could have have significant impact on the overall market integrity should the parent company of both becomes insolvent or is shut down the by New York AG’s office. The fears have stopped Bitcoin’s April rally in its tracks, and now crypto traders who were once bullish and calling for $6,000 are now suggesting that Bitcoin will need to retest resistance turned support at $4,200 before healthy upward movement can continue.

While most of the market was bullish, the market is now equally divided as to where Bitcoin price will go next. The sentiment can be visualized using a Twitter poll shared by crypto trader Bagsy, who asked the crypto Twitter community which of the two prices would come first: $4,200 or $6,000.

Which comes first for $BTC ?

— Bagsy (@imBagsy) April 28, 2019

Surprisingly, even with over 6,000 votes on the poll, respondents were equally split down the middle, with 50% voting on each option. With crypto traders so torn on price direction, one side of the argument is bound to be in for quite a shock when the price of the leading cryptocurrency goes counter to the direction of their choosing.

Related Reading | Next Big Move For Bitcoin Price: Will The Infamous Golden Cross Fakeout Strike Again?

The sentiment could also be viewed as positive, as prior to the recent Bitcoin rally, most bears were calling for sub-$3K prices as the Bitcoin bottom, but now even the most bearish of traders are warming up to the idea that the bear market has ended.

Featured image from Shutterstock

The post Crypto Traders Split 50/50 On Where Bitcoin Price Goes Next: $6K or $4200 appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/crypto-traders-split-5050-on-where-bitcoin-price-goes-next-6k-or-4200-5cc8e1805e27663e7ced63b6

Money 2.0 Stuff: 1 in 5 Millennials prefers Bitcoin to…gold? @TheBlock__ #Adoption #Bitcoin #Bitfinex #Genesis #IEO #Tether #bitcoin #millenials #Survey

On surveys

When it comes to building a market edge, investment funds have several tools at their disposal. High frequency trading firms invest heavily in financial data and servers, all...

On surveys

When it comes to building a market edge, investment funds have several tools at their disposal. High frequency trading firms invest heavily in financial data and servers, allowing them to formulate and execute profitable trades before competitors. Macro hedge funds look to synthesize both quantitative data and qualitative analysis in order to inform outlooks on the relative strength and weaknesses of a nation’s economy. Venture funds build deal flow through their sprawling networks.

The common thread tying these seemingly disparate investment strategies together is the use of surveys. Perhaps the most high profile use of surveys in recent times came from the Brexit Big Short, where several hedge funds hired international polling firm, YouGov, among others, to conduct private exit-polling on the results of the UK referendum to leave the European Union.

Join Genesis now and continue reading, Money 2.0 Stuff: 1 in 5 Millennials prefers Bitcoin to…gold?!

source https://www.tokentalk.co/The Block/money-20-stuff-1-in-5-millennials-prefers-bitcoin-togold-5cc8fad15e27663e7ced63b9

What Is Horizen Network? Introduction to ZEN Token @crypto_briefing #Coin Guide #E-J #Altcoins #Forks #Privacy Coins

What Is Horizen Network?

Horizen (formerly called ZenCash</...

What Is Horizen Network?

Horizen (formerly called ZenCash) is a privacy-focused, zk-SNARKs based blockchain platform that forked from Zclassic, itself a Zcash fork. The Horizen network includes a decentralized autonomous organization (DAO), ZenChat (a private messenger), ZenPub (an anonymous publishing platform), and ZenHide (TOR-like endpoint masking). ZEN is the native cryptocurrency coin used by the Horizen network.

Privacy and security seem like niche topics only discussed by tinfoil-hat conspiracy theorists, but cybersecurity is a major concern in today’s world.

Norton estimates 60 million Americans have been impacted by identity theft and the U.S. will account for half of worldwide data breached by 2023. And it’s not your personal computer that’s being attacked, especially in a cloud-based world.

Accounts we hold with trusted companies like Amazon, Google, Sony, Microsoft, Equifax, Visa, and the U.S. government are the databases criminals want. And these major players have a lot of data security rules to abide by. Europe’s GDPR and even new U.S. privacy laws, along with international Safe Harbor laws, dole out hefty fines and other consequences for allowing data breaches – although not hefty enough to actually make their behavior change, it sometimes seems.

With the stakes so high, Horizen pivoted its focus to enterprise applications. Nobody needs more security and privacy than these organizations, and they have deep enough pockets to spend whatever it takes to stay running in a technology-run society.

Before exploring Horizon’s nuts and bolts, along with its chances of achieving sustainable success, let’s review ZEN, the proprietary cryptocurrency used in the Horizen blockchain, and its performance on the cryptocurrency market.

ZenCash (ZEN) Cryptocurrency Summary

As of April 30th, 2019, the circulating supply of ZenCash is 6,347,700 out of a total supply of 21,000,000 ZEN. The peak price so far of ZEN was $65.16 on January 9, 2018.

No Horizen ICO was held. Instead, Horizen (then known as ZenCash) forked from Zclassic (ZCL) on May 23, 2017 at block 110,000. At this time, ZEN was issued to ZCL holders at a 1:1 ratio.

ZEN is mined using the Equihash Proof-of-Work (PoW) mining algorithm. The block reward is set at 12.5 ZEN, with a block mined approximately every 2.5 minutes. Rewards half approximately every four years and are distributed with 20 percent split evenly between Secure Nodes and Super Nodes (which we’ll outline in the next section), while 10 percent goes to the Horizen/ZenCash team treasury, and the remaining 70 percent rewarded to miners.

