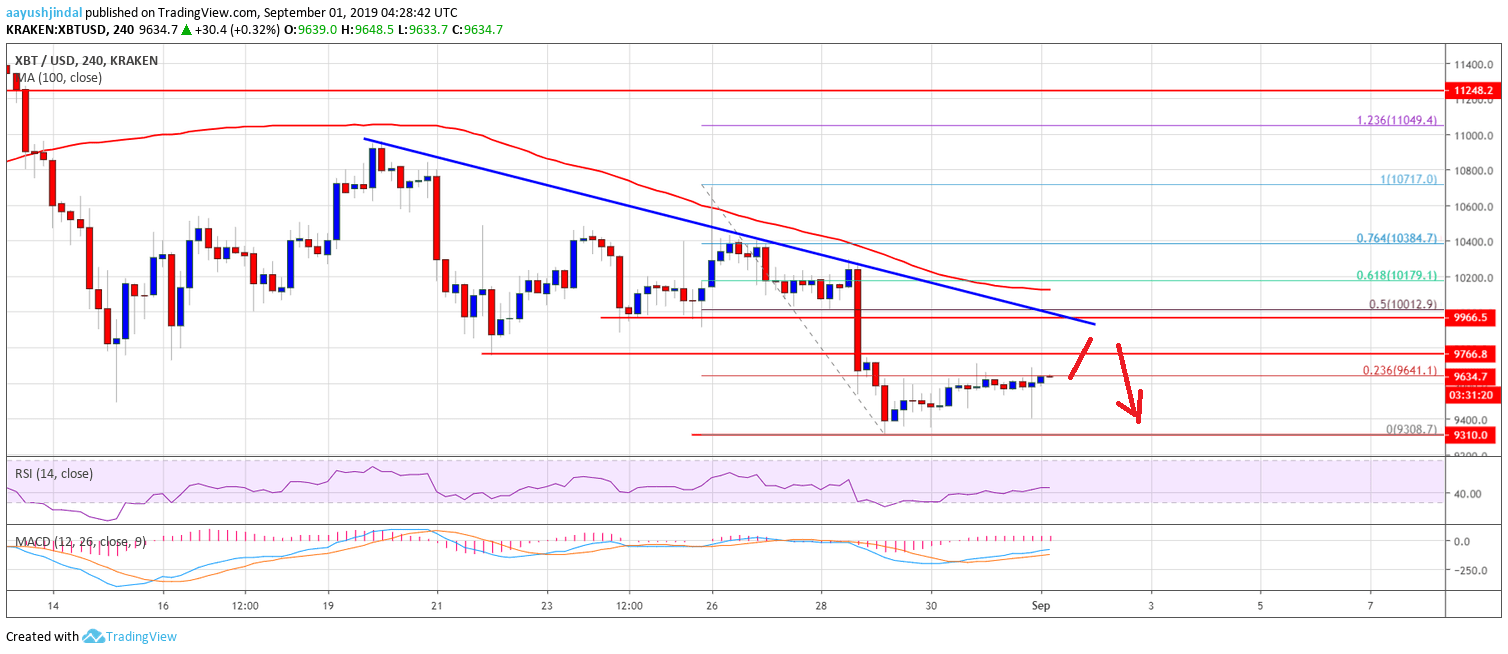

- There was a major downward move below the $10,000 support in bitcoin price against the US Dollar.

- The price is currently correcting higher, but upsides remain capped near $9,800 and $10,000.

- Ther...

- There was a major downward move below the $10,000 support in bitcoin price against the US Dollar.

- The price is currently correcting higher, but upsides remain capped near $9,800 and $10,000.

- There is a major bearish trend line forming with resistance near $9,980 on the 4-hours chart of the BTC/USD pair (data feed from Kraken).

- There could be a short term upside correction, but the bulls are likely to struggle near $10,000.

Bitcoin price is facing a lot of hurdles on the upside near $10,000 against the US Dollar. BTC remains sell on rallies as long as it is trading below the $10,000 resistance.

Bitcoin Price Weekly Analysis (BTC)

In the last weekly forecast, we discussed the possibilities of a downward move below $10,000 in bitcoin price against the US Dollar. The BTC/USD pair did move down and broke the key $10,000 and $9,800 support levels. Moreover, there was a close below the $10,000 pivot and the 100 simple moving average (4-hours). Finally, there was a break below the $9,800 and $9,500 supports as well.

A new monthly low was formed near $9,300 and the price is currently consolidating losses. It is testing the 23.6% Fib retracement level of the recent decline from the $10,717 high to $9,308 low. However, there are many hurdles on the upside near the $9,800 and $9,900 levels. Additionally, there is a major bearish trend line forming with resistance near $9,980 on the 4-hours chart of the BTC/USD pair.

Moreover, the 50% Fib retracement level of the recent decline from the $10,717 high to $9,308 low is also near the $10,010 level. Therefore, upsides are likely to remain capped near the $9,800 and $10,000 levels. Above the trend line, the 100 SMA is waiting near the $10,150 level. The 61.8% Fib retracement level of the recent decline from the $10,717 high to $9,308 low is also waiting near the $10,170 level.

On the downside, an immediate support is near the $9,500 level. If there is a downside break below the $9,500 support, the price may continue to move down below the last swing low at $9,300. The next key supports are near the $9,100 and $9,000 levels.

Looking at the chart, bitcoin price is clearly trading in a downtrend below $10,000. In the short term, there could be an upside correction, but the $9,800 and $10,000 levels are likely to act as major sell zones in the coming sessions.

Technical indicators

4 hours MACD – The MACD for BTC/USD is slowly moving into the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for BTC/USD is slowly rising towards the 50 level.

Major Support Level – $9,500

Major Resistance Level – $10,000

The post Bitcoin (BTC) Price Weekly Forecast: $10K Holds Key For Recovery appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/bitcoin-btc-price-weekly-forecast-10k-holds-key-for-recovery-5d6b4f61b98396a4770c96e7

Saturday 31 August 2019

Bitcoin (BTC) Price Weekly Forecast: $10K Holds Key For Recovery @newsbtc #Analysis #Technical #bitcoin #btc

Bitcoin Need Accentuated as Negative-Yielding Debt Hits $17 Trillion @newsbtc #Bitcoin #bitcoin #bloomberg #cryptocurrency

If you told economists twenty years ago about Bitcoin (BTC) and negative-yielding debt, they would be shocked.

In the 1990s...

If you told economists twenty years ago about Bitcoin (BTC) and negative-yielding debt, they would be shocked.

In the 1990s or even the 2000s, decentralized digital money and a bond that made your money disappear with time would have seemed abstract — quite abstract. Now, however, these two financial trends, which came to fruition mostly over the last decade, have become widely recognized.

Related Reading: Bitcoin Becoming a Better Hedge as US National Debt Hits $22.5 Trillion

On Friday, Bloomberg reported that the negative-yielding bond situation has just developed. Their report, which cites the Bloomberg Barclays Global-Aggregate bond index, shows that $17 trillion worth of bonds is negative-yielding.

#Bloomberg re "unstoppable surge in negative yields."

