Wednesday 31 July 2019

Bitcoin Price (BTC/USD) Correcting Gains, Dips Remain Supported @newsbtc #Analysis #Technical #bitcoin #btc

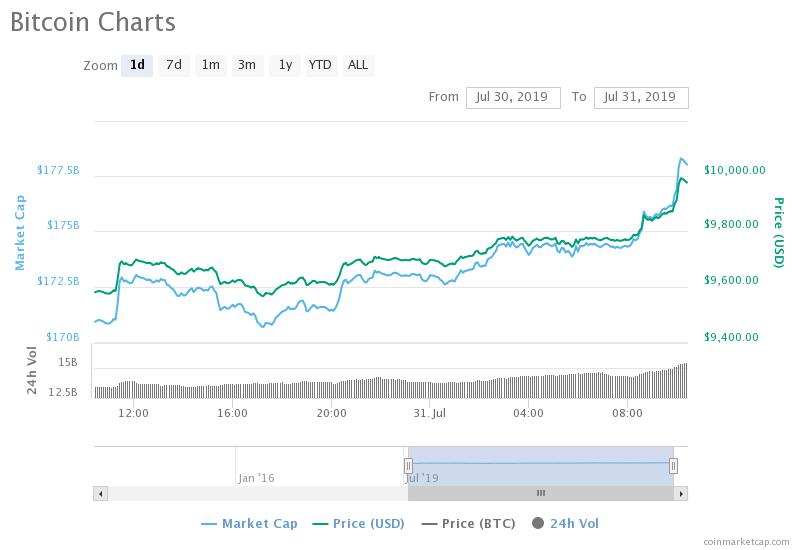

- Bitcoin price climbed higher recently and broke the $10,000 resistance area against the US Dollar.

- The price retested the $10,200 resistance area and it is currently correcting lower.

- There was a...

- Bitcoin price climbed higher recently and broke the $10,000 resistance area against the US Dollar.

- The price retested the $10,200 resistance area and it is currently correcting lower.

- There was a break below a short term ascending channel with support near $10,020 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The price is currently correcting lower, but dips remain supported near the $9,850 and $9,800 levels.

Recently, there was a nice upward move in bitcoin price above $10,000 against the US Dollar. BTC price retested the main $10,200 resistance level and it is currently correcting gains.

Bitcoin Price Analysis

Yesterday, we discussed the chances of more upsides in bitcoin price above $10,000 against the US Dollar. The BTC/USD pair did gain momentum above the $9,800 resistance and the 100 hourly simple moving average. Moreover, the pair broke the $10,000 resistance level and revisited the $10,200 resistance. A swing high was formed near $10,182 and the price is currently correcting lower.

It traded below $10,100 plus the 23% Fib retracement level of the recent rise from the $9,645 low to $10,182 high. Moreover, there was a break below a short term ascending channel with support near $10,020 on the hourly chart of the BTC/USD pair. The pair is now trading near the $10,000 level, with an immediate support near the $9,940 level. Additionally, the next key support is near $9,910 plus the 50% Fib retracement level of the recent rise from the $9,645 low to $10,182 high.

The main support is near the $9,850 level. If there is a downside break below the $9,850 support, the price could revisit the $9,650 level. The 100 hourly SMA is also waiting near the $9,640 level. Any further losses might push the price towards the $9,300 zone. It represents the 1.236 Fib extension level of the recent rise from the $9,645 low to $10,182 high.

On the upside, an immediate resistance is near the $10,050 level, above which the price is likely to retest the $10,200 resistance level. Therefore, the bulls need to gain strength above the $10,180 and $10,200 resistance levels in the near term for further gains.

Looking at the chart, bitcoin price is clearly trading with a positive bias above the $9,900 and $9,850 levels. Conversely, if there is a fresh decline, the bulls are likely to protect the $9,640 support level. On the upside, a clear break above $10,200 will most likely set the pace for a move towards $10,500.

Technical indicators:

Hourly MACD – The MACD is slowly gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is currently declining lower towards the 50 level.

Major Support Levels – $9,910 followed by $9,850.

Major Resistance Levels – $10,050, $10,200 and $10,500.

The post Bitcoin Price (BTC/USD) Correcting Gains, Dips Remain Supported appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/bitcoin-price-btcusd-correcting-gains-dips-remain-supported-5d427ef1f4c85eab76fc980b

Crypto Market Cap & Bitcoin Climbing Higher: BCH, Litecoin, ADA, TRX Analysis @newsbtc #Analysis #Technical #ADA #BCH #Bitcoin Cash #btc #Litecoin #TRON #TRX

- The total crypto market cap extended gains and broke the key $260.0B resistance area.

- Bitcoin price gained more than 3% and broke the $10,000 resistance area.

- Litecoin (LTC) price climbed higher ...

- The total crypto market cap extended gains and broke the key $260.0B resistance area.

- Bitcoin price gained more than 3% and broke the $10,000 resistance area.

- Litecoin (LTC) price climbed higher and recently tested the $100.00 resistance area.

- BCH price is correcting gains and it could revisit the $315 support level.

- Tron (TRX) price is trading above the $0.0220 level and it could continue to rise in the near term.

- Cardano (ADA) price is struggling to settle above $0.0600 and it could retest the $0.0580 support.

The crypto market cap and bitcoin (BTC) are climbing higher steadily. Ethereum (ETH), LTC, BCH, EOS, cardano, ripple, TRX, XLM and BNB are likely to recover further.

Bitcoin Cash Price Analysis

Bitcoin cash price climbed higher recently above the $320 and $330 resistance levels against the US Dollar. BCH/USD traded close to the $340 resistance level and recently started a downside correction. It broke the $330 level and is now approaching the $320 support level.

On the downside, an initial support is near the $320 level. If there are more losses below $320, the price could revisit the $305 support level. An intermediate support is near the $315 level.

Cardano (ADA), Litecoin (LTC) and Tron (TRX) Price Analysis

Litecoin price gained bullish momentum and climbed above the $92.00 and $95.00 resistance levels. LTC price even tested the $100.00 resistance and it is currently correcting gains. On the downside, the previous resistances near $95.00 and $92.00 are likely to act as strong supports in the near term.

Tron price managed to settle above the $0.0220 level and it is currently consolidating in a range. On the upside, there are many resistances near the $0.0250, $0.0280 and $0.0300. On the downside, a break below $0.0220 might push the price back towards the $0.0210 support

Cardano price struggled on many occasions to gain strength above $0.0600 and $0.0610. ADA price is currently below $0.0600 and it could test the $0.0580 support level. On the upside, a proper follow though above $0.0610 might push the price towards the $0.0650 level.

Looking at the total cryptocurrency market cap 4-hours chart, there was a decent recovery above the $255.0B and $260.0B resistance levels. More importantly, the market cap climbed above a major bearish trend line near the $260.0B level. The next key resistance is near the $270.0B level, above which the market cap is likely to rise steadily towards the $290.0B and $300.0B resistance levels. On the downside, the main support is near the $248.0B level. Overall, it seems like there are chances of more gains in bitcoin, Ethereum, EOS, litecoin, ripple, ADA, BCH, TRX, ICX, XLM and other altcoins in the short term.

The post Crypto Market Cap & Bitcoin Climbing Higher: BCH, Litecoin, ADA, TRX Analysis appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/crypto-market-cap-bitcoin-climbing-higher-bch-litecoin-ada-trx-analysis-5d4270e1f4c85eab76fc980a

Ripple Price (XRP) Primed For More Gains, BTC Signaling Uptrend @newsbtc #Analysis #Technical #Ripple #xrp

- Ripple price extended gains and traded above the $0.3220 resistance area against the US dollar.