Secure nodes act as master nodes and require staking 42 ZEN. Unlike other similar projects, it also secures the nodes by using end-to-end encryption, similar to what you’d find in [some] popular messengers.

ZenCash is traded on a wide variety of cryptocurrency exchange markets, including Binance, Bittrex, DragonEX, Upbit, OKEx, Sistemkoin, and COSS. ZEN trading pairs include BTC, ETH, and USDT.

ZenCash uses commercial content distribution networks (CDN) and Hypertext Transfer Protocol Secure (HTTPS) to ensure secure transfers. It also uses the same zero-knowledge Non-Interactive Arguments of Knowledge (zk-SNARKS) cryptography that ZCash does. This means ZEN transactions can be both pseudonymous and anonymous, providing the highest levels of privacy and security.

There are also criticisms against the protocol, ranging from rumors of a possible Zerocoin backdoor (the predecessor of the zk-SNARK powered Zerocash), to the necessity of conducting a “trusted setup”, an encryption key generation event that could allow the creation of unlimited coins if compromised.

Horizen has a variety of official ZenCash cryptocurrency wallets, including the Arizen and Swing wallets, web, mobile, and paper wallets. It’s also supported by Ledger hardware wallets.

Achieving a ZEN-like State on the Blockchain

As discussed above, Horizen is selling itself as a full-suite of blockchain-based tools for enterprise. The four key functions (so far) are:

- ZenCash – The original aim of Zcash was to be an anonymous financial tool, and that tool is still available in Horizen. It has simply been expanded upon to provide a full suite of options for enterprise users.

- ZenPub – Publishing documents can be a risky (and often difficult) business in many countries. Even in the U.S., where freedom of press is among the first Constitutionally guaranteed rights, journalists can be silenced. ZenPub uses anonymized addresses to publish documents to IPFS to ensure an open and free press is always maintained.

- ZenChat – Our communications are constantly monitored, and ZenChat uses AES-256 encryption for transaction of end-to-end encrypted messages.

- ZenHide – Countries like China setup firewalls that can block block processing to essential disable a cryptocurrency within its geographic borders. ZenHide uses proxy-like technology to pass data through HTTPS to bypass such restrictions.

Secure nodes on the Horizen blockchain ensure all network communication remains encrypted. They maintain the network and provide secure tunnels for encrypted Horizen data to pass through. Recently they also introduced Super Nodes, which will serve as a supporting network for future sidechains.

This type of security has a wide range of enterprise and governmental use cases, and even Charles Hoskinson and IOHK have had their sights set on Horizen, with the two companies signing a partnership.

Horizen Summary

Horizen isn’t your typical privacy coin – instead of catering to privacy advocates like Edward Snowden, they provide a full suite of secure and private tools for use by the institutions he despises. The success of Horizen hinges on these key blockchain features.

- Horizen includes four main tools – ZenPub, ZenChat, ZenHide, and ZEN (ZenCash). Each is privacy focused and encrypted through secure nodes.

- ZEN is the native cryptocurrency coin utilized by the Horizen platform. ZEN is rewarded to miners and secure nodes and can be traded on the open cryptocurrency market.

- Horizen uses the same Zerocash protocol as Zcash, Zclassic, and other privacy coins, making it susceptible to the same backdoors and glitches.

With these pieces in place, Horizen is well-positioned to become a sustainable blockchain. Enterprise users are the best use-cases of the technology because they pay well over long periods of time. If the Horizen team can execute on their roadmap and deliver an SDK, ZenCash could provide peace of mind to a lot of investors.

The post What Is Horizen Network? Introduction to ZEN Token appeared first on Crypto Briefing.

source https://www.tokentalk.co/Crypto Briefing/what-is-horizen-network-introduction-to-zen-token-5cc8c4715e27663e7ced63af

Is Binance’s Changpeng Zhao the ‘Zuckerberg’ of Crypto? @bitcoinist #Altcoins #Bitcoin Businesses #Companies #News #News teaser #binance #Changpeng Zhao #Facebook #mark zuckerberg

Believable parallels have been drawn between Binance CEO Changpeng Zhao and Mark Zuckerberg of Facebook on podcast #74 of Coin Talk hosted by Aaron Lammer & Jay Caspian Kang, titled “When Trolls Get Rekt.”

The podcast was later covered by Forbes contributor Billy Bamrough who covers cryptocurrency-related content for the publication.

In his article, Bamrough shared several parallels between blockchain and social media companies and their leadership. For instance, before Facebook, there was Myspace; a platform that reportedly “struggled to grow beyond its original interests.”

“Then came along Facebook,” wrote Bamrough. “Building a userbase of 2.3 billion people worldwide and successfully integrating itself and social networks into aspects of life that seemed entirely unnecessary as little as 10 years ago.”

Bamrough then gave a summation of how the social media and blockchain landscapes have converged in terms of their key challenges:

Bitcoin and cryptocurrency developers are now faced with a similar challenge to that of Myspace—how to grow beyond the niche uses that currently exist to something more that can be used by people around the world for things that we find hard to imagine today.

Zuckerberg’s and Zhao’s parallels

Personal parallels were also drawn between Zuckerberg and Zhao — such as their unconventional business styles and humble caricatures described as “alternative company leaders.”

Zuckerberg was reportedly known for wearing jeans and t-shirts instead of suits “thumbing his nose at many of the traditional chief executive tropes” writes Bambrough.