Universe of negative-yielding bonds–once unthinkable (after all, who would pay rather than receive interest when #lending money)–reached $17 trillion at the end of August; and it's spreading its wingshttps://t.co/B6IhuYwUZc pic.twitter.com/P44I7G5ZeV— Mohamed A. El-Erian (@elerianm) August 31, 2019

To describe how crazy negative interest rates are, here’s Bitcoin commentator Rhythm to explain. As he explained in a recent tweet, it’s essentially like lending someone your capital and expecting to receive less of it back in a few years’ time. In no world does this make sense. After all, investments are supposed to yield a return, not result in you slowly losing your capital.

What if I said I wanted to borrow $100 from you and pay you back $99 five years later?

Would you do it? Of course not.

Yet, this is happening right now with $17,000,000,000,000 of debt with negative yields.

The mother of all financial bubbles.

— Rhythm (@Rhythmtrader) August 31, 2019

There’s a silver lining in all this: the demand for Bitcoin and other alternative assets should only grow.

Bitcoin Demand to Grow Amid Bond Crisis

Raoul Pal, the former head of Goldman Sachs’s hedge funds sales business, recently sat down with Bitcoin podcaster Stephen Livera to talk investments. The economist explained that as it stands, the most popular asset classes make no sense for millenials with ten- to 20-year outlooks.

Equities, he remarked, are roughly at all-time highs, and are pushing extreme valuations for relatively little profit and potential. As Ray Dalio, a legendary hedge fund manager,explained earlier this year:

“There are a lot of parallels between now and the late 1930s. From 1929 to 1932 we had a debt crisis — interest rates hit zero. Then there was a lot of printing of money, and purchases of financial assets brought their prices higher.”

Bonds aren’t much better, Pal opines, drawing attention to the “virtually zero yields” — and negative yields in some cases — that debt deemed safe provides.

Even real estate isn’t attractive, with the prominent investor calling this asset class “unaffordable”, adding that it makes even less sense to purchase homes because they’re trading near all-time highs. Enter Bitcoin. Pal quipped:

“So what the hell does a millennial do to save for your future, when almost all assets have negative imputed returns for the next 20 years, 10 years? And the answer is well, you take the optionality of cryptocurrency and Bitcoin.”

He went on to explain the rationality of why buying Bitcoin as a millennial (and under) makes sense. Pal remarked that nothing like digital assets provide “that risk-reward profile where you can be wrong but you do it earlier on, you’ve still got plenty of time to accumulate wealth in other assets too.”

Featured Image from Shutterstock

The post Bitcoin Need Accentuated as Negative-Yielding Debt Hits $17 Trillion appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/bitcoin-need-accentuated-as-negativeyielding-debt-hits-17-trillion-5d6b0910b98396a4770c96e6

Bitcoin, Major Stablecoin Wallets Added to Samsung Galaxy S10 @bitcoinist #Bitcoin Wallet #bitcoin #Samsung Galaxy S10

Earlier this year, the Samsung Blockchain Wallet was added to their flagship phone, the Galaxy S10. Initially only supporting Ethereum and some ERC20 tokens, the Samsung Wallet now supports Bitcoin, Binance Coin (BNB), and most of the major stable coins.

Putting Bitcoin Wallets in Everyone’s hand

Now that some of the biggest coins are supported, Samsung has put in the effort to add other highly used tokens on the market. Wallets for Bitcoin and Ethereum will be generated automatically by the device. Binance Coin and Basic Attention Token (BAT) have been added to the wallet along with several stable coins like TrueUSD, Maker, and USD Coin. The wallet is notably missing Tether from that list.

Coins like BAT have been bringing non-crypto users into the space. BAT specifically allows content makers to earn money via tipping. The system is already live on Twitter and the team hopes to expand to allow everyone on the internet to have an alternative revenue stream. Adding these tokens to the Samsung wallet will allow millions of people to get started using crypto-currencies.

Crypto-powered Phones

Samsung isn’t the only phone maker in the market looking to integrate blockchain technology into their products. Startup Sirin Labs sells the Finney phone, an ultra-secure smartphone for cryptocurrencies. It’s price rivals the newest iPhones, totaling nearly $1,900.

However, the Finney has not been able to garner much adoption. Due to poor sales in the United States and Europe, Sirin laid off a quarter of its staff earlier this year. The Finney just recently launched in Singapore, which opens up an entirely new market for Sirin Labs.

Adding blockchain wallets to smartphones is a necessary step towards mass adoption. Allowing people to carry their funds in their pockets is one of the biggest selling points in the crypto-currency space. Hopefully having easy access to blockchain infrastructure will show people the power of crypto-currencies.

Do these updates make you want to switch phones? If you have a Samsung Galaxy S10, do you use the blockchain wallet? Let us know down in the comments below!

Images courtesy of Shutterstock, Bitcoinist Media Library and Sirin Labs

The post Bitcoin, Major Stablecoin Wallets Added to Samsung Galaxy S10 appeared first on Bitcoinist.com.

source https://www.tokentalk.co/Bitcoinist/bitcoin-major-stablecoin-wallets-added-to-samsung-galaxy-s10-5d6ad76081ecacac7097625a

Top 5 Smart Contract Platforms To Watch in 2020 @bitcoinist #Blockchain #Technology #Bitcoin smart contracts #DApps #Ethereum #RSK #smart contracts

The number of blockchain-based smart contract development platforms available to crypto developers is now greater than ever. Over the last 18 months, a Cambrian explosion in smart contract platforms has resulted in an embarrassment of riches and a plethora of options.

No longer are crypto projects forced to choose between network effects (Ethereum) and scalability (EOS). Thanks to an array of first and second layer solutions, there’s a multitude of ways to build and deploy dApps, exchanges, lending protocols and other crypto products that harness the power of smart contracts to automate processes and create uncensorable applications. If you’re seeking a smart contracting platform on which to build, here are five of the best.

RSK

RSK is a second layer solution that was created to develop and run smart contracts using the Bitcoin blockchain. These contracts are coded and digitally recorded on-chain in a trustless, autonomous and entirely self-sufficient manner. As well as adding value and functionality by introducing smart contracts to the Bitcoin ecosystem, RSK scales to up to 100 transactions per second, which is more than enough for most applications. It also reduces storage and bandwidth using probabilistic verification and fraud detection techniques.

Founded in 2016, RSK was acquired last year by RIF Labs and there have been many positive developments since, including enhancements to storage and security assured by July’s Wasabi update. The native RBTC token, known as Smart Bitcoin, represents BTC on the RSK network, which includes the RSK Infrastructure Framework Open Standard (RIF OS). RIFOS goes beyond smart contracts and encompasses payment channels, storage and communication features. Think of RSK as an Ethereum-esque platform, which benefits greatly from being pegged to the world’s first and most secure blockchain. It combines the best of both worlds, Bitcoin and Ethereum, packaging them into a smart contract platform that’s suited to the needs of consumers and enterprises alike.

LiquidApps

Launched in early 2019, LiquidApps promises to help you build better, whether your domain is crypto tools, utilities, dApps, products, services – or pretty much anything else. The smart contract experts behind LiquidApps specialize in engineering technical solutions that make developing on-chain faster, easier and more affordable. The platform has an incredibly strong team behind it – CEO and co-founder Beni Hakak has a proven track record, having been Director of Operations at Bancor and also a strategic consultant manager at Ernst & Young.