- The price topped near the $0.3240 level and it is currently correcting gains.

- There is a short term...

- Ripple price extended gains and traded above the $0.3220 resistance area against the US dollar.

- The price topped near the $0.3240 level and it is currently correcting gains.

- There is a short term bullish trend line forming with support near $0.3160 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The price is likely to bounce back as long as it is trading above the $0.3120 support area.

Ripple price is placed nicely in a bullish zone above $0.3100 against the US Dollar, and bitcoin rallied above $10K. XRP price could climb back above $0.3240 in the near term.

Ripple Price Analysis

In the past two sessions, there was a steady rise in bitcoin, Ethereum and ripple against the US Dollar. The XRP/USD pair climbed above the $0.3120 and $0.3150 resistance levels. Moreover, there was a close above the $0.3150 level and the 100 hourly simple moving average. Later, the price gained traction above the $0.3200 and $0.3220 resistance levels.

Finally, the price tested the $0.3240 level and recently started a downside correction. There was a break below the $0.3200 level plus the 23.6% Fib retracement level of the last upward move from the $0.3065 low to $0.3240 high. Besides, the price spiked below the $0.3160 level and tested the $0.3140 support area. The 50% Fib retracement level of the last upward move from the $0.3065 low to $0.3240 high also acted as a support.

At the outset, there is a short term bullish trend line forming with support near $0.3160 on the hourly chart of the XRP/USD pair. The pair might break the trend line and test the $0.3120 support level. Moreover, the 100 hourly SMA is also waiting near the $0.3132 level to act as a support. As long as there is no close below $0.3120, the price is likely to bounce back.

On the upside, there are two key resistances forming near $0.3220 and $0.3240. If there is an upside break above the $0.3240 level, the price could rise sharply towards the $0.3300 and $0.3320 levels. The next key resistance is near the $0.3400 level.

Looking at the chart, ripple price is trading above a few important supports near $0.3140 and $0.3120. As long as there is no clear break below $0.3120, the price is likely to resume its upward move. The overall price action is positive and suggesting more gains above $0.3220 and $0.3240.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is about to move back into the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is currently well below the 50 level.

Major Support Levels – $0.3150, $0.3140 and $0.3120.

Major Resistance Levels – $0.3200, $0.3220 and $0.3240.

The post Ripple Price (XRP) Primed For More Gains, BTC Signaling Uptrend appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/ripple-price-xrp-primed-for-more-gains-btc-signaling-uptrend-5d4264b1f4c85eab76fc9806

Ethereum Price (ETH) Sighting More Upsides, Bitcoin Breaks $10K @newsbtc #Analysis #Technical #ETH #ethereum

- ETH price climbed higher steadily and broke the $215 resistance area against the US Dollar.

- The price topped near the $220 level and recently corrected below $215.

- There was a break below an asce...

- ETH price climbed higher steadily and broke the $215 resistance area against the US Dollar.

- The price topped near the $220 level and recently corrected below $215.

- There was a break below an ascending channel with support at $216 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair remains well bid on the downside near the $210 and $208 support levels.

Ethereum price is struggling to continue higher versus the US Dollar, while bitcoin broke $10,000. ETH price is likely to bounce back as long as it is above the $210 support.

Ethereum Price Analysis

In the past few hours, Ethereum price climbed higher steadily above $210 against the US Dollar. The ETH/USD pair broke the key $215 resistance level to post a new weekly high. Moreover, there was a close above the $210 level and the 100 hourly simple moving average. Finally, the price traded towards the $220 level, where sellers emerged and protected more gains.

More importantly, bitcoin price climbed higher and recently broke the $10,000 resistance level. After topping near the $220 level, ETH price corrected lower. It traded below the $215 support level to move away from the uptrend. Moreover, there was a break below an ascending channel with support at $216 on the hourly chart of ETH/USD. The pair tested the 50% Fib retracement level of the upward leg from the $204 low to $220 high.

However, the decline was protected by the $210 support level and the 100 hourly SMA. Additionally, the 61.8% Fib retracement level of the upward leg from the $204 low to $220 high is also near the $210 level to provide support. Therefore, the $210 level might play an important role in the next move. As long as the price is above the $210 level, there could be a fresh upward move.

On the upside, the $220 level is an immediate resistance. If there is a clear break above the $220 resistance, the price could break the $225 level in the near term. Conversely, if there is a downside break below the $210 support, the price might revisit the $205 support area.

Looking at the chart, Ethereum price is showing positive signs above the $210 level. The price action suggests a fresh increase above the $215 and $218 levels. However, a clear break above the $220 level will most likely open the doors for a solid upward move above $225 and $230.

ETH Technical Indicators

Hourly MACD – The MACD for ETH/USD is slowly moving in the bearish zone.

Hourly RSI – The RSI for ETH/USD is currently below the 50 level, but it could bounce back.

Major Support Level – $210

Major Resistance Level – $220

The post Ethereum Price (ETH) Sighting More Upsides, Bitcoin Breaks $10K appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/ethereum-price-eth-sighting-more-upsides-bitcoin-breaks-10k-5d4256a0d56d6edc2d1493ca

SLAM DUNK! Professional basketball jumps on blockchain bandwagon @MICKYNewsOz #Blockchain #blockchain #Game #MLB #NBA #NBA Top Shot #Sports

The National Basketball Association is launching NBA Top Shot, a blockchain-based platform for digital collectibles.

Users will be able to collect, trade, and own live in-game moments from NBA history on the new platform.

Shooting a three

NBA Top Shot is a joint venture between the NBA, National Basketball Players Association (NBPA), and Dapper Labs, the creator of the massively successful CryptoKitties collectibles game built on the Ethereum blockchain.

Initially, users will be able to acquire blockchain-based digital video clips from some of the league’s most iconic moments, such as a Kevin Durant 3-point shot.

Kevin Durant takes the hit and drains the triple!@warriors 4-point play!#DubNation pic.twitter.com/WYnh6lLy3t

— NBA (@NBA) January 11, 2018

Each digital video clip will have a number to mark it as distinct on the blockchain and users will be able to trade or sell the digital collectibles to others.

However, NBA Top Shot will be more than just collecting historic moments as users will be able to go head-to-head against each other in competition.

Players can create a roster using their digital collections and then compete against each other in online tournaments and leagues on-chain.

NBA Top Shot will launch this fall, but the game portion of the blockchain project will not launch until 2020.

“We believe blockchain technology creates a truly unique product that fans can collect, manage and engage within a fun environment, and we are excited to partner with Dapper Labs to introduce these groundbreaking digital assets to the NBA community,” said Josh Goodstadt, Executive VP of Licensing for THINK450, the commercial arm of the NBPA.

“Dapper Labs’ innovation and expertise make them a perfect partner to introduce this groundbreaking game and what we believe will become coveted digital collectibles for basketball fans around the world,” added Adrienne O’Keeffe, NBA Senior Director, Consumer Products & Gaming Partnerships.

Not the first pro sports blockchain game

NBA Top Shot follows on the heels of MLB Crypto Baseball (now known as MLB Champions), a blockchain-based platform from Lucid Sight for collecting digital figures of ballplayers and competing against other players.

However, the MLB blockchain project has not been the biggest hit.

The game made some headlines when it first launched, especially when a player bought a Los Angeles Angels team for 68 ETH, which was worth US$18,900 at the time.

Lucid Sight CEO Randy Saaf acknowledged that the platform released later than intended, which meant it missed most of the MLB season in 2018.