While Changpeng Zhao, CEO of the world’s largest cryptocurrency exchange, is described as the real-life version of ‘Zuckerberg’ in the film The Social Network, which depicts the creation of Facebook.

He was play acting a cool guy that doesn’t care about anything, seemed to be just rolling with the punches but is totally in control. CZ is like the real version of that in crypto.

CZ’s and Zuckerberg’s shared charity and humility

There also appears to be a deeply empathetic human side to both CEOs. CZ went as a far as putting down his own blockchain a peg in a series of tweets covered by Bitcoinist stating that

Ethereum can can do much more than BNB in features. Let’s grow together.

Binance also has its own charitable organization. Through donations from the Binance community, the organization donates during time of disasters and has started an initiative to feed the hungry titled “Binance Lunch for Children.” At the time of writing, this initiative, in particular, had raised 8.7227 BTC or USD $45972 to feed hungry children in countries such as “Kenya, Uganda, and Tanzania.”

While the “Chan Zuckerberg Initative” on Facebook’s side is a limited liability company with an investment of “up to 1 billion in Facebook shares in each of the next three years.” The initiative aims to “advance human potential and promote equality in areas such as health, education, scientific research, and energy.”

Is CZ similar to Facebook’s Mark Zuckerberg? Share your thoughts below!

Images via Shutterstock, Bitcoinist archives

The post Is Binance’s Changpeng Zhao the ‘Zuckerberg’ of Crypto? appeared first on Bitcoinist.com.

source https://www.tokentalk.co/Bitcoinist/is-binances-changpeng-zhao-the-zuckerberg-of-crypto-5cc8d3715e27663e7ced63b3

Bitfinex reveals stablecoin is only 74% backed by cash, says it’s ‘simultaneously addressing’ requests from NYAG, DOJ and CFTC @TheBlock__ #Bitfinex #Legal #Stablecoin #Tether #CFTC #Lawsuit #stablecoin

In an affidavit released Tuesday, Stuart Hoegner, general counsel for Tether, revealed that only 74% of its stablecoins were backed by its cash reserves, claiming the company knowingly did not disclose this informat...

In an affidavit released Tuesday, Stuart Hoegner, general counsel for Tether, revealed that only 74% of its stablecoins were backed by its cash reserves, claiming the company knowingly did not disclose this information to its customers.

Hoegner wrote that Tether currently has cash or cash equivalent of around $2.1 billion, representing around 74% of its current outstanding stablecoins. The remaining 26% is held by Bitfinex, the crypto exchange that was charged by the New York Attorney General's office for draining $700 million from Tether to cover its alleged $850 million loss.

Hoegner wrote that Tether intentionally decided not to disclose to its customers that tethers are not 100% fiat backed. Although he said the practice was nothing new, in the affidavit, he drew on the example that traditional commercial banks operate under a similar “fractional reserve” system where only a small portion of customers’ deposits are backed by cash reserves.

However, as of Feb. 19, Tether's company website still said that its stablecoins are 100% backed “by traditional currency held in our reserves. So 1 USD₮ is always equivalent to 1 USD.” Interestingly, around Feb. 27, Tether quietly added some language to this statement, an apparent attempt to obscure the definition of "100% backed".

The additions hedge on the initial claim slightly, stating that “every tether is always 100% backed by our reserves, which include traditional currency and cash equivalents and, from time to time, may include other assets and receivables from loans made by Tether to third parties, which may include affiliated entities (collectively, “reserves”).”

In a Feb. 21 meeting with NYAG, Tether and Bifinex’s lawyers, David Miller and Jason Weinstein stated that Tether's reserves had “previously been encumbered and that the Companies intend to enter into an agreement in the future to provide the Bitfinex platform with a line of credit from Tether’s reserves.”

NYAG immediately followed up with Miller and Weinstein for more details, requesting all documents related to the issuance and redemption of tether and transaction records between Tether and Bitfinex. It specifically asked for records dated between Aug.-Oct. 2018, “regarding $400 million in tethers redemption via Bitfinex.”

However, the two companies apparently didn't provide NYAG with satisfactory answers, according to a March 22 email from NYAG to Miller and Weinstein in which NYAG said, "the Companies have failed to produce a single such contract or other documentation to the OAG,” noting they tried instead to offer “verbal responses.”

In Weinstein's response, he argued that NYAG’s requests were overly burdensome, complaining that they had been "voluminous and have had unreasonably tight deadlines." He also mentioned that the companies were simultaneously dealing with “a substantial number of requests” from the Department of Justice (DOJ), the Commodity Futures Trading Commission (CFTC). However, the disclosed correspondences do not specify why the DOJ and the CFTC made these requests.

It was not clear what kind of information Weinstein eventually provided to NYAG, but it seems from the April 24 lawsuit NYAG presented that the office never received the documents it needs to lift the cloud from around Tether's reserves.

source https://www.tokentalk.co/The Block/bitfinex-reveals-stablecoin-is-only-74-backed-by-cash-says-its-simultaneously-addressing-requests-from-nyag-doj-and-cftc-5cc8c0b15e27663e7ced63ae

Despite Crypto Winter, US Bitcoin Awareness, Knowledge, and Perception Increased “Dramatically” Since 2017 @newsbtc #Bitcoin #Crypto #bitcoin #bitcoin awareness #us

Research suggests that Bitcoin is more fully under...

Research suggests that Bitcoin is more fully understood and accepted today across US society than it was at the height of the bull market of 2017. According to a recent study, young adults are way ahead of other demographics with regards awareness, familiarity, perception, and likelihood to buy Bitcoin in the future.