With the DAPP Network native token, LiquidApps helps dApp developers externalize the CPU and RAM from the EOS blockchain while enjoying superior functionality – all without breaking the bank. The company’s latest product, LiquidLink, bridges the EOS and Ethereum blockchains, creating a framework for dApps to be launched on both chains simultaneously. Building bridges between siloed chains is one of LiquidApps’ primary drivers, which it sees as instrumental in driving the next wave of dApp adoption, and onboarding masses to the benefits of Web3 without the trade-offs this has hitherto entailed. Other working products from the rising smart contract specialists include oracles, for querying off-chain data, and Zeus, an SDK for dApp developers that simplifies the creation and deployment process.

Matic

Matic is yet another smart contract development solution with a lot of buzz about it, starting the moment it blossomed from a Binance Launchpad IEO earlier this year. The involvement of Coinbase Ventures, who invested early, bodes well for the prospects of Matic Network and gives an indication of where its token may end up trading. The layer two scaling solution, which utilizes sidechains bolstered by the security of the Plasma framework, seeks to address common scalability and usability issues, without compromising on decentralization.

High throughput of up to 10,000 TPS is coupled with superior UX and a suite of tools for developers. Given the array of smart contracting platforms now on the market, developers are finding themselves being courted by a string of well-funded and well-funded suitors. In the case of Matic Network, those overtures include a full SDK with WalletConnect support, and tools to abstract away much of the complexity, enabling devs to focus on coding killer dApps without the need to worry too much about what’s going on under the hood.

Ethereum is its current platform of choice, with Matic already having a working implementation for the platform on Kovan Testnet. However, the team’s ultimate goal is to provide solutions for blockchains across the board. Matic endeavors to supply payment APIs and SDKs, products and identity solutions that will enable developers to design, implement and migrate dApps built on base protocols.

Echo

Echo is another Bitcoin-based smart contracting solution. Like RSK, it seeks to capitalize on the security and network effects of the Bitcoin main chain, leveraging this to create a framework to launch highly decentralized applications. Envisaged use cases include decentralized finance, without the need to incorporate a native token if desired. One of Echo’s main claims is that it doesn’t limit developers to a single programming language; a whole bunch are supported including Solidity, C++, Go, Python, and Rust, and smart contracts can be ported over from Ethereum in a matter of minutes.

Echo has a working block explorer, desktop and mobile wallet, a 64x virtual machine and EVM, and a consensus mechanism based on BFT that uses what’s known as proof of weighted randomness (PoWR). Envisaged use cases for dApps built with Echo and secured on the Bitcoin blockchain include derivatives markets, stablecoins, lending and decentralized exchanges.

Loom

Many of the smart contracting platforms that have sprung up over the last 18 months have been focused on supercharging Ethereum and overcoming its flaws. Loom is the perfect example of this. It operates as a layer two, with a delegated proof of stake (DPoS) powering its own high throughput dApp network. It has witnessed significant success in luring projects frustrated by Ethereum’s inability to scale, and now boasts dApps such as Neon District, Axie Infinity and Battle Racers. Blockchain gaming is just one of the many use cases for Loom, which is also now integrated with Tron and EOS.

Because it’s compatible with all ERC20 and ERC721 assets, Loom enables Ethereum-based dApps to switch with minimal disruption, and to tap into a production-ready smart contract solution that’s fast, secure, and blessed with excellent UX for ease of onboarding. Thanks to the efforts of Loom, RSK, Matic and the countless other companies tirelessly innovating, launching smart contract-powered applications is now safer and easier than ever. We expect to see a plethora of new products and new use cases unleashed in the wild as the smart contract ecosystem matures.

The post Top 5 Smart Contract Platforms To Watch in 2020 appeared first on Bitcoinist.com.

source https://www.tokentalk.co/Bitcoinist/top-5-smart-contract-platforms-to-watch-in-2020-5d6acfe181ecacac70976255

Bitcoin Bull Jack Dorsey’s Twitter Hack Is a Wakeup Call for Crypto Security @newsbtc #Bitcoin #Crypto #bitcoin #crypto #Jack Dorsey #sim swap hack #twitter

Yesterday, the CEO of Twitter and Square Inc., and staunch Bitcoin and crypto supporter, Jack Dorsey, had his personal Twitter account hacked by the way of a SIM-swap...

Yesterday, the CEO of Twitter and Square Inc., and staunch Bitcoin and crypto supporter, Jack Dorsey, had his personal Twitter account hacked by the way of a SIM-swap attack and SMS-based backdoor.

The hack demonstrates that even the CEO can have his own company’s highly-valuable personal account compromised, and is a painful reminder that if it can happen to someone as high profile as Dorsey, it could happen to you too.

Bitcoin Bull Jack Dorsey Falls Victim to Sim-Swap Hack, Twitter Account Compromised

Yesterday, the Twitter account of the social media platform’s CEO – used often as an important bulletin board the company and soapbox for the outspoken executive – was hacked by a group of hackers calling themselves ChucklingSquad. The hackers had accessed the Twitter account and posted nonsensical notes, racial slurs, and “hello world” style messages to prove that their cybercriminal prowess was able to achieve such a feat.

Related Reading | Pro League of Legends Gamer Robbed of $200K in Crypto in Sim-Hack

And while Bitcoin wasn’t directly involved, Dorsey’s account was comprised due to having been the victim of a SIM-card swap attack – a relatively new type of hack that has been increasingly targeting cryptocurrency holders. Jack Dorsey is among the world’s most renowned Bitcoin bulls, using his Square Cash app to bring Bitcoin buying to the mainstream public and suggests that one day the crypto-asset would become the world’s single global currency for the internet.

As is the case with some high profile crypto investors, the hackers were able to assign Dorsey’s phone number to a dummy phone. However, unique to this case, the number was then used to text message Twitter’s text-to-tweet service to send the offensive tweets.

Others haven’t been so lucky. In the past, angel investor Michael Terpin was the victim of a SIM-swap attack that resulted in $24 million in crypto being stolen. Later, Terpin filed a lawsuit against his mobile service carrier at the time – AT&T – for their negligence and was awarded a $75.8 million victory in the case. AT&T is also Dorsey’s service provider, showing that there could be a connection somehow.

More influential figures known for their involvement in crypto and Bitcoin have been the targets of similar attacks. Recently, a prominent eSports player was targeted and shared the incident on his YouTube channel. The incidences are only increasing as cybercriminals continue to target crypto holders.

ATTENTION: If the CEO of Twitter can get his account hacked on his own platform, I promise your bitcoin is likely MUCH more vulnerable.

Use two-factor authentication where ever possible.

Get your bitcoin off exchanges.

— Rhythm (@Rhythmtrader) August 30, 2019

It’s important for crypto investors to use additional security protections such as two-factor authentication using Google Authenticator and to avoid SMS-based 2FA for this very reason. Always remember to back up your 2FA codes on paper for safekeeping.

Related Reading | 15 Crypto Community Members Targeted As SIM-Port Hack Trend Spikes

Other tips include keeping assets like Bitcoin off exchanges and in cold storage. Also never disclose that you hold any crypto to anyone ever, and use unique usernames and passwords whenever possible. Running malware protection software like MalwareBytes, and being cautious about installing browser add-ons and the like is also recommended.

Dorsey likely has taken all of the steps above and more, yet still, hackers were able to obtain access to his account. The situation proves that no one can ever be 100% safe at all times, however, these steps can certainly aid in keeping one’s assets safe.