The late launch and some bugs have hampered the game’s momentum, but MLB Champions is soldiering on as it has recently released Star-Spangled and All-Star packs in July

The post SLAM DUNK! Professional basketball jumps on blockchain bandwagon appeared first on Micky.

source https://www.tokentalk.co/Micky/slam-dunk-professional-basketball-jumps-on-blockchain-bandwagon-5d4229a1d56d6edc2d1493c4

Dow Jones Drops After Fed Rate Cut, What’s This Mean for Bitcoin? @newsbtc #Bitcoin #Crypto #bitcoin #Dow Jones #federal reserve #gold #Stock Market

July was yet another strong month for the stock markets despite looming threat of a coming economic recession, with the Dow, Nasdaq, and S&P 500 all close to beating out their average mon...

July was yet another strong month for the stock markets despite looming threat of a coming economic recession, with the Dow, Nasdaq, and S&P 500 all close to beating out their average monthly gains for the calendar month. Bitcoin, however, has spent much of July locked in a downtrend.

This morning as the Fed monetary policy meeting met its deadline to cut rates, the Dow Jones Industrial Average dropped sharply over the news. Around the same time, Bitcoin spiked above its local lows and could be signaling a bullish reversal is around the corner. As the two markets respond to the news, what’s next for each?

Dow Jones Industrial Average Drops After Federal Rate Cut

Today, the Federal Open Market Committee lowered the lending rate by 25 basis points. Worried stock market investors had begun the selloff late Tuesday into Wednesday, resulting in as much as a 450 point drop for the Dow following the announcement from Federal Reserve Chairman Jerome Powell.

Related Reading | Bitcoin Rises as Markets Expect Decade’s First Fed Rate Cut

Powell called the cut a “mid-cycle adjustment to policy,” and says that it’s “not the beginning of a long series of rate cuts.” But stock market investors were shaken regardless, resulting in the steep decline.

United States President Donald Trump had called for a cut of 50 basis points, so despite the reaction, Powell’s cut is modest by comparison.

Looming concerns surrounding the US and China trade war has only further fueled investor anxiety fearing the rate cut is just another ingredient in a recipe for economic disaster. During economic downturns, investors often sell off their stocks in exchange for “safe haven” assets and could be what is driving the selloff in the stock market.

Does Dow Dropping Bode Well for Bitcoin?

While stock market investors de-risk and separate themselves from US-driven stocks and indices, the outflow of capital typically goes somewhere. In the past, as economic turmoil heats up, so does the price of gold, and safe-haven currencies such as the Swiss franc or Japanese yen.

Related Reading | Prominent Investor: Mainstream Finance Is Now Considering Bitcoin As a Safe Haven Asset

In recent weeks, gold has captured media attention for kickstarting what many believe to be a bull run for the precious metal and investment asset. Gold’s scarcity and longevity make it a top choice during economic downtrends as a way to hedge against further decline. Both Bitcoin and gold have been showing correlated price movements.

Bitcoin was designed in the wake of the 2009 financial crisis and just experienced the first-ever federal rate cut since it existed. How it reacts from here is anyone’s guess. The crypto asset recently left its bear market lows and has risen alongside gold. Bitcoin is pitched as the digital version of gold, sharing many similarities.

Bitcoin, in the face of economic downturn, may finally show its true potential as a digital replacement for gold, and as the economic hedge creator, Satoshi Nakamoto had designed it to be. And as capital flees falling stock markets, Bitcoin very well could continue on its bull run from here and become the global currency replacement for fiat that many envision it to be.

The post Dow Jones Drops After Fed Rate Cut, What’s This Mean for Bitcoin? appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/dow-jones-drops-after-fed-rate-cut-whats-this-mean-for-bitcoin-5d4238a1d56d6edc2d1493c8

Curzio Equity Owners – Securitize Issues 10th Token @securitiesio #Security Token News #CEO token #Curzio Equity Owners #ds token #securitize

Investor excitement continues to grow over Securitizes announcement that Curzio Equity Owners is to be the 10th official token issued on the network. Curzio Equity Owners is an analytical industry newsletter publishing firm. Uniquely, the company seeks to provide small investors access to this previously exclusive market via an upcoming STO.

Publishing firms such as analytical newsletters are high-margin investments that, prior to the advent of blockchain technology, would be very difficult for small investors to ever participate in. The reality is that your average investor doesn’t possess the funds to open a printing or research firm on their own.

Curzio Equity Owners seeks to change the status quo and provide small and medium investors access to this long-held exclusive market. The company allows investors to forgo the huge upfront costs of this business model and share in the profits.

Securitize with the Assist

In order to accomplish this task, Curzio Equity Owners recruited the help of Securitize. Securitize is one of the most recognized names in the token issuance sector. To date, the firm has issued over a $150 million in tokenized securities.

Curzio Equity Owners via Homepage

Speaking publicly, a company official explained the roles each firm agreed upon. Curzio agreed to take responsibility for the legal aspects of the STO. Basically, the company will handle the notification and regulatory requirements as part of this agreement.

For its part, Securitize will bear the technical workload. The firm will issue, monitor, trade, and program the CEO token. As part of the smart contract program, all regulatory requirements must be met before the token can be transferred. In this manner, Securitize ensures its tokens remain compliant on the secondary market.

CEO Token

STO participants will receive CEO tokens for their crypto. CEO tokens are to operate on the DS token protocol. This protocol is an ERC-20 variant that features advanced security protocols such as the compliance mechanisms tailored specifically for a given industry.

Investors

CEO tokens entitle the holder to equity in Curzio Research. Curzio Research is the actual analytical newsletter subsidiary for Curzio Equity Owners. Token holders receive quarterly dividends based on their equity holdings. Importantly, investors are paid out in the stable coin USDC.

The Road to Success

If Curzio Equity Owners sounds familiar its because they have received heavy media coverage including features on CNN, FOX Business, Forbes, and CNBC, to name a few. Additionally, the company has some impressive backing including North America’s largest crypto exchange, Coinbase.

In the past, the company worked with numerous token launch platforms. These platforms include Overstock’s tZERO ATS, Sharepost, and Open Finance Network. The company continues utilizing new technologies to further its goal to significantly improve the quality of analytical newsletters. Now, Securitize is a valuable partner that is sure to share some insight into the STO process.

Curzio Equity Owners – Securitize

Securitize continues to make wise strategic partnerships. This latest venture is sure to boost both firms positioning in their respective markets. You can expect to hear more from these firms as the STO enters stage 1 in the coming days.

The post Curzio Equity Owners – Securitize Issues 10th Token appeared first on .

source https://www.tokentalk.co/Securities/curzio-equity-owners-securitize-issues-10th-token-5d4226d1d56d6edc2d1493c3

Ripple CEO says Facebook went too far with Libra @cryptoslate #Libra #People of Blockchain #Regulation #Ripple

Brad Garlinghouse, the CEO of Ripple, said that Facebook was responsible for the scrutiny and criticism it encountered from regulators a...

Brad Garlinghouse, the CEO of Ripple, said that Facebook was responsible for the scrutiny and criticism it encountered from regulators and policymakers. In an interview with Bloomberg TV, Garlinghouse said that the company went “too far” in its whitepaper by stating Libra was going to become a “new currency.”

Facebook sabotaged Libra with “arrogant” approach

While the regulatory scrutiny Facebook‘s Libra was subjected to since its announcement was welcomed by those opposing its launch, others argued that it actually brought more harm to the crypto industry. Brad Garlinghouse, the CEO of Ripple, seems to be one of them.

Garlinghouse told Fortune earlier this week that Libra has forced regulators to lump all cryptocurrencies into “one big bucket” and that Ripple could easily get caught in the crossfire. He later told Bloomberg TV that it was Facebook’s arrogant approach to Libra that caused turmoil in the market. Garlinghouse added that by defining libra as a “new currency,” Facebook instantly became a thorn in the eye of financial regulators.