Blockchain Capital recently asked 2,029 randomly selected American adults a series of questions relating to Bitcoin. The survey was a follow up to a similar one conducted in October 2017, when prices were rising and overall market sentiment was entirely different.

US Public Becoming Increasingly Knowledgeable About Bitcoin

The test was divided into various categories. First, the participants were asked if they had even heard of Bitcoin. A massive 89 percent answered that they had. This was up from 77 percent in October 2017. This is hardly surprising given that the spectacular crash of late 2017/early 2018 was covered by just about ever mainstream media outlet on the planet.

Next, the participants’ familiarity with Bitcoin was gauged. They were given the question: How familiar are you with Bitcoin? along with a series of responses: “never heard of it”, “heard of but not familiar”, “somewhat familiar”, “very familiar”, and “I own/have owned Bitcoin”.

The percentage of people that are “at least somewhat familiar” with Bitcoin rose by nearly half — from 30 percent in October 2017 to 43% in April 2019.

Amongst those aged 18 to 34, 60 percent described themselves as at least ‘somewhat familiar’ with Bitcoin — up from 42 percent in October 2017. An equally large increase was observed in the age group 45-54. Previously, just 25 percent were at least familiar with Bitcoin. Now that figure is 43 percent.

The percentages of those familiar with the cryptocurrency really diminish in older generations but still show an increase over those from 2017. Of those aged 55 to 64, 32 percent were at least familiar with it. This was up from 22 percent in 2017. Meanwhile, just 20 percent of those over 65 claimed to be knowledgeable about the decentralised payment tech, up from the 15 percent observed in the previous study.

Next, the participants were asked how much they agreed that Bitcoin is a positive financial and technological innovation. Again, there was a significant increase in those answering favourably here too. In 2017, 34 percent of those asked agreed or strongly agreed with the statement. This rose by 9 percent in the recent survey to 43 percent.

Younger respondents were much more likely to view Bitcoin positively. Of those aged between 18 and 34, a massive 59 percent said that they though Bitcoin was a positive innovation versus 48 percent in the previous survey.

The figures relating to the likelihood that Bitcoin will be widely used in the future show similar tendencies too. A third of US adults now believe that the digital asset will be in common use in the next 10 years. This is a five percent increase to the figure observed in the previous study.

Raising this overall average once again is the younger generation. A massive 48 percent of those aged between 18 and 34 agree that Bitcoin will be widely used within the next decade.

The findings also indicate that 27 percent of people are considering buying Bitcoin in the next five years. Despite the bear market, this figure is up from just 19 percent in 2017.

The write up of the report, summarised by Spencer Bogart, concludes by inquiring about people’s store-of-value preferences. The respondents were asked which asset they would like to own $1,000 of between Bitcoin and a traditional investment:

- Over one in five people said they would prefer the cryptocurrency to government bonds.

- Bitcoin was preferable to stocks for 17 percent of those asked.

- Fourteen percent of respondents would prefer Bitcoin to real estate.

- Just 12 percent said they would rather have digital gold over physical gold.

Again, the figures for the youngest age group in the sample reflect a much greater acceptance of Bitcoin than the rest of the US public. Almost one in three prefers Bitcoin to government bonds, more than one in four prefers Bitcoin to stocks, just under one in four would rather own Bitcoin than real-estate, and over one in five would favour the crypto over gold.

Younger Generations Championing Crypto Revolution

The figures show that the younger generations are much more knowledgeable of, familiar with, and accepting of Bitcoin. This is summed up by Bogart himself when he states:

“Ultimately, Bitcoin is a demographic mega-trend: Younger demographics are leading in terms of Bitcoin awareness, familiarity, perception, conviction, propensity to purchase, and ownership rates.”

As a purely digital currency, it figures that the first to get to grips with the concept would be those that have grown up in a purely digital world. In that vein, crypto investment fund Adamant Capital’s CEO Michiel Lescrauwaet neatly summed up why digital cash might be alluring for millennials earlier today in response to the research detailed above:

It makes sense that Millennials like Bitcoin most:

1) found their way through 2008 crisis as young adults

2) grew up with P2P (BitTorrent, Limewire)

3) digitally native & familiar with open source (Linux, Wikipedia)

5) first investments in zero interest rate environment https://t.co/bQQLmwFk0u

— Michiel Lescrauwaet (@MLescrauwaet) April 30, 2019

Related Reading: Global Bitcoin Acceptance Up More than 702% Since 2013

Featured Image from Shutterstock.

The post Despite Crypto Winter, US Bitcoin Awareness, Knowledge, and Perception Increased “Dramatically” Since 2017 appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/despite-crypto-winter-us-bitcoin-awareness-knowledge-and-perception-increased-dramatically-since-2017-5cc8d3715e27663e7ced63b2

Should You Diversify Your Crypto Portfolio? @crypto_briefing #Analysis #News #Bitcoin #Trading

A commonplace wisdom in crypto markets, as well as common sense, advises wary hodlers to diversify their investments. Cryptocurrencies are extremely risky, according to this reasoning; spreading your wealth means mor...

A commonplace wisdom in crypto markets, as well as common sense, advises wary hodlers to diversify their investments. Cryptocurrencies are extremely risky, according to this reasoning; spreading your wealth means more chances to win big.

As sagely as it sounds, this advice is incorrect. The purpose of diversifying an investment portfolio is to decrease your risk; you need assets that are negatively correlated to properly optimize a long term portfolio. And if you want to find assets which are negatively correlated, well, you’re probably better off looking somewhere else.