The post Bitcoin Bull Jack Dorsey’s Twitter Hack Is a Wakeup Call for Crypto Security appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/bitcoin-bull-jack-dorseys-twitter-hack-is-a-wakeup-call-for-crypto-security-5d6ad1c181ecacac70976259

Brazilian payment processing giant announces bitcoin support @TheBlock__ #Bitcoin #$BTC #brazil #merchants #payments #pos

Cielo, a Brazilian payments giant, is looking to unleash cryptocurrencies onto the nation of over 200 million people.

According to a report by CoinTelegraph Brazil, Cielo announced its support for bitcoin and other cryptocurrency purchases via its 1.4 million point-of-sale devices. Customers will now have the ability to make bitcoin purchases through Cielo's point-of-sale devices by creating an account with its network partners, Uzzo or Criptohub. The PoS devices generate a QR code which the customer can scan using the partner app.

Later this year, customers could be able to make cryptocurrency purchases with the Cielo Pay app, according to CoinTelegraph Brazil's report.

Brazil has become a hot spot for bitcoin. O Globo reports that the country's bitcoin investors have possibly surpassed the number of individuals registered on the Sao Paulo Stock Exchange. In February, the country's largest investment bank announced it would raise $15 million via a token raise.

source https://www.tokentalk.co/The Block/brazilian-payment-processing-giant-announces-bitcoin-support-5d6acfe081ecacac70976254

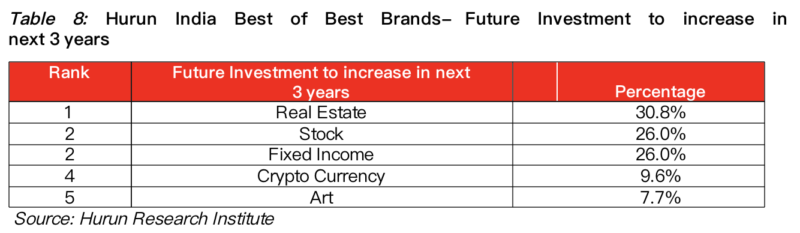

Nearly 10% of India’s richest investors are looking to increase allocation to cryptocurrency @TheBlock__ #Bitcoin #Cryptocurrency #$BTC #$ETH #$XRP #cryptocurrency #India #investment

India's richest investors are looking to ramp up their allocation to cryptocurrencies, as concerns about a slowdown in the economy grip the nation.

As reported by Quartz, about 36% of India's high-net worth individuals are pessimistic abou...

India's richest investors are looking to ramp up their allocation to cryptocurrencies, as concerns about a slowdown in the economy grip the nation.

As reported by Quartz, about 36% of India's high-net worth individuals are pessimistic about the Indian economy over the next three years, citing data from Hurun Report. That fact is pushing them to invest in safer and alternative assets, namely real estate. A similar percentage of people say they are avoiding risk altogether when it comes to their future investing.

Still, despite the desire for risk-off assets, 9% of wealthy Indians said they would increase their allocation to cryptocurrencies over the next three years.

Nearly half of the respondents said they don't know much about virtual currency, per the report. Among those who were educated about it, the largest group indicated a preference to invest in Bitcoin (29.15%); the next 8.74% preferred Ethereum and 6.80% would like to invest in Ripple.

Still, the volatility of cryptocurrencies, including bitcoin, could prevent it from becoming a so-called safe haven asset class, as noted by The Block's Ryan Todd.

"Looking at average 30-day rolling volatility, bitcoin has seen an average 12.4% annualized 30-day volatility over the last five years, and currently sits just under 20%. Compare that to treasuries at ~.50%, and even the S&P 500 and gold at 2.5%, and you can see why there was a collective push-back on the notion that bitcoin offers 'safety,'" Todd wrote in August.

source https://www.tokentalk.co/The Block/nearly-10-of-indias-richest-investors-are-looking-to-increase-allocation-to-cryptocurrency-5d6ad1c081ecacac70976258

Brazilian payment processor giant announces bitcoin support @TheBlock__ #Bitcoin #$BTC #brazil #merchants #payments #pos

Cielo, a Brazilian payments giant, is looking to unleash cryptocurrencies onto the nation of over 200 million people.

According to a report by CoinTelegraph Brazil, Cielo announced its support for bitcoin and other cryptocurrency purchases via its 1.4 million point-of-sale devices. Customers will now have the ability to make bitcoin purchases through Cielo's point-of-sale devices by creating an account with its network partners, Uzzo or Criptohub. The PoS devices generate a QR code which the customer can scan using the partner app.

Later this year, customers could be able to make cryptocurrency purchases with the Cielo Pay app, according to CoinTelegraph Brazil's report.

Brazil has become a hot spot for bitcoin. O Globo reports that the country's bitcoin investors have possibly surpassed the number of individuals registered on the Sao Paulo Stock Exchange. In February, the country's largest investment bank announced it would raise $15 million via a token raise.

source https://www.tokentalk.co/The Block/brazilian-payment-processor-giant-announces-bitcoin-support-5d6ac86081ecacac70976253

Bitcoin Bull Jack Dorsey’s Twitter Hack Is Painful Reminder For Crypto Security @newsbtc #Bitcoin #Crypto #bitcoin #crypto #Jack Dorsey #sim swap hack #twitter

Yesterday, the CEO of Twitter and Square Inc., and staunch Bitcoin and crypto supporter, Jack Dorsey, had his personal Twitter account hacked by the way of a SIM-swap...

Yesterday, the CEO of Twitter and Square Inc., and staunch Bitcoin and crypto supporter, Jack Dorsey, had his personal Twitter account hacked by the way of a SIM-swap attack and SMS-based backdoor.

The hack demonstrates that even the CEO can have his own company’s highly-valuable personal account compromised, and is a painful reminder that if it can happen to someone as high profile as Dorsey, it could happen to you too.

Bitcoin Bull Jack Dorsey Falls Victim to Sim-Swap Hack, Twitter Account Compromised

Yesterday, the Twitter account of the social media platform’s CEO – used often as an important bulletin board the company and soapbox for the outspoken executive – was hacked by a group of hackers calling themselves ChucklingSquad. The hackers had accessed the Twitter account and posted nonsensical notes, racial slurs, and “hello world” style messages to prove that their cybercriminal prowess was able to achieve such a feat.

Related Reading | Pro League of Legends Gamer Robbed of $200K in Crypto in Sim-Hack

And while Bitcoin wasn’t directly involved, Dorsey’s account was comprised due to having been the victim of a SIM-card swap attack – a relatively new type of hack that has been increasingly targeting cryptocurrency holders. Jack Dorsey is among the world’s most renowned Bitcoin bulls, using his Square Cash app to bring Bitcoin buying to the mainstream public and suggests that one day the crypto-asset would become the world’s single global currency for the internet.

As is the case with some high profile crypto investors, the hackers were able to assign Dorsey’s phone number to a dummy phone. However, unique to this case, the number was then used to text message Twitter’s text-to-tweet service to send the offensive tweets.

Others haven’t been so lucky. In the past, angel investor Michael Terpin was the victim of a SIM-swap attack that resulted in $24 million in crypto being stolen. Later, Terpin filed a lawsuit against his mobile service carrier at the time – AT&T – for their negligence and was awarded a $75.8 million victory in the case. AT&T is also Dorsey’s service provider, showing that there could be a connection somehow.