“I think the U.S. dollar actually works pretty well,” he continued, saying that the world doesn’t need a new fiat currency. The way Facebook rolled out Libra caused a lot of turbulence, which is one of the many reasons why it got such a negative reaction.

"I think the U.S. dollar works pretty well. We don't need a new fiat currency"– Ripple CEO Brad Garlinghouse on why he thinks Facebook took an arrogant approach with Librahttps://t.co/faVtrXTMej pic.twitter.com/aAs8YyyiEU

— Bloomberg TV (@BloombergTV) July 29, 2019

Apart from that, Libra’s model was built on challenging traditional financial institutions and money transmitters. And while setting ambitious goals is at the very core of Silicon Valley, Facebook might have gone too far this time, Garlinghouse said.

Ripple and Libra aren’t competitors

When asked about Libra’s influence on the crypto industry, Garlinghouse said that it could be a bad omen to crypto. He cited President Donald Trump’s anti-crypto tweets as a clear example of negative press Libra has brought upon the crypto space.

“The danger that is happening right now is that legitimate projects working on taking advantage of crypto to solve real problems get caught in the crossfire a little bit. Because you are seeing even the president came out and tweet ‘I don’t like cryptocurrencies,’” he told Bloomberg TV.

Increased regulatory pressure seems to have affected Ripple, as the company wrote an open letter asking the U.S. Congress not to “paint all crypto projects with the same broad brush.” The company asserted that some digital currencies, especially XRP, offer the opportunity to complement fiat currencies and shouldn’t see the innovation behind them stifled.

Garlinghouse had the same sentiment during the Bloomberg TV interview, saying that Ripple was an institution-centric company that works alongside governments and financial institutions. Libra, he explained, wants to replace banks and still hasn’t met any of the anti-money laundering and anti-terrorism regulations in the U.S.

The post Ripple CEO says Facebook went too far with Libra appeared first on CryptoSlate.

source https://www.tokentalk.co/Cryptoslate/ripple-ceo-says-facebook-went-too-far-with-libra-5d4237b1d56d6edc2d1493c7

Court rules in favor of Roger Ver in Craig Wright’s Satoshi Nakamoto defamation lawsuit @cryptoslate #Bitcoin #Bitcoin Cash #People of Blockchain #Price Watch

Bitcoin SV creator Craig Wright claimed that he created Bitcoin as Satoshi Nakamoto—<...

Bitcoin SV creator Craig Wright claimed that he created Bitcoin as Satoshi Nakamoto—Bitcoin Cash founder Roger Ver called him a fraud. Today, England’s high court ruled in favor of Ver.

Craig Wright’s litigious rampage

In April, Craig Wright invoked the wrath of the Bitcoin community by threatening legal action against a host of people claiming he was a fraud (for claiming to be Satoshi Nakamoto).

The incident began with Hodlonaut, the founder of the Lightning Network Trust Chain and a longstanding Bitcoin advocate. The astronautical feline denounced Wright as a fraud, and in response Craig Wright threatened legal action.

Wright’s legal threat enraged the Bitcoin community, with many rallying behind Hodlonaut. Many in the community performed acts of solidarity, such as changing their profile picture and Twitter handles to match Hodlonaut’s to obfuscate the cat’s identity.

Other high-profile crypto advocates also solidified their positions, publicly calling Craig Wright a fraud for his unsubstantiated claims of being the person behind the Satoshi Nakamoto alias. Figures such as Ethereum co-founder Vitalik Buterin, podcaster Peter McCormack, and hundreds of others called Wright a fraud.

One other figurehead who called Wright a fraud was his former partner, the founder of Bitcoin Cash Roger Ver. Previously, the two had a falling out that resulted in a split that created Bitcoin SV during the famous hash wars.

On Apr. 15, 2019, Roger Ver’s website Bitcoin.com posted (a now redacted) video, which in short, said Craig Wright fraudulently claimed to be Satoshi Nakamoto. Ver went a step further, publicly calling Wright a fraud on his personal Twitter on May 3, and goading Wright to sue him.

My response to CSW’s 100,000 GBP lawsuit: pic.twitter.com/Ob1WZITrM3

— Roger Ver (@rogerkver) May 3, 2019

Taking the matter to court

In response to the message, the Bitcoin SV founder took the matter to the England and Wales High Court, Queen’s Bench Division. Wright claimed that his reputation was materially damaged by Roger Ver’s defamatory statements.

“The defamatory attacks by Roger Ver damaged my integrity within the United Kingdom’s community of business people with whom I primarily deal. Being labelled a fraud has a repellent effect with regard to future business—if people view me as a fraud, my proficiency as a computer scientist as well as my life’s work will be called into question. Moreover, no one would reasonably enter into business dealings with someone thought to be a fraud,” said Wright in the court documents.

In addition to Ver’s supposedly defamatory remarks, Wright claims that it encouraged others to participate in damaging remarks, citing one tweet in particular.

— BkkShadow (@BkkShadow) May 3, 2019

Taking the trial to the United States

However, the British court determined that the U.K. was not the appropriate venue for the lawsuit. Based on the audience of the Bitcoin youTube Channel and Roger Ver’s Twitter account, the overwhelming majority of viewers were based in the United States, followed by the United Kingdom.

Even though Craig Wright had moved from Australia to the U.K. with his family in 2015, and intends to apply for British citizenship, the court deemed that Wright had a “global” reputation in line with the global nature of Bitcoin.

Instead, the statements from the judge may suggest that the U.S. would be a more appropriate place to decide the lawsuit. Roger Ver consented to taking the lawsuit to the United States, said the court documents. CryptoSlate reached out to Roger Ver for comment on the matter and has yet to receive a response.

Little evidence that Craig Wright’s reputation was damaged

The judge also stated there Craig Wright did not sufficiently prove his reputation was harmed. As Roger Ver’s counsel aptly argued:

“Specifically, there is no evidence at all of any actual reputational harm that the Claimant [Wright] has suffered as a result of any of the Defendant’s [Ver’s] publications.”

The judge more or less agreed with the counsel’s statement.

“There is no objective evidence of any harm to reputation in England and Wales. The Claimant [Wright] has failed completely to address whether and to what extent the publications complained of have harmed his reputation in other jurisdictions. The evidence demonstrates clearly that the Claimant enjoys a global reputation, the vast majority of which was generated before he moved to the UK. It is impossible for the Claimant to divide his reputation into neat jurisdictions; it is clearly global.”

And, more conclusively from the judge:

“In my judgment, the Claimant’s evidence as to the extent of harm that the publications have caused (or are likely to cause) is weak, lacks detail and [Craig Wright’s claims] put forward evidence at a level of generality that is almost entirely speculative.”

Craig Wright is engaged in several other lawsuits hinging around his supposed status as Satoshi Nakamoto. Based on the evidence so far, it seems unlikely that these cases will go in Wright’s favor until he can conclusively prove he is not fraudulently claiming to be Satoshi.

The post Court rules in favor of Roger Ver in Craig Wright’s Satoshi Nakamoto defamation lawsuit appeared first on CryptoSlate.

source https://www.tokentalk.co/Cryptoslate/court-rules-in-favor-of-roger-ver-in-craig-wrights-satoshi-nakamoto-defamation-lawsuit-5d4217d1d56d6edc2d1493c2

RISE Wealth Technologies Aim for a $120 million Security Token Offering @securitiesio #Security Token News #blockchain #digital securities #rise wealth technologies #Security Tokens #STO

Security Token Offering Goes Live

RISE Wealth Technologies has announced their long planned security token offering. The event recently opened up to accredited investors, with tokens, called ‘RSE,’ being distributed.