In June 2018, a Crypto Briefing analysis found that diversifying your crypto portfolio could actually be harmful. Because virtual assets were highly correlated at the time, diversifying could increase risk without a significant benefit.

Those correlations remain high. Anthony Xie, founder of HodlBot, did a comprehensive investigation that found declining correlations between virtual assets. According to his analysis, the average correlation between coins dropped from +0.89 over 2018 to +0.58 in 2019.

Correlation coefficients range from -1 to +1, where +1 indicates values that move in perfect unison. Anything above +0.5 is considered highly correlated.

As shown in the matrix below, only a few coins show negative correlations with one another. Positive correlations are shown in green, and negatively correlated assets are marked in red:

Based on these data, TRON (TRX) is a clear outlier, and is negatively correlated to all other listed coins. This is likely because of the bull run beforeo the launch of BitTorrent (BTT).

As Circle Research noted in their Q1 2019 Retrospective, BNB is another strong outlier, since its performance is tied to Binance’s success. Three events in Q1 led to BNB outperforming the market: (1) the launch of its DEX testnet, (2) the general excitement for IEO’s, and (3) the popular BitTorrent offering that required TRX or BNB to participate.

These trends are unlikely to last long, and they are likely the main reason for the decline in digital asset correlations. Other tokens continue to exhibit strong correlations with one another.

Nonetheless, Xie shows that the average correlation coefficient is falling from 2018, when markets exhibited the highest levels of correlation ever seen.

The market was much less correlated between 2014-2016 than it was in 2018, as evident in the histogram below.

However, Xie notes, this observed decline in cross-correlations among coins should be taken with a grain of salt. Correlations are quite volatile, as demonstrated by the BTC-BCH correlations in the graph below.

So what does this mean for portfolios?

Despite the apparent decrease in correlations, we are not yet at a point where it is financially wise to hold a large number of coins. Increasing the number of highly-correlated assets in your portfolio actually adds risk, and with a correlation coefficient above +0.5 these assets might as well be identical.

Circle Research found that Bitcoin still heavily influences the price direction of large and small cap coins, and has an even higher influence on its “clones” (such as LTC, XMR and Bitcoin forks).

Interestingly, the study also found a declining, and low, relationship between physical gold and large-cap US equities. According to the team at Circle, this suggests that like gold, the entire crypto asset-class could be seen as a hedge against traditional markets.

The post Should You Diversify Your Crypto Portfolio? appeared first on Crypto Briefing.

source https://www.tokentalk.co/Crypto Briefing/should-you-diversify-your-crypto-portfolio-5cc8bde45e27663e7ced63ad

Ripple Surges After Nasdaq Adds XRP Liquidity Index, Will Growing Adoption Propel It Higher? @newsbtc #Crypto #Ripple #crypto #xrp

Over the past several months many cryptocurrencies have incurred relatively large gains that have put a significant amount of distance between their current prices and their 2018 lows. But much to the chagrin of investo...

Over the past several months many cryptocurrencies have incurred relatively large gains that have put a significant amount of distance between their current prices and their 2018 lows. But much to the chagrin of investors, Ripple (XRP) has not been one of these cryptos, as it has remained relatively stable around the $0.30 region.

Today, however, Ripple has gained some upwards momentum after news broke regarding XRP’s Liquidity Index being added to the Nasdaq Global Index Data Service, joining Bitcoin and Ethereum, which were both added previously.

Ripple (XRP) Sees Growing Adoption Despite Lackluster Price Action

Although many investors directly equate positive price action with growing fundamental strength, the two are not inextricably linked, as often times cryptocurrencies incur massive price movements – both upwards and downwards – regardless of fundamental, news-based developments.

XRP, whose future largely hinges on whether or not banks begin taking to it to facilitate payments, has been floating slightly above its 2018 lows that were set in the mid-$0.20 region in late-December, and many investors are beginning to lose faith in it as it continues to face downwards pressure despite the improving market conditions.

Despite this, in the past week the embattled cryptocurrency has incurred a few positive developments that may ultimately help it climb out of its rut.

Today it was announced that Nasdaq would be adding Brave New Coin’s XRP Liquidity Index to its Global Index Data Service, which was developed by BNC with a goal of meeting the “marketplace requirement for a single, reliable and fair USD price for XRP — based on live real-world trading activity.”

In addition to this, it was also recently announced that Saudi British Bank (SAAB) – which is a subsidiary of banking giant HSBC – has officially launched its first Ripple-based payment system, although it remains unclear as to whether or not they will be utilizing xCurrent or the XRP-based xRapid.

Majed Najm, SAAB’s deputy managing director or corporate and institutional banking, spoke about their decision to use a Ripple-based payment system, saying:

“This step is part of the Bank’s ongoing efforts to provide the best banking services to customers, make use of the latest technology and global banking products available, and create methods and means to save time and effort for our customers.”

Could Growing Adoption Push XRP Higher?

At the time of writing, XRP is trading up 4.2% at its current price of $0.306, up from its daily lows of $0.29.

Over a one-month period, however, XRP is still down significantly from its highs of $0.37 that were set earlier this month.

This recent price surge may be technically significant for XRP, as it recently hit a price level below $0.30 that many analysts deemed to be a “do or die” price level for the cryptocurrency.

Peter Brandt, a popular analyst on Twitter, explained this in a recent tweet, saying its “do or die time for the $XRP bag holders.”