More influential figures known for their involvement in crypto and Bitcoin have been the targets of similar attacks. Recently, a prominent eSports player was targeted and shared the incident on his YouTube channel. The incidences are only increasing as cybercriminals continue to target crypto holders.

ATTENTION: If the CEO of Twitter can get his account hacked on his own platform, I promise your bitcoin is likely MUCH more vulnerable.

Use two-factor authentication where ever possible.

Get your bitcoin off exchanges.

— Rhythm (@Rhythmtrader) August 30, 2019

It’s important for crypto investors to use additional security protections such as two-factor authentication using Google Authenticator and to avoid SMS-based 2FA for this very reason. Always remember to back up your 2FA codes on paper for safekeeping.

Related Reading | 15 Crypto Community Members Targeted As SIM-Port Hack Trend Spikes

Other tips include keeping assets like Bitcoin off exchanges and in cold storage. Also never disclose that you hold any crypto to anyone ever, and use unique usernames and passwords whenever possible. Running malware protection software like MalwareBytes, and being cautious about installing browser add-ons and the like is also recommended.

Dorsey likely has taken all of the steps above and more, yet still, hackers were able to obtain access to his account. The situation proves that no one can ever be 100% safe at all times, however, these steps can certainly aid in keeping one’s assets safe.

The post Bitcoin Bull Jack Dorsey’s Twitter Hack Is Painful Reminder For Crypto Security appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/bitcoin-bull-jack-dorseys-twitter-hack-is-painful-reminder-for-crypto-security-5d6ad0d181ecacac70976257

Crypto Tidbits: Bakkt Bitcoin Custody, China’s Cryptocurrency On the Horizon, XRP In Hot Water @newsbtc #Bitcoin #Crypto #bitcoin #Crypto Tidbits #cryptocurrency

Another week, another of Crypto Tidbits. Bitcoin saw yet another tumultuous week in terms of price action. It fell by over 8% in one day, as bears managed to take control of the market. But, despite this downward price ...

Another week, another of Crypto Tidbits. Bitcoin saw yet another tumultuous week in terms of price action. It fell by over 8% in one day, as bears managed to take control of the market. But, despite this downward price movement, this industry continued to trudge forward.

Related Reading: Crypto Tidbits: Bitcoin Hash Rate High, Square Crypto Bags Hire, Libra in Turmoil

Bitcoin & Crypto Tidbits

- Bakkt To Start Custodying Bitcoin Next Week: According to a recent Twitter announcement, Bakkt, the New York Stock Exchange-backed crypto startup, will soon start taking custody of Bitcoin (BTC) through Bakkt Trust Company. The long-awaited exchange will activate this product on September 6th — a Friday. Custody is being launched two weeks out from the activation of Bakkt’s Bitcoin Daily and Monthly Futures contracts. This news comes shortly after the firm revealed that it had received the “greenlight from the CFTC through the self-certification process and user acceptance testing has begun.” Analysts bill the launch of Bakkt as “arguably the most bullish event for institutional investors in the history of Bitcoin”.

On Sept 6, our Warehouse will begin offering secure storage of customer bitcoin to prepare for the launch of Bakkt Bitcoin Daily & Monthly Futures when they launch on Sept 23

These contracts will enable physical delivery of bitcoin with end-to-end regulated markets and custody

— Bakkt (@Bakkt) August 28, 2019

- Telegram May Soon Launch Blockchain And Crypto: According to an anonymous investor in Telegram’s Open Network blockchain (TON), the social media giant will begin publicly testing its chain on September 1st. A Russian outlet claims that the launch of beta testing will coincide with a release of TON’s node software and certain technical documentation. TON raised a purported $1.8 billion over the past year or two, with there being much hype around how the blockchain and cryptocurrency can be deployed to Telegram’s 200 million users.

- Aircraft Manufacturing Giant Boeing Joins Consortium Pushing Blockchain-esque Technology: CoinDesk has found that Boeing, the world’s largest aircraft manufacturer, is making a foray into blockchain, well, Hedera Hashgraph to be more specific. Their sources tell them that the aerospace giant is the 10th member of Hedera’s governing council, which hosts other big names in finance and technology like Nomura Holdings and the blockchain-friendly IBM. It isn’t clear how Boeing will be participating in Hedera’s ecosystem just yet.

- Forbes Drops Bombshell Report About China’s Crypto: Forbes’s crypto editor, Michael del Castillo, recently came out with an extensive report on the People’s Bank of China (PBOC) soon-to-launch cryptocurrency. In it, it was stated that according to Paul Schulte, who worked as global head of financial strategy for China Construction Bank until 2012, seven institutions — massive names in the China corporate and political scene — will be the first to receive access to the digital asset. Schulte purportedly singled out the world’s two largest banks — the Industrial and Commercial Bank of China and Bank of China, respectively — the Agricultural Bank of China; China Construction Bank; Alibaba and Tencent; and Union Pay, a banking consortium in the Asian nation. Another source speaking to Forbes echoed this, stating that those seven and an eight are likely to get access to the cryptocurrency, which he/she/they says is dubbed DC/EP.

- Samsung Galaxy S10 Now Supports Bitcoin, Stablecoins: This year, the cryptocurrency industry was shocked when Samsung unveiled its Galaxy S10 lineup of smartphones, as the firm mentioned blockchain in press statements on the phone. According to U.today, Samsung’s internal cryptocurrency wallet now supports stablecoins — TrueUSD and USD Coin (USDC) — briefly after adding support for Bitcoin and launching with native support for Ethereum.

- Brad Garlinghouse Quashes XRP Fud: Brad Garlinghouse, the chief executive of Ripple, recently came out to debunk “questionable sources spreading FUD” about XRP in an impassioned Twitter thread. In the scathing message, the industry executive wrote that XRP should not be classified as a digital security. Garlinghouse cited comments from the United Kingdom’s Financial Conduct Authority and “others” on the cryptocurrency to back his point. Garlinghouse also addressed a response to an article from Bloomberg about the sale of XRP tokens by Ripple. In that article, the outlet cited countless cryptocurrency industry executives and investors, most of which expressed skepticism towards Ripple’s decision to dump hundreds of millions of dollars worth of XRP on the open market. In his response tweet, the CEO wrote that these sales help expand the utility of XRP, not just the size of Ripple’s coffers.

- UN Official Bashes Crypto in Scathing Interview: In an interview with the Australian Broadcasting Corporation, a leading official of the United Nations, Neil Walsh, pushed anti-crypto rhetoric, alleging that these digital assets can be used in criminal activity. Walsh, the leading authority on anti-money laundering and cybercrime at the UN, asserted that cryptocurrencies are “another layer” to the “nightmare” that is criminal activity. He specifically called out child exploitation networks, which he opines benefit from digital asset technology. He brought up one case where digital content in which a child was abused could be accessed with a fee paid in cryptocurrency. Walsh also claimed that the fight against cybercriminals, nuclear weapon proliferation, terrorist financing, and money laundering is being hampered by the propagation of cryptocurrencies.

- Institution Looks To Create $1 Billion Crypto Venture: According to a recent report from the Financial Times, Elwood Asset Management, an institution that manages British billionaire investor Alan Howard, is looking to launch a crypto venture worth $1 billion. Speaking in an interview with FT, Bin Ren, the chief executive of Elwood Asset Management, said that his firm is working on a platform that would assign institutional investors diverse, vetted crypto portfolios. As it stands, there are countless “crypto hedge funds” that aren’t suitable for institutional investment. By sifting through the good and the bad, Elwood hopes to create relatively safe crypto portfolios for institutional investors.