These assets are structured as profit-sharing security tokens, and are being sold with the intent to be used to further the development of RISE technologies, in addition to fueling global expansion.

$120 Million

The STO launched has been structured with the goal of raising up to $120 million. RISE lists the following benefits to be expected by token holders.

- Quarterly Profit Payouts

- Profits are garnered from all aspects of the platform, including revenue from trading fees, licensing of technology to 3rd parties, etc.

- 4% p.a. Extra Payback in addition to Profit Payouts

- Entitlement to Proceeds should RISE undergo an IPO

Investor Inclusion

While initially restricted to accredited investors, RISE intends for their offering to eventually open up for investors of any ilk. While there is no timeline for this, RISE indicates that this will occur upon successfully satisfying imposed regulations.

Brought to You By…

In what is becoming a common theme in the industry, this STO is being brought to investors by none other than Securitize. This issuance platform is fast becoming an industry favourite, as they have successfully helped various companies throughout the tokenization process, to date.

Commentary

Upon announcing the launch of their STO, RISE CEO, Stefan Tittel, had the following to say on the event. He stated,

“The RISE STO is a one-time opportunity for investors to benefit from the fundamental shifts in a trillion-dollar market. The future of investment management lies in artificial intelligence. The flood of data on the financial markets is continuously increasing, while markets are changing more rapidly…The replacement of manual trading by an automated, data-driven algorithm will be breathtakingly rapid. The use of computers running at billions of times higher processing capacity simply leads to continuously better results in the global financial markets, as in all other areas of life. We believe that in the future, the most successful asset managers will be technology companies. At the same time, our approach is fully in line with the German tradition of engineering; we industrialize the invention process of trading models with our software.”

He continued,

“RISE has an ambitious goal – to revolutionize the trillion-dollar asset management industry with our AI-based technology. The STO offers investors the opportunity to participate in the success of AI technology in the financial industry, with a repayment claim, profit share and an additional entrepreneurial opportunity to participate in an exit. This will enable us to link future technology with an exciting investment model…I am optimistic that within the next five years up to $12 billion in institutional capital will be able to flow into trading strategies using RISE technology. Which would still be a negligible part of the market.”

RISE Wealth Technologies

Rise Wealth Technologies is a Grunwald, Germany, based company, and was founded in 2012. Above all, Rise works to develop and implement AI based trading algorithms. The goal of which is to provide professional style investing tactics to the common trader.

CEO, Stefan Tittel, currently oversees company operations.

In Other News

As time rolls on, we are seeing an increasing amount of STOs being announced and launched. Whether these opportunities represent >$100 million events, or something much smaller, the opportunities are mounting. Check out the following articles to learn a bit more about various recent STOs – big and small.

Security Token Offerings from SMEs & Boutique Companies

Fundament Group to Issue €250 million in Security Tokens backed by German Real Estate

Multiple Security Token Offerings (STOs), Have Exceeded Expectations

The post RISE Wealth Technologies Aim for a $120 million Security Token Offering appeared first on .

source https://www.tokentalk.co/Securities/rise-wealth-technologies-aim-for-a-120-million-security-token-offering-5d423121d56d6edc2d1493c6

Bees, Bud And Business: Top Projects Surfing on the WAVES Platform @crypto_briefing #Blockchain Tech #Crypto Tech #Waves

Waves swept onto the shores of the blockchain scene back in 2016, thanks to a group of Russian developers who became disillusioned with NXT. They decided to launch their own platform, aiming to make it quick and easy for anyone to issue...

Waves swept onto the shores of the blockchain scene back in 2016, thanks to a group of Russian developers who became disillusioned with NXT. They decided to launch their own platform, aiming to make it quick and easy for anyone to issue their own token.

Waves quickly became the first platform to market with its own decentralized exchange. At the end of 2018, the project raised $120 million from investors to develop a private version of its Vostok platform, which is designed to deploy Waves in commercial and government IT systems. However, recent reports suggest that the Waves founder sold his stake in Vostok to focus on developing out the Waves platform.

Nevertheless, Waves still has plenty of activity, with over thirty projects listed on the WavesDapp website. Here are a few of the most unique use cases.

Apismellifera

Apis mellifera is the Latin name for the western honey bee, and now also the name of a Waves project aiming to help the declining honey bee population.

The plight of the bees is real, y’all. Bees pollinate 70% of the crops that feed 90% of the world. Without honey bees, the global agricultural sector would be $30 billion poorer each year. But intensive farming, mono-cropping, and climate change mean that the bee population has declined by up to 45% in some parts of the western world.

By participating in the Apismellifera project, you can use Waves-based Beehive tokens to purchase a bee adoption plan. Participation entitles you to a portion of the honey produced by your very own adopted bee colony.

Tokens are locked up for a fixed period of time, and the project will establish more hives each year. Therefore, the number of hives your tokens are sponsoring increases each year that you participate. Adoption plans are available for individuals and businesses, with the higher-level plans even including a visit to the bee family in the hives.

Tokes

It’d be worth a mention for the pun-tastic name alone, but the Tokes (TKS) project has far more to offer than just humorous wordplay. It started life on the Waves platform as a tokenized payment solution for the legal cannabis industry.

Despite being legal in many states, cannabis remains outlawed at the federal level. Much like crypto companies, the cannabis industry has faced problems in gaining access to traditional banking services, forcing businesses to accept only cash payments.

Enter Tokes.

Along with the payment solution, Tokes also developed consumer mobile apps, merchant point-of-sale software, and e-commerce modules to transact in the token. However, Tokes also recognized that blockchain has broader applications in the cannabis sector. It now provides “track-and-trace” solutions that can be deployed in the cannabis supply chain, as well as other verticals.

RentApp

RentApp uses the Waves platform to provide a P2P sharing marketplace, where anyone can rent anything to anyone else. Services like Airbnb have evolved to an “own-to-rent” model that doesn’t exactly fulfill the original spirit of the sharing economy. RentApp aims to restore that intent by allowing people to rent out unused resources like a lawnmower, or let someone try-before-they-buy through renting.

Unlike many blockchain-based sharing economy initiatives, RentApp doesn’t force you to use the native RENT token. You can agree to pay via PayPal, wire transfer, or other digital currencies. Funds are held in escrow by the Waves blockchain until both parties agree that the transaction is complete.

However, if you do opt to use the RENT token, then you get to participate in additional benefits, like discounts and a loyalty and referral program.

Boltt

Wearable fitness trackers and apps are contributing to an explosion of healthcare data. So much so, that the growth of big data in healthcare is soon expected to outpace other sectors including manufacturing, financial services, or even media. Boltt aims to capitalize on this trend by developing the biggest health data network in the world.

With Boltt, users can monetize the health data in return for Boltt tokens. That data can be accessed in aggregate by organizations willing to stake Boltt tokens on the platform. There are also a host of other features, including user contests, and a portal where you can view your own health data from a variety of sources including health apps, pharmacies, labs, or anywhere else it’s stored.

Boltt has already been making waves (cough cough) in the dApps world, having clocked more than 10,000 daily active users in March this year. It’s also among the top dApps on the Waves blockchain, and was included in the Waves Labs accelerator program. The token is actually issued as a hybrid on the Waves and Ethereum blockchain, with the project having opted for Waves due to its higher transaction speed.

Kolin

Kolin is developing a decentralized, international translation and information exchange service on the Waves platform. The name is an acronym of “Konscienco Lingvo” means “Conscious Language” in Esperanto. It’s designed to reflect the mission of Kolin to bridge language boundaries – not just between different spoken languages, but also between technical and non-technical language.