Do or die time for the $XRP bag holders pic.twitter.com/ZrRtHtBDCY

— Peter Brandt (@PeterLBrandt) April 27, 2019

As the week continues on and XRP’s price action continues to unfold, it will likely grow increasingly clear as to whether or not growing fundamental strength will be enough to hold it above $0.30 and to propel it higher.

Featured image from Shutterstock.

The post Ripple Surges After Nasdaq Adds XRP Liquidity Index, Will Growing Adoption Propel It Higher? appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/ripple-surges-after-nasdaq-adds-xrp-liquidity-index-will-growing-adoption-propel-it-higher-5cc8c5615e27663e7ced63b0

US AG charges two individuals for ‘providing shadow banking services’ to crypto exchanges; including Bitfinex @TheBlock__

The crypto crackdown continues.

The U.S. Attorney General's Office has charged two individuals for offering ...

The crypto crackdown continues.

The U.S. Attorney General's Office has charged two individuals for offering so-called shadow banking services to unnamed cryptocurrency exchanges, according to an announcement out April 30.

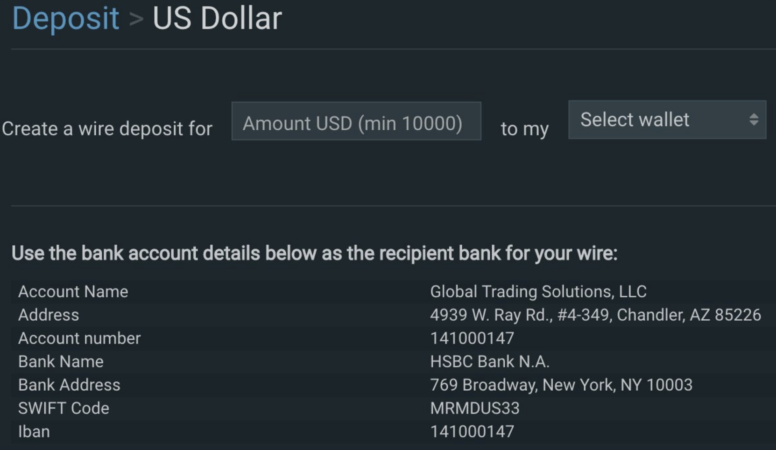

As per the press release, Ravid Yosef and Reginald Fowler were hit with charges of "bank fraud and operating an unlicensed money transmitting business." According to a court document filed in the Southern District of New York, the duo opened up accounts to transfer funds to crypto exchanges under Global Trading Solutions.

Readers of The Block might recall the name. As The Block's Larry Cermak first reported, that firm served as a banking partner with crypto exchange Bitfinex, which was issued a lawsuit by the New York Attorney General's Office.

source https://www.tokentalk.co/The Block/us-ag-charges-two-individuals-for-providing-shadow-banking-services-to-crypto-exchanges-including-bitfinex-5cc8a9415e27663e7ced63a5

Cryptocurrency Security Threats Are Keeping the Market Down @bitcoinist #News #News teaser

From the start, Bitcoin has b...

From the start, Bitcoin has been seen as something of a ‘behind closed doors’ asset. With SilkRoad and other black market sites been heavily Bitcoin dependent, the image has not been good.

While this has begun to change, and the general public has started to hear more positive reports, things are still touch and go. And the main cause of the loss of consumer confidence in the cryptocurrency is the almost incessant security breaches that plague the industry.

A quick summary

Because Bitcoin is a digital currency, the potential for hacking is extreme. Of course, this is also true of banking institutions that handle digital funds, but it seems more prevalent in cryptocurrencies. In fact, the total for stolen funds in cryptocurrencies crossed $1.3 billion—a massive amount of loss for an industry just ten years old.

And, for those who think the direction is positive, and security is improving, statistics show that more than 61% of the losses occurred in 2018. It seems that as values for cryptocurrencies increase, the motivation to steal them increases proportionately.

Seeking solutions

This increase in security failures is due, in large part, to the early stage of adoption of the industry. While banks have had thirty years of digital transactions to improve security, Bitcoin has been around just ten. The nascent technology has left gaps for some to exploit, and exchanges are the biggest culprit.

But beyond simply security threats, exchanges are often their own worst enemy. For example, the recent news of the death of the CEO of QuadrigaCX, and the loss of his personally held private keys for investor funds only highlights the need for better and stricter exchange policies.

This has led investors to pursue new and more secure exchange options, and particularly those with financial backing. Exchanges that refuse to move toward security and fiscal responsibility will eventually be left on the sideline.

Secure and backed

One such example of this new exchange model is FT Exchange or FTX for short. The company has the backing of Alameda Research, responsible for more than $1 billion in trades. With this level of external support, the exchange offers a level of investor security that is rarely available in the cryptocurrency world. Plus, they have created some of the tightest security protocols around.

Other exchanges are coming into the market or seeking to enhance their value proposition as well. The main goal is to allow the freedom of financial transacting that has characterized Bitcoin and cryptocurrencies, while at the same time protecting investor funds. This sort of ‘safe/freedom’ model has been tricky to provide but is growing.

Of course, as with most assets, Bitcoin and cryptocurrencies can be stored offline for maximum security. Simply storing private keys on a hardware or paper wallet will make the coins effectively 100% safe for users. But this defeats the purpose of a cash/payment methodology originally conceived by Bitcoin creator Satoshi Nakamoto.