- SEC Slaps Crypto Firm & Founders WIth $10 Million Fine: The U.S. Securities and Exchange Commission has just settled a massive $10 million case with an unregistered cryptocurrency platform. Announced in a press release published on Thursday, the SEC has settled charges with Bitqyck, a Dallas-based cryptocurrency exchange, and its founders for offering security-like cryptocurrencies and making false statements about its product.

Featured Image from Shutterstock

The post Crypto Tidbits: Bakkt Bitcoin Custody, China’s Cryptocurrency On the Horizon, XRP In Hot Water appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/crypto-tidbits-bakkt-bitcoin-custody-chinas-cryptocurrency-on-the-horizon-xrp-in-hot-water-5d6ad0d081ecacac70976256

Bitcoin Price Analysis: $9,400 Key Support Holds For Now @bitcoinist #Bitcoin #News #Bitcoin analysis #bitcoin forecast #BitMEX #btc ta #btcusd #coinbase #Technical Analysis #xbtusd

Bitcoin’s volatility has drastically decreased over the last few weeks as price action unfolds close to key support at $9,400. This key support line creates the bottom of the asymmetrical triangle stemming from $14,000 down to $9,400 mentioned in a previous analysis on Bitcoin.

Bitcoin 1-Hour Analysis

On the 1 hour chart for XBT/USD, we can see the decreasing volatility alongside low volume. There was a large bearish candle on the 29th of August that resulted in price levels dropping around $800, despite this no real momentum gathered up for the bears as price action now trades predominantly sideways around the 0.382 Fibonacci level around $9,500.

20 SMMA and 50 MA starting to visibly curl upwards around market price indicating a potential new bullish trend could form and take market price up to POC at $10,000. This is also the level in which the large bearish candle developed.

I expect price action to be quite boring over the next few weeks until either $9,400 is broken to the downside with clear sustainable bearish volume and not just one random large volume spike. Adversely, we would need to see the same increase in volume for the bulls taking price levels above $11,000 and clearly breaking up through the asymmetrical triangle mentioned.

Maxx momentum flashed a buy signal on the 30th of August (yesterday). This is a potential reversal sign alongside the 20 SMMA and 50 MA visibly curling up just above key support at $9,400.

Bitcoin Daily Analysis

On the daily chart for XBT/USD, we can see the large asymmetrical triangle that has formed from the visible range highs at $14,000 to the lows at $9,100. POC (Point of Control) running directly through the middle indicates price action within the triangle formed is very much sideways consolidation despite the large range. This means there’s a large move ahead and this period of consolidation will act as the fuel behind the large move.

The trend is still very much bullish until price action breaks down through the triangle leading me to believe the large move will be to the upside. I will not be acting on any trades until the triangle has been broken, this allows me to trade with the market flow instead of trying to predict the market flow. Bitcoin could take until October to break out of this period of consolidation.

Maxx momentum currently sits just shy of the lowest point within the trading range visible on the daily chart. Maxx momentum will need to avoid dropping any lower otherwise momentum will very much favor the bears and likely result in Bitcoins price level breaking down through the asymmetrical triangle. Volume is a key factor to watch out for.

Do you think $9,300 will hold over the coming days? Please leave your thoughts in the comments below!

Images via Bitcoinist Image Library, BTC/USD charts by TradingView

This article is strictly for educational purposes and should not be construed as financial advice.

The post Bitcoin Price Analysis: $9,400 Key Support Holds For Now appeared first on Bitcoinist.com.

source https://www.tokentalk.co/Bitcoinist/bitcoin-price-analysis-9400-key-support-holds-for-now-5d6aab513d0b939a2526038c

Is Satoshi Nakamoto Proven Right as Scalability Appears Uncrackable? @trustnodes #Bitcoin #Bitcoin Cash #Cryptopolitics #Editorial #Ethereum

Ethereum’s ratio has fallen because it has failed to scale in a reasonable time according to the co-founder of a crypto hedge fund. While bitcoin hasn’t been affected as much...

The post Is Satoshi Nakamoto Proven Right as Scalability Appears Uncrackable? appeared first on Trustnodes.

source https://www.tokentalk.co/Trustnodes/is-satoshi-nakamoto-proven-right-as-scalability-appears-uncrackable-5d6abb4181ecacac70976252

CoinMarketCap is set to adjust crypto ranking standards, release metric to weed out fake volumes @TheBlock__ #Cryptocurrency #Exchanges #CMC #fake volumes #trading

CoinMarketCap is set to adjust a change it recently made to its cryptocurrency ranking mechanism, which resulted in "harsher-than-intended rank drops."

The data provider rolled-out an internal feature that would prohibit coins from being r...

CoinMarketCap is set to adjust a change it recently made to its cryptocurrency ranking mechanism, which resulted in "harsher-than-intended rank drops."

The data provider rolled-out an internal feature that would prohibit coins from being ranked in the Top 200 if they did not meet the firm's so-called Section 10 criteria. But the change went too far, according to CMC.

"Due to the segmentation logic of this change, some cryptoassets that did not meet the criteria had harsher-than-intended rank drops," the firm said in a blog post. "In extreme cases, a cryptoasset dropped 1000 ranks."

As such, CMC will announce Monday an update that will "streamline the rankings so that all crypto assets will be fairly represented in the rankings."

CoinMarketCap has long been criticized for its exchange ranking by volumes, which market experts have proven includes fake data from numerous exchanges. Bitwise has put out research to show as much as 95% of cryptocurrency trading volumes are erroneous. The Block's Larry Cermak estimates it sits as high as 86%.

As per the blog post, CMC will soon incorporate a new metric around liquidity into its exchange ranking process — in an attempt to weed out fake volumes. Unlike others who have chosen to exclude certain exchanges from their own rankings altogether, CMC says its new metric will be comprehensive and not easily game-able.

"Ultimately, this liquidity metric will factor into market pairs, and will be combined with other metrics that will go into the ranking of exchanges and projects," according to CMC. "We are continuing to refine this based on feedback, and welcome more of your thoughts too."

The metric will be released in November 2019.

source https://www.tokentalk.co/The Block/coinmarketcap-is-set-to-adjust-crypto-ranking-standards-release-metric-to-weed-out-fake-volumes-5d6ab78081ecacac70976251

Brazil’s leading payment processor begins accepting bitcoin @decryptmedia #Business #brazil #cielo #cryptocurrency #point-of-sale

Cielo, which operates 1.4 million point-of-sale devices and is a leading credit card provider in Brazil, is rolling out crypto payments.

The post ...

Cielo, which operates 1.4 million point-of-sale devices and is a leading credit card provider in Brazil, is rolling out crypto payments.

The post Brazil’s leading payment processor begins accepting bitcoin appeared first on Decrypt.

source https://www.tokentalk.co/Decrypt/brazils-leading-payment-processor-begins-accepting-bitcoin-5d6aa6a23d0b939a2526038b

Bitcoin Hashrate Hits Record 83.5 TH/s While Price Trades Sideways @bitcoinist #Bitcoin #Bitcoin News #Bitcoin Price #News #News teaser #bitcoin #bitcoin mining #bitcoin news #Max keiser

Bitcoin’s blockchain produced new historic records this week as the cryptocurrency’s technical health increasingly contradicts its lower price.