The application operates around the Kolin token and operates as a kind of dual marketplace for translation services. The private marketplace enables anyone to request a translation by a professional translator., for which they’ll pay in Kolin tokens On the private platform, prices are fixed based on word count and the transaction complexity.

The social marketplace operates in a similar way, except volunteers perform the translations. Those who volunteer are proportionately rewarded for their accuracy, simplicity, and word count.

Waves Platform – Riding the Market Currents

These are just a select few of the projects currently riding on Waves. Others include various DeFi initiatives, organic food, and coffee supply chain trackers, and loyalty programs. Although the Waves coin itself currently has a bearish outlook, the Waves blockchain still has a lot to offer the broader ecosystem.

The post Bees, Bud And Business: Top Projects Surfing on the WAVES Platform appeared first on Crypto Briefing.

source https://www.tokentalk.co/Crypto Briefing/bees-bud-and-business-top-projects-surfing-on-the-waves-platform-5d4217d0d56d6edc2d1493c1

Bitcoin Rises as Markets Expect Decade’s First Fed Rate Cut @newsbtc #Analysis #Bitcoin #Crypto #Fundamental

The bitcoin price was higher on Wednesday morning as investors prepared themselves for the outcome of the Federal Reserve’s meeting later in the afternoon.

At around 07:00 UTC, the BTC/USD instrument establ...

The bitcoin price was higher on Wednesday morning as investors prepared themselves for the outcome of the Federal Reserve’s meeting later in the afternoon.

At around 07:00 UTC, the BTC/USD instrument established a local high of $9,814.61, up close to 3 percent in the previous 24 hours. Futures on CME were also up by 2.31 percent. Bitcoin’s upside also influenced other cryptocurrencies to follow suit, with Ethereum, XRP, Litecoin, and Binance Coin surging in the range of 2-3 percent. Bitcoin Cash, meanwhile, registered profits of more than 5.5 percent, the highest in the top ten crypto index.

Rate Cut

The US central bank expects to cut interest rates for the first time in a decade. It will likely announce its decision at 14:00 ET with chairman Jerome Powell cataloged to hold a press conference at 14:30 ET. Market expectations indicate a quarter-point rate cut.

The proposed move from the Fed has sent the US stock index futures higher in tandem with bitcoin. Nevertheless, issues arising from the US-China trade war is capping the profits, at least of the US stocks. President Donald Trump said in a string of tweets that China is not keeping its promise to purchase US agricultural products. On the other hand, China denied the accusation, saying it is making those purchases.

China is doing very badly, worst year in 27 – was supposed to start buying our agricultural product now – no signs that they are doing so. That is the problem with China, they just don’t come through. Our Economy has become MUCH larger than the Chinese Economy is last 3 years….

— Donald J. Trump (@realDonaldTrump) July 30, 2019

US and China agreed to restart their discussions on the trade war late June. The two nations have slapped billions of dollars worth of tariffs of each others’ imports.

Bitcoin, which so far has profited from an inconclusive trade deal between the two superpowers, is battling its own troubles – in terms of regulations. While an interministerial committee in India has proposed a complete ban on cryptocurrencies, matters in the US are also bleak ever since the Treasury Secretary Steven Mnuchin called bitcoin a national security threat during a White House press briefing.

“This is indeed a national security issue,” he told reporters at a press conference on July 15. “Cryptocurrencies such as bitcoin have been exploited to support billions of dollars of illicit activity like cybercrime, tax evasion, extortion, ransomware, illicit drugs, and human trafficking.”

"I can assure you I will personally not be loaded up on bitcoin" in 10 years, says Treasury Secretary Mnuchin #bitcoin pic.twitter.com/0J5acWQwRO

— Squawk Box (@SquawkCNBC) July 24, 2019

Investors’ Call

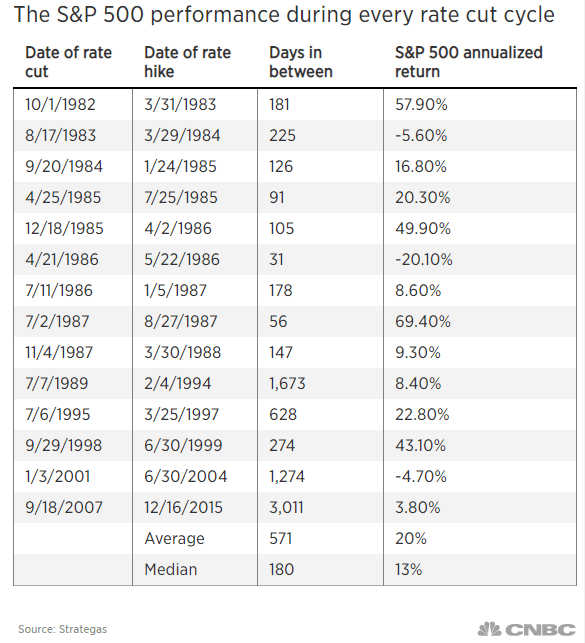

Fed’s dovish cycles have typically resulted in higher annualized returns for the benchmark S&P 500 Index. Strategas noted that the market returned a 20 percent average profits between the first Fed rate cut and the next hike. Investment sentiment didn’t fight the Fed but supported it thanks to cheaper lending at banking levels.

Bitcoin, which is gaining momentum in the mainstream owing to spot and derivative products introduced by Bakkt, Fidelity Investments, TD Ameritrade, and whatnot, expects to become one of the investment choices.

Anthony Pompliano, the co-founder & partner at Morgan Creek Digital Assets, said last week that US economy was declining on a quarter-to-quarter basis. He added that the Fed’s decision to cut rates or to increase the money supply means investors would hedge into non-correlated assets.

“They don’t realize that they’re giving Bitcoin the rocket fuel it was built to consume,” Pompliano stated. “Long Bitcoin, Short the Bankers!”

The post Bitcoin Rises as Markets Expect Decade’s First Fed Rate Cut appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/bitcoin-rises-as-markets-expect-decades-first-fed-rate-cut-5d4181d1d56d6edc2d149381

Crypto payments startup Bitwala raises $14.49M for global expansion @TheBlock__ #Banking #Blockchain #banking #Bitwala #Europe #Germany

Germany-based cryptocurrency payments and banking services provider, Bitwala, has raised 13 million euros (~14.49 million) in Series A funding for global expansion.

The round is led by Sony Financial Ventures and NKB Group, with partici...

Germany-based cryptocurrency payments and banking services provider, Bitwala, has raised 13 million euros (~14.49 million) in Series A funding for global expansion.

The round is led by Sony Financial Ventures and NKB Group, with participation from existing venture capitalists Earlybird and Coparion, who contributed half of the Series, Bitwala announced Wednesday.

The investment will be utilized to gain new customers, expand the team, and start offering bitcoin accounts for businesses, the firm said.

Bitwala currently offers such accounts for retail customers, in an association with local fintech firm SolarisBank that has a banking license and is regulated. The service has seen “fast growth,” Bitwala said, reaching customers in all 31 countries of the European Economic Area (EEA) since launch in December.

Join Genesis now and continue reading, Crypto payments startup Bitwala raises $14.49M for global expansion!

source https://www.tokentalk.co/The Block/crypto-payments-startup-bitwala-raises-1449m-for-global-expansion-5d4174b1d56d6edc2d14937d

New Research Reveals Crypto Girls Are On The Rise @newsbtc #Crypto #crypto #europe #investors #research #survey #Women

Diversity among crypto holders is increasing according to a new survey of European cryptocurrency investors and traders. The number of women in crypto is increasing as the industry shakes off is male dominated past.