Crushing the market

As security threats continue, the adoption cycle for Bitcoin has begun to slow. No wonder the euphoria of 2017 turned into the crypto winter of 2018. What seemed a great opportunity for quick returns turned into a security nightmare.

And, convincing banks and business owners to offer cryptocurrency support for payments and transfers is an uphill battle. The risks associated with moving into the space are dramatic. And, given the risks, the cost associated with creating the necessary security protocols can be dramatic.

Of course, those costs can be offset by market gains and profits. And, the current bull run that Bitcoin is experiencing should provide additional incentive. However, the end game of market adoption won’t be easy to achieve without massive change.

Whether Bitcoin and its cryptocurrency cousins eventually grow in adoption remains to be seen. However, the great need in the market is not another low-security exchange startup. Instead, the market must find ways to bring well-funded, secure exchanges online for consumers to use. Without these types of market enhancements adoption will stagnate and the market will be crushed before it reaches maturity.

The post Cryptocurrency Security Threats Are Keeping the Market Down appeared first on Bitcoinist.com.

source https://www.tokentalk.co/Bitcoinist/cryptocurrency-security-threats-are-keeping-the-market-down-5cc8b7515e27663e7ced63ab

No, Bitfinex’s seized $850 million is not likely to be unfrozen within weeks @TheBlock__ #Bitfinex #Genesis #Regulation #Research #Tether #bank #crypto capital #NY AG #nyag #nysag #poland

The extent of the fallout after the New York State Attorney General (NYAG) The extent of the fallout after the New York State Attorney General (NYAG) sued Bitfinex is still taking shape, but we do know that $850 million belonging to Bitfinex’s customers is currently missing, or rather, inaccessible. Bitfinex executives have made reassurances that the seized funds would be released within weeks, but a deep dive into information currently known shows that is unlikely to be the case.

The series of events that led us here started in March of 2017, when Bitfinex, registered in the British Virgin Islands, was working with a range of banks in Taiwan. Wells Fargo, the last remaining U.S.

Join Genesis now and continue reading, No, Bitfinex’s seized $850 million is not likely to be unfrozen within weeks!

source https://www.tokentalk.co/The Block/no-bitfinexs-seized-850-million-is-not-likely-to-be-unfrozen-within-weeks-5cc8a9415e27663e7ced63a7

Crypto Community Reacts to Tether Admitting USDT Not Fully Backed @newsbtc #Crypto #bitfinex #crypto #tether

According to the company behind it, stablecoin USDT is not fully backed by fiat currency deposits. It was revealed today that the controversial cr...

According to the company behind it, stablecoin USDT is not fully backed by fiat currency deposits. It was revealed today that the controversial crypto asset firm Tether only holds around 74 percent of the total value of USDT’s current circulating supply.

Tether and the crypto exchange Bitfinex are currently defending allegations from the New York Attorney General’s office that the latter borrowed $600 million from Tether to stay afloat after the trading venue reportedly lost $850 million. The dramatic shortcomings are thought to be the result of Crypto Capital, a Panama-based payments processor that Bitfinex used, having assets frozen in various nations around the world.

USDT Not Backed 100%, But Did Anyone Think That it Was?

An affidavit filed by Stuart Hoeger, the general counsel at both Tether and Bitfinex, has today claimed that the stablecoin crypto asset USDT is only backed by around $2.1 billion. This falls short of the $2.8 billion worth of USDT currently in circulation. The document states:

“As of the date [April 30] I am signing this affidavit, Tether has cash and cash equivalents (short term securities) on hand totaling approximately $2.1 billion, representing approximately 74 percent of the current outstanding tethers.”

He also details that a credit agreement between Tether and Bitfinex did indeed exist and was in place “for the protection of the virtual currency market.”

According to a memorandum by Tether’s defence lawyer, Zoe Phillip of Morgan Lewis, there is no need for each USDT token to even be backed by a dollar:

“According to the Attorney General, the line of credit needed to be frozen because it improperly impairs the reserves Tether would use for redemptions. The Attorney General appears to believe that Tether must hold $1 in cash fiat currency for every dollar of tether. These allegations are wrong on multiple levels.”

Hoegner’s affidavit seems to support this by highlighting that the stance of the company had officially changed with regards the 100 percent backing of USDT in recent months. Given that this was widely reported at the time, it seems a wonder firstly that anyone was even continuing to use USDT when numerous other stablecoins now exist and secondly, why the news of the New York Attorney General’s allegations against the two companies should drop the price in the way it did last week.

Crypto Community Reacts to Tether and Bitfinex Legal Troubles

The CEO of social trading platform eToro, Yoni Assia, took to Twitter to opine about the revelation’s likely impact on crypto prices. He mused on the likelihood of a potential Bitcoin price pump if the news causes people exit USDT en masse. Ultimately, however, he admits that the shady goings on between Tether and Bitfinex will be negative for crypto. Although, he is sparse on specific details.

Are the news supposed to pump or dump BTC ? Its bad news, but if $2B USDT get exchanged to BTC it actually increases its price… what a predicament .

Tether Lawyer Admits Stablecoin Now 74% Backed by Cash and Equivalents https://t.co/f9Rw75FNCO via @CoinDesk— Yoni Assia (@yoniassia) April 30, 2019

Meanwhile, independent crypto researcher and analyst Hasu seemed to hint that the debacle would inevitably invite greater regulatory scrutiny to exchanges, which could in turn damage the utility of Bitcoin and other crypto assets:

I'm not surprised that bitcoiners have a soft spot for Tether/BFX.