Bitcoin Hashrate Hits 83 Quintillion

As data from monitoring resource and wallet provider Blockchain.com confirms, it was Bitcoin’s 00 hashrate leading the charge, hitting 83.5 quintillion hashes per second on August 29.

That number is BTC’s best achievement in its ten-year history, and the first time hashrate has surpassed 80 quintillion hashes per second.

Hashrate refers to the amount of computing power servicing the Bitcoin network. The more hashes per second involved, the more power miners are devoting to processing and validating transactions.

A higher network hashrate also means better security and often better decentralization of mining power across more users.

The metric has hit record levels continually in recent months, and the implied benefits make it a cause for celebration among BTC proponents.

On Friday, it was RT host and serial Bitcoin ‘permabull’ Max Keiser who took heart from the statistics, even as BTC/USD dropped 8% in a sudden loss of support.

Keiser additionally noted Bitcoin’s high share of the overall cryptocurrency market cap. That number hit 70% this week, according to some measures, its highest since March 2017.

“New (all-time high) for (Bitcoin) hashrate as alts die and players position themselves strategically ahead of BTC’s move back to 85% dominance,” Keiser summarized on Twitter.

BTC Booms At Altcoins’ Expense

As Bitcoinist noted, altcoins have indeed suffered as a result of Bitcoin’s rise. For Keiser, the future is also bleak – he claimed Bitcoin Cash and Bitcoin SV are “particularly vulnerable” to further loss of value.

Ethereum, meanwhile, is set for a halving – not of the block reward, but of price.

“ETH heading back to $90,” he finished, repeated a warning from earlier in the week about the largest altcoin.

Bitcoin’s price meanwhile has failed to match the strength of its network fundamentals. While not unprecedented, the schism nonetheless gives analysts cause for concern, with several advising traders to take precautionary measures with their holdings.

“I’m long BTC,” popular day trader FilbFilb told Twitter followers as Bitcoin hit $9600. Despite being up from local lows of $9350, this was not enough to restore sentiment.

“Live by the sword, die by the sword,” he added.

Earlier, Bitcoinist noted a theory that margin trading was responsible for sudden turbulence on Bitcoin markets. BTC/USD losing $500 in minutes is just the latest example of the phenomenon, which intersperses periods of sideways price action.

What do you think about BTC’s network performance versus price? Let us know in the comments below!

Images via Shutterstock

The post Bitcoin Hashrate Hits Record 83.5 TH/s While Price Trades Sideways appeared first on Bitcoinist.com.

source https://www.tokentalk.co/Bitcoinist/bitcoin-hashrate-hits-record-835-ths-while-price-trades-sideways-5d6a6e613d0b939a25260384

Ripple up, buoyed by a $25 million transaction on its chain @CoinInsidercom #Price Analysis #Technical Analysis #Ripple

Recap of the Top Five Cryptos

Since the previous day, the five most-watched cryptos (Bitcoin, Bitcoin Cash, Litecoin, Ethereum, and Ripple) provided their holders with a return of -0.09%. Out of the aforementioned five, XRP gave investors the best daily return; it was up 1.66%, which has its price now near $0.255509 USD. As for the worst-performing crypto out of the Big Five, yesterday that was Litecoin; it came in at down 2.56%, which drove its price to around $63.373865 USD. Out of the five coins observed here, two cryptocurrencies were up — which is a mixed sign for the crypto sector as a whole.

Price Patterns to Monitor

Buy Bitcoin online using your credit card

Yesterday was a fairly normal day for all of these cryptocurrencies, in the sense that they fluctuated within the normal daily range we have come to suspect them to move within. Traders may also wish to bear in mind the following events going on regarding current price patterns:

- XRP has no clear trend. Perhaps one for trend following traders to avoid.

- If coins in a clear downtrend are your thing, consider Litecoin, Bitcoin, Bitcoin Cash, and Ethereum. Those have been in a clear downtrend over the past 14 days, and thus might be of interest to trend followers comfortable with short selling.

Insights From Transaction Data

The blockchain that saw the most transactions recorded on its blockchain over the past day was Ripple; its 786,028 transfers added was about 14% greater than the transactions recorded on Ethereum, which was the runner up for transactions logged on its chain over the past 24 hours. Ripple has a transaction fee less than the transaction fee of Ethereum, which may indicate that transaction fees might be a key reason why users are preferring Ripple. Ripple was the coin with the largest transaction across all blockchains yesterday; the largest transaction on its chain was valued at $25,724,000,000 US dollars.

Article by SixJupiter

The post Ripple up, buoyed by a $25 million transaction on its chain appeared first on Coin Insider.

source https://www.tokentalk.co/CoinInsider/ripple-up-buoyed-by-a-25-million-transaction-on-its-chain-5d6a65f13d0b939a25260383

Bitcoin Stable While Brits Take to the Streets @trustnodes #Bitcoin #News #Politics

Bitcoin is maintaining a somewhat stable level after rising some 3x since December to around $10,000. The currency is sidewaying for now in an undicided manner as events reach crossroads...

The post Bitcoin Stable While Brits Take to the Streets appeared first on Trustnodes.

source https://www.tokentalk.co/Trustnodes/bitcoin-stable-while-brits-take-to-the-streets-5d6a74f23d0b939a25260387

What Does Jack Dorsey’s Twitter Account Hack Mean For Bitcoin? @bitcoinist #Bitcoin #Bitcoin Security #News #News teaser #Op-Ed #bitcoin #hack #Jack Dorsey #twitter

Twitter and Square CEO, Jack Dorsey, had his personal Twitter account hacked this week. Whilst in control of the account, the hackers posted a bizarre stream of messages including racial slurs and a bomb threat. Dorsey has been very vocal in his support for Bitcoin, so what impact could this have?

What Does A Twitter Hack Have To Do With Bitcoin?

Nothing, right?… or at least, perhaps there is no direct link. But it does provide us with a timely reminder about security.

The media made a big thing about Dorsey getting hacked on his own platform. “If the CEO of Twitter can have his account hacked, then what chance do the rest of us have?” came the overarching response.

Of course, the media completely missed the point. Why shouldn’t Dorsey be hacked on his own platform? Why should his account be any different to anybody else’s? Does Jack’s account have additional security measures, and if so, why don’t all the other accounts?

In fact, as the CEO of Twitter, one would imagine that he is targeted more than most. So shouldn’t he be more likely to be hacked than other users?

The Weakest Link (In Any Security System)

The point here is that Dorsey is just a human being like all the rest of us. As great as any security measures are, we are always the weak link in the chain. This applies to Twitter or BTC or anything else.

Ultimately, the responsibility lies with us, and we are, unfortunately, fallible. Imperfect memories compel us to write things down, or worse, store them electronically. We forget to lock screens and lose things on trains. When it comes to security we contain any number of attack vectors and need all the help we can get.

In order to feel secure, we should take all the steps that we can to protect our Bitcoin (our Twitter accounts generally aren’t as valuable). This means employing such means as two-factor authentication, and for the love of God, stop storing your BTC on exchanges already!

ATTENTION: If the CEO of Twitter can get his account hacked on his own platform, I promise your bitcoin is likely MUCH more vulnerable.

Use two-factor authentication where ever possible.

Get your bitcoin off exchanges.