...Diversity among crypto holders is increasing according to a new survey of European cryptocurrency investors and traders. The number of women in crypto is increasing as the industry shakes off is male dominated past.

The survey was carried out across three waves of research in 2018, sampling almost 120,000 unique internet users aged 16 to 64 in 17 countries across Europe.

Crypto Girls at 20 Percent

Vienna based fintech firm Bitpanda has partnered with GlobalWebIndex to produce an in-depth survey of cryptocurrency holders across Europe and Russia. According to the research paper, the goal was to determine what sets crypto investors apart from average investors.

One of the key findings was that the stereotypes are shifting which is leading to greater diversification. One in five crypto holders and investors are women, a figure that is on the rise from the estimated 5 percent in early 2018. Jason Mander, Chief Research Officer at GlobalWebIndex, commented;

“When it comes to attitudes, there’s very little difference between men and women. The slight differences pale when we compare cryptocurrency holders to the general public.”

Although the study did not go into the number of women in professional positions in the crypto industry, that number is also on the rise with prominent influencers such as Meltem Demirors, Amber Baldet, Connie Gallippi, and Joyce Kim leading the way in what has traditionally been a male dominated arena.

According to Coin Dance there are still very few women, around ten percent, engaged in the crypto community. However, this could be down to the nature of how things are conducted on Twitter and Reddit with little accountability and a lot of mudslinging.

Not all Millennials

The research made some other interesting findings that crypto is not all about the millennials. Around 40 percent of crypto investors are over the age of 35 according to the study. However, in line with current stereotypes it did add that most cryptocurrency holders tend to be young, highly educated, high-income males working in European financial centers in IT, engineering or finance.

It also stated that European crypto holders had a higher technical knowledge, more disposable income and were less averse to risk taking. They pursue novelty, are open to risk and have a strong sense of economic empowerment, it continued. Bitpanda CEO, Eric Demuth, stated;

“We wanted to demystify the people that shape the cryptocurrency industry. I’m hoping this report will help everyone to better understand who these people are, what their attitudes are, as well as their lifestyle, finance & investment behaviours,”

The new study challenges others that have reported female portion of the crypto pie at less than ten percent.

Image from Shutterstock

The post New Research Reveals Crypto Girls Are On The Rise appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/new-research-reveals-crypto-girls-are-on-the-rise-5d4181d1d56d6edc2d149382

BitMEX, Jimmy Song lead funding round for Middle Eastern cryptocurrency exchange @decryptmedia #Cryptocurrencies #cryptocurrency

BitMEX, Breadwallet and Blockwater join crypto heavyweights in pushing eastward.

The post BitMEX, Jimmy Song ...

BitMEX, Breadwallet and Blockwater join crypto heavyweights in pushing eastward.

The post BitMEX, Jimmy Song lead funding round for Middle Eastern cryptocurrency exchange appeared first on Decrypt.

source https://www.tokentalk.co/Decrypt/bitmex-jimmy-song-lead-funding-round-for-middle-eastern-cryptocurrency-exchange-5d4173c1d56d6edc2d14937c

Bitcoin and Crypto Shouldn’t & Can’t Be Banned, Say Politicians: Why? @newsbtc #Bitcoin #Crypto #bitcoin #congress #crypto #senate

Bitcoin and crypto are finally entering the mainstream political discourse. The launch of Facebook’s Libra lit somewhat a fire under the

Bitcoin and crypto are finally entering the mainstream political discourse. The launch of Facebook’s Libra lit somewhat a fire under the rear of politicians the world over, mandating them, along with other economic and social commentators, to address the issues that the Silicon Valley-backed cryptocurrency could bring.

Related Reading: Peter Schiff Reveals if Receiving Bitcoin Donations has Converted to Crypto

Anti-Crypto Stance

If you have perused financial news or industry headlines over recent weeks, you would know of the anti-crypto stance that some of the world’s most powerful people have struck.

American President Donald Trump, for instance, explained that he believes that cryptocurrencies have no inherent value, calling these nascent markets “thin air”. He went on to touch on the volatility of assets like Bitcoin, along with the fact that they can be used to facilitate illicit activities like money laundering, tax evasion, and terrorist financing.

U.S. Treasury Secretary Steven Mnuchin echoed Trump’s concerns in his own comment. Mnuchin, who claimed that he doesn’t believe that USD isn’t an asset for criminals, remarked that cryptocurrencies should be subject to more stringent regulations to deter illicit activity.

While many Congressmen and Senators followed suit, repeating those concerns in hearings on the matter of digital assets, a select few have started to come out in support of Bitcoin.

Bitcoin, The Unstoppable Force

Most recently, Senate Banking Committee Chairman Mike Crapo, a Senior Senator from Idaho, claimed that he is coming under the impression that “these technologies and other digital innovations are inevitable”.

It seems to me that digital technology innovations are inevitable, could be beneficial, and I believe that the U.S. should lead in developing these innovations and what the rules of the road should be. https://t.co/5PIAmKRUQt

— Senator Mike Crapo (@MikeCrapo) July 30, 2019

He added that if the United States was to try and ban Bitcoin and other cryptocurrencies, “we couldn’t succeed in doing that because this is a global innovation”. Continuing the tacitly pro-crypto narrative, Crapo went on to note that the U.S. would be unwise to crackdown on the industry, as they could be “beneficial” to many facets of the economy and society.

Crapo’s comment comes hot on the heels of a near-identical one from Patrick McHenry, who basically said the exact same thing as Crapo did in a Congressional hearing regarding Libra and a segment of CNBC “Squawk Box” with the Bitcoin-friendly Joe Kernen. McHenry of North Carolina called Bitcoin and the ecosystem that surrounds it is an “unstoppable force”.

Why is Bitcoin Unstoppable?

Alright, this may leave some of you wondering, why is crypto unstoppable?

Well, as prominent economist and industry analyst Alex Kruger wrote in an extensive thread, Trump’s and Mnuchin’s comments on Bitcoin and other cryptocurrencies suggest a close-to-zero chance that a ban is on the horizon.

He laid out a number of reasons for this: code is unstoppable, an executive order from Trump banning Bitcoin could be “easily overturned by Congress or Courts, banning cryptocurrency may not be a prudent political move.

Even if a ban was to occur, it would likely not work.

Take historical precedent from China, for instance. After Bitcoin began to strongly rally into 2017, which coincided with it becoming increasingly used as a medium for capital flight out of China, Chinese authorities cracked down hard.

Related Reading: Prominent Investor on Why Bitcoin Can Hit $20,000 by Year’s End

Although the ownership of Bitcoin was never banned, the nation’s central bank bashed cryptocurrencies; exchanges were banned, as were industry events, media outlets, transactions made through WeChat Pay involving crypto, and online forums; and there was once even talk of a ban of digital asset mining.

Just one year and change later, some powerful Chinese entities have started to laud Bitcoin publicly, implying that the authorities’ crackdown efforts were mostly unsuccessful. Case in point, an Hangzhou court ruled that Bitcoin is legally protected as “digital property”, and the Bank of China recently came out to explain the 5 W’s of Bitcoin for an audience of millions.

Featured Image from Shutterstock

The post Bitcoin and Crypto Shouldn’t & Can’t Be Banned, Say Politicians: Why? appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/bitcoin-and-crypto-shouldnt-cant-be-banned-say-politicians-why-5d4173c1d56d6edc2d14937b

Banking Committee Chairman Crapo: US Couldn’t Ban Bitcoin @bitcoinist #Altcoins #Bitcoin #Bitcoin Regulation #News #News teaser #Banking committee #bitcoin #blockchain #Facebook #Libra #regulations #US

<...