Lightly-regulated fiat on/off ramps are part of bitcoin's extended security model. Bitcoin is less useful when every way in and out is US-regulated. They accept that this increases the risk of getting cheated. https://t.co/kPdNK9N0A1

— Hasu (@hasufl) April 30, 2019

Cardano (ADA) founder and Ethereum (ETH) co-founder Charles Hoskinson used the news to draw attention to the fact that banks routinely operate on far lower reserves than those admitted by Tether today. This sentiment was also echoed by RT’s Max Keiser and many others.

Well at least tether has more backing than my bank account https://t.co/Tm6ZgBiXZF

— Charles Hoskinson (@IOHK_Charles) April 30, 2019

Tether is 74% backed.

Fed is 1% backed.

JP Morgan is -20% (un)backed.

— Max Keiser, tweet poet. (@maxkeiser) April 30, 2019

Ultimately, such a comparison is largely redundant, however, as any form of fractional reserve backing USDT the anti-thesis of what many people in crypto signed up for when they got involved with the industry. Larry Cermak, an analyst with The Block, stated that comparisons between the percentage reserves held by Tether and those of the average bank ultimately ignore the shady goings on of the crypto exchange Bitfinex. He went as far as to state that both companies are guilty of pathological lies:

So all of the sudden it’s fine that Tether only has 74% of cash on hand because banks are even worse? And it’s fine that Tether as well as Bitfinex pathologically lie about anything they can get away with? pic.twitter.com/y8jVU21HSw

— Larry Cermak (@lawmaster) April 30, 2019

The Tether/Bitfinex saga is far from over yet. NewsBTC will continue to bring you coverage of the legal hearings as they develop.

Related Reading: Technical Indicator Suggests Tether Trouble Has Put an End to Bitcoin Rally

Featured Image from Shutterstock.

The post Crypto Community Reacts to Tether Admitting USDT Not Fully Backed appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/crypto-community-reacts-to-tether-admitting-usdt-not-fully-backed-5cc8b7515e27663e7ced63ac

US-Based Traders Dominate Crypto Trading, More Than Next 5 Countries Combined @newsbtc #Bitcoin #Crypto #bitcoin #crypto #crypto traders #Datalight #united states

The United States has long been one of the world’s most important economies, having a massive influence on the overall global economy and often helps to shape economic policy all over the world. It’s no surprise that th...

The United States has long been one of the world’s most important economies, having a massive influence on the overall global economy and often helps to shape economic policy all over the world. It’s no surprise that the the country dominates the Bitcoin and overall crypto market similar to how it does other financial markets.

A new report on the global distribution of crypto traders based on exchange traffic shows that not only the United States as the dominant country in all of crypto trading, it has more crypto traders than the next five ranked countries behind it combined.

Bitcoin Traders Across the Globe: United States Leads the Crypto Charge

In a new published report by cryptocurrency and blockchain analytics firm Datalight, the company has revealed the results of a detailed analysis on the global distribution of Bitcoin and altcoin traders by country. The research looked at website traffic from “the 100 most popular crypto exchanges” to determine the rankings.

The report reveals, “as expected” the United States leads crypto trading “by a long distance.” Bitcoin and other altcoin traders in the country account for over 22 million visits per month.

Related Reading | Sell in May and Go Away? A Look At Historic Bitcoin Price Performance in May

Following behind the US is another one of the world’s most important economies, with Japan being home to over 6 million monthly crypto traders. Japan has also been home to a number of hacks over the course of the last couple years, and the abundance of crypto traders in the country may be part of the reason.

Image courtesy of Datalight

In third is Korea, home of Samsung and other tech-forward companies that have recently warmed up to the crypto space. Korea is also home to many cryptocurrency projects, such as ICON (ICX).

The UK follows in 4th place, with just under 4 million monthly crypto traders. Russian and Brazil ranked 5th and 6th respectively, with both garnering just 3.1 million monthly crypto traders each.

The United States and its 22.26 million monthly crypto traders amounts to more active traders each month than Japan, Korea, the UK, Russia, and Brazil combined, showing what a dominant economy the United States is.

Related Reading | Visualized: Bitcoin, Ethereum, Ripple, and the Rest of Crypto Battle for the Top Ten

China is large missing from the list, despite being an economic superpower and having a massive population. China tightly controls the way its citizens interact with the internet, and hasn’t been welcoming to the new financial technology and asset class, which could be why the country is absent from the data.

The remainder of the top 20 countries by monthly crypto traders all have roughly 1-2 million monthly users.

The amount of crypto traders in the United States suggests that roughly 6.7% of the country’s population is actively trading cryptocurrencies, according to the data.

Featured image from Shutterstock

The post US-Based Traders Dominate Crypto Trading, More Than Next 5 Countries Combined appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/usbased-traders-dominate-crypto-trading-more-than-next-5-countries-combined-5cc8a9415e27663e7ced63a6

This analyst says there’s a “high chance” Bitcoin may never fall under $5k again @cryptoslate #Analysis #Price Watch

Once Bitcoin (BTC) started to incur strong losses in the second half of 2019, analysts were once again making extremely low price prediction...

-

App-enabled cryptocurrency exchange and wallet provider, Zebpay, has announced that it is enabling Lightning Network payments for all its ...

-

The Indian Ministry of Commerce and Industry announced yesterday that the Coffee Board in the country is integrating blockchain into the cof...

-

The pharmaceutical industry is one of the world’s few (almost) trillion-dollar verticals, worth more than $900 billion annually, according t...