— Rhythm (@Rhythmtrader) August 30, 2019

What does Jack Dorsey’s Twitter account hack mean for Bitcoin? It means that nobody is immune to security risks, so buckle up.

The post What Does Jack Dorsey’s Twitter Account Hack Mean For Bitcoin? appeared first on Bitcoinist.com.

source https://www.tokentalk.co/Bitcoinist/what-does-jack-dorseys-twitter-account-hack-mean-for-bitcoin-5d6a60513d0b939a25260382

Who is and who isn't working on a state-backed digital currency? @decryptmedia #Cryptocurrencies #china #cryptocurrency #economy #iran #russia

China’s digital currency is expected soon. Will Iran or the U.K. be next to launch one? And why is the world’s most powerful economy sitting on the sidelines?

The post Who is and who isn't working on a state-backed digital currency? appeared first on Decrypt.

source https://www.tokentalk.co/Decrypt/who-is-and-who-isnt-working-on-a-statebacked-digital-currency-5d6a6f523d0b939a25260386

Capital One, 30 More Hacked For Cryptocurrency Mining @bitcoinist #Companies #News #News teaser #Online Privacy #Technology #Capital One #cryptocurrency mining #cryptocurrency news #hacking

Ex-Amazon employee, arrested last month over Capital One data breach, has also been accused of hacking over 30 more companies. In addition to stealing data, Paige Thompson allegedly used the compromised servers to mine cryptocurrency.

Hacking The Hand That Feeds You

The FBI arrested Thompson at the end of July, concerning a massive data breach at Capital One. The hack had exposed over 100 million credit card applicants personal details, including social security numbers and bank accounts.

However, a federal grand jury this week charged her with two counts of fraud pertaining to over 30 other entities.

Thompson stole the data from misconfigured servers hosted with a cloud computing company. The indictment doesn’t name which cloud computing company, but Thompson is an ex-employee of Amazon Web Services… which provides cloud computing services to Capital One.

Compromised Servers Also Used For Cryptojacking

Not content with hacking the servers and stealing data, Thompson also allegedly used the servers processing power to mine cryptocurrency. From the Indictment:

It was further part of the scheme and artifice that PAIGE A. THOMPSON used her unauthorised access to certain victim servers – and the stolen computing power of this servers – to “mine” cryptocurrency for her own benefit, a practice often referred to as “cryptojacking.”

Amazon Web Services itself was not compromised, despite the fact, the Thompson is an ex-employee. Access to the servers was due to misconfiguration by Capital One, rather than a vulnerability in Amazon’s infrastructure.

The authorities discovered Thompson’s activities after she posted details of the Capital One hack on her GitHub account. There is no evidence of her trying to sell or disseminate any of the stolen data.

Cryptojacking On The Rise

Cryptojacking appears to be on the rise, with IBM reporting earlier this year that it has overtaken ransomware as the crypto-cybercrime of choice. A recent report by McAfee (the security company, not the crypto-stalwart who founded it) suggests that cryptojacking campaigns rose 29% in the first quarter of this year.

How do you think will these privacy violations and data breach isuues be addressed? Let us know n the comments below.

Images via Bitcoinist Image Library

The post Capital One, 30 More Hacked For Cryptocurrency Mining appeared first on Bitcoinist.com.

source https://www.tokentalk.co/Bitcoinist/capital-one-30-more-hacked-for-cryptocurrency-mining-5d6a44313d0b939a2526037c

Friday 30 August 2019

How do I buy Golem using a credit card? @CoinInsidercom #Altcoin News #Blockchain News #Cryptocurrency #How To #GNT #Golem

What is Golem?

Golem is a blokchain-based project with the idea to utilise unused computing power. The concept is two-fold – offering computing power to those who might need large amounts while rewarding those with extra space, paying out in GNT in payment for ‘renting’ the power.

How to create a Golem wallet

Sign up for a free Coindirect account and you will automatically get a free Golem online wallet. You can use your Golem wallet to buy, sell, store, send (withdraw) and receive (deposit) XRP.

How to create a Golem address

Once you have signed up for a free Coindirect account all you need to do is press the ‘Receive’ button to reveal your Coindirect Golem wallet address.

How to buy Golem with a credit card

- Sign up for a free Coindirect account.

- Find your Golem Wallet and click the ‘Buy’ button in your Golem Wallet.

- Select “New VISA Card (EUR)” or “New credit card (NGN)” if you are in Nigeria.

- Enter EUR value of Golem you want to purchase (more than the minimum limit) or the Golem amount you want to buy and then click ‘Preview Buy’.

- You will receive a quote, press ‘confirm’ before the timer runs out (counts down from 55 seconds).

- Type in your credit card details and pay.

- You will be taken to a page to verify your transaction.

- Finally, you will be redirected back to your Coindirect Wallet once the payment is successful.

How do I purchase Golem from my bank account?

If you are in South Africa or in Europe in a SEPA country you can deposit ZAR and EUR into your Coindirect ZAR Wallet or Euro Wallet respectively.

To fund your account you have to transfer money using bank transfers. To get the funding instructions so that your account is credited:

- Go to your ZAR/EUR wallet and click the “Fund now” button. Alternatively, click the Fund tab in your Coindirect wallet and click on “Transfer Now”.

- Select the bank to transfer to from the drop-down menu to get payment details and the reference you should use (highlighted in blue).

- Transfer the money from your bank account into the account shown on the screen then wait for the bank transfer to be processed (0-3 business days depending on the bank).

- Once the funds reflect in your ZAR wallet, go to your Golem wallet and click “Buy” and select “Wallet (ZAR)” or “Wallet (EUR)” as you payment method.

Where can I sell my Golem?

You can sell Golem from your Coindirect wallet by clicking the ‘Sell’ button in your Golem wallet.

If you are in a SEPA region or South Africa. You can sell your Golem and instantly get money transferred to your Wallet (ZAR or EUR).

If you are in another region with no local currency wallet. You can sell your Golem by creating a sell offer on the marketplace.

You now know how to buy Golem instantly from almost anywhere in the world. Make sure to download the Coindirect App to trade Golem from the palm of your hands.

Credit card limits

Please note that Coindirect has limits for credit card purchases in place.

Make sure that your account is verified so that your credit card purchase limits are increased.

Currently, the limits for credit card purchases are:

Earn Ripple

If you are interested in introducing your friends to a way to buy Golem with their credit cards, make sure you share a link through the Earn programme. If they sign up to Coindirect, both you and the friend will receive 5 XRP for free when they perform their first transaction.

The post How do I buy Golem using a credit card? appeared first on Coin Insider.

source https://www.tokentalk.co/CoinInsider/how-do-i-buy-golem-using-a-credit-card-5d6913813d0b939a25260342

This analyst says there’s a “high chance” Bitcoin may never fall under $5k again @cryptoslate #Analysis #Price Watch

Once Bitcoin (BTC) started to incur strong losses in the second half of 2019, analysts were once again making extremely low price prediction...

-

App-enabled cryptocurrency exchange and wallet provider, Zebpay, has announced that it is enabling Lightning Network payments for all its ...

-

The Indian Ministry of Commerce and Industry announced yesterday that the Coffee Board in the country is integrating blockchain into the cof...

-

The pharmaceutical industry is one of the world’s few (almost) trillion-dollar verticals, worth more than $900 billion annually, according t...