Yesterday saw yet another U.S. Senate Banking Committee hearing on regulatory frameworks for digital currencies and blockchain. Libra got another bashing, and Chairman, Mike Crapo, surmised the U.S. “couldn’t succeed” in banning Bitcoin and cryptocurrencies even if it wanted to.

Good Start For Bitcoin, Bad For Facebook

Crapo introduced the hearing on a positive note for crypto, noting that although the hearings had started by examining Libra, the cryptocurrency ecosystem was diverse, saying:

It seems to me that these technologies and other digital innovations are inevitable. They could be beneficial… and I believe the US should lead in their development. I look forward to hearing more about the ecosystem during this hearing.

His colleague, Senator Sherrod Brown, continued that previous hearings had left serious concerns about Facebook’s plan to ‘run its own currency out of a Swiss Bank Account’. Questions put to Calibra head, David Marcus had been dodged, proving again that Facebook doesn’t understand accountability. According to Brown, Facebook cannot be trusted as it just doesn’t care, preferring to ‘move fast and break things’.

“Now it wants to break our currency and payment systems hiding behind the phrase innovation,” Brown said.

We should be a little suspicious when someone tells us that only big corporations can be trusted to provide critical public services.

Current US Banking System is Broken

One thing agreed on by all the panellists was that the current U.S. Banking system is not working for everyone. High fees for basic services like ATMs, lack of real-time payment processing, and minimum balance requirements, mean 25% of U.S. Citizens are unbanked or underbanked.

Circle CEO, Jeremy Allaire, opined that Bitcoin and cryptocurrency could address this imbalance, and help to create a financial system with equal opportunity for everyone.

Law Professor, Mehra Baradaran, however, suggested that financial exclusion was not the result of faulty technology, but faulty policy. She claimed that the U.S. Federal Reserve had the power to fix the banking system straight away, without the need for cryptocurrency.

Whilst this may well be true, it was somewhat off the topic for the hearing.

Regulatory Uncertainty Means US Falling Behind

Allaire said that the current uncertainty over regulation in the U.S. was leading the country to a significant loss of opportunity. Examples such as the Securities and Exchange Commission (SEC) using the seventy-year-old Howey Test, to determine the nature of 21st century digital assets, has had a serious impact on US companies.

Many digital assets do not easily fit into the classifications that are currently defined in the financial system. They are not entirely either currency, commodity, or investment, and some have features of all three. New regulation is needed , he continued, and it was important for this regulation to distinguish between the types of digital asset.

Contradicting this, Baradaran claimed that these digital assets are not new products, just delivered with new technology. Therefore they could be dealt with using existing regulation. She then undermined this argument by saying that ‘to an extent the asset fits the currency model, or the security model, so we enforce those rules’. But gave no indication of which rules we enforce when an asset fits both (or more) models.

Cryptocurrency Friendly Jurisdictions

The hearing then went on to discuss more crypto-friendly jurisdictions, as Allaire’s Circle is moving its core non-U.S. business to Bermuda.

As an example for why this might be, Allaire pointed to the SEC’s extremely narrow view of what isn’t a security. It is the coupling of utility with financial worth which makes certain digital assets innovative, and if treated as a security, the utility cannot function.

Therefore, companies creating such products would move operations elsewhere and perhaps even block U.S. citizens and companies from accessing products and technologies.

International Trade and Finance Specialist, Dr Rebecca M Nelson, assured the Committee that crypto-positive jurisdictions were not about shirking regulation, but about providing clarity. This was not the wild west; risks are controlled, but definitions are clear, whereas the U.S. had a lot of great areas.

U.S. Can’t Ban Bitcoin, Because…

Crapo then pondered the logistics of an attempt to ban cryptocurrency in the United States:

I’m not saying that it should, but… If the United States were to decide it didn’t want cryptocurrency to happen in the United States and tried to ban it… I’m pretty confident we couldn’t succeed in doing that because it is a global innovation.

However, he was interested in how a company would get around such a ban, or what methods it might use. To which Allaire pointed out that digital assets exist everywhere the internet exists. Any ban could only apply to U.S. companies trying to work in the space, and could not be enforced on the assets themselves.

What do you make of these latest comments on Bitcoin? Let us know your thoughts in the comment section below!

Images via Shutterstock, Morning Consult

The post Banking Committee Chairman Crapo: US Couldn’t Ban Bitcoin appeared first on Bitcoinist.com.

source https://www.tokentalk.co/Bitcoinist/banking-committee-chairman-crapo-us-couldnt-ban-bitcoin-5d4181d1d56d6edc2d149383

Bitcoin Cash bests major cryptos for the day, climbing up in price @CoinInsidercom #Price Analysis #Technical Analysis

How Did the Fab Five Finish?

Since the previous day, the five most-watched cryptos (Bitcoin, Bitcoin Cash, Litecoin, Ethereum, and Ripple) provided their holders with a return of 2.67%. The best performer of the bunch was Bitcoin Cash, wh...

How Did the Fab Five Finish?

Since the previous day, the five most-watched cryptos (Bitcoin, Bitcoin Cash, Litecoin, Ethereum, and Ripple) provided their holders with a return of 2.67%. The best performer of the bunch was Bitcoin Cash, which went up 3.89% and currently is sitting near $330.37 USD. As for the worst-performing crypto out of the Big Five, yesterday that was Ethereum; it came in at up 1.59%, which drove its price to around $213.15 USD. In total, all five coins were up from the day prior, which is nice for those bullish on cryptocurrencies.

Key Technical Moves

It should be noted that the price behaviour of XRP and Bitcoin Cash was especially curious, as their moves yesterday were much larger than their respective normal daily trading ranges. Traders may also wish to bear in mind the following events going on regarding current price patterns:

- If coins without a clear trend are your thing, consider Litecoin, XRP and Bitcoin Cash. Those have not been in any clear trend over the past 14 days, and thus might be of interest to rangebound traders.

- Bitcoin is in a clear downtrend on a two-week timeframe. This could an interesting opportunity for short-sellers.

Insights From Transaction Data

Ripple had more transactions recorded on its chain yesterday than any other coin; to be precise, it had about 65% more transactions recorded than Ethereum, which was the runner up for the day in terms of transactions recorded. Ripple has a transaction fee less than the transaction fee of Ethereum, which may indicate that transaction fees might be a key reason why users are preferring Ripple. The largest transaction in the cryptocurrency space yesterday, coming in at a value of $108,005,872 occurred on Bitcoin’s chain. Bitcoin continues to dominate the crypto market, with the total circulating value of its currency equal to approximately $174.06 billion US dollars. That’s about 64.33% of the value of all circulating cryptocurrencies. Note that Bitcoin’s dominance level has been in a downtrend, going between 64.12% to 65.77% over the past two weeks.

Article by SixJupiter

The post Bitcoin Cash bests major cryptos for the day, climbing up in price appeared first on Coin Insider.

source https://www.tokentalk.co/CoinInsider/bitcoin-cash-bests-major-cryptos-for-the-day-climbing-up-in-price-5d4175a1d56d6edc2d14937e

This analyst says there’s a “high chance” Bitcoin may never fall under $5k again @cryptoslate #Analysis #Price Watch

Once Bitcoin (BTC) started to incur strong losses in the second half of 2019, analysts were once again making extremely low price prediction...

-

App-enabled cryptocurrency exchange and wallet provider, Zebpay, has announced that it is enabling Lightning Network payments for all its ...

-

The Indian Ministry of Commerce and Industry announced yesterday that the Coffee Board in the country is integrating blockchain into the cof...

-

The pharmaceutical industry is one of the world’s few (almost) trillion-dollar verticals, worth more than $900 billion annually, according t...