- ETH price is currently trimming gains from the $158 resistance area against the US Dollar.

- The price is now approaching a couple of important supports near the $144 area.

- Earlier, there was a bre...

- ETH price is currently trimming gains from the $158 resistance area against the US Dollar.

- The price is now approaching a couple of important supports near the $144 area.

- Earlier, there was a break above a major bearish trend line with resistance near $152 on the 4-hours chart of ETH/USD (data feed via Kraken).

- The pair is likely to bounce back as long as it is above the $142 support area.

Ethereum price is approaching a crucial support area against the US Dollar, similar to bitcoin. ETH price must hold the $142 support to climb towards $160.

Ethereum Price Weekly Analysis

This past week, Ethereum started a solid recovery above the $142 resistance area against the US Dollar. Furthermore, ETH price surpassed a major resistance area near the $150 level.

More importantly, there was a break above a major bearish trend line with resistance near $152 on the 4-hours chart of ETH/USD. Besides, the pair surpassed the $155 resistance area, but it struggled to gain momentum above $158.

A swing high was formed near $158 and the price remained well below the 100 simple moving average (4-hours). Ethereum is currently correcting lower below the 23.6% Fib retracement level of the upward move from the $131 swing low to $158 high.

The price is now approaching the broken trend line and the $145 support area. Additionally, the 50% Fib retracement level of the upward move from the $131 swing low to $158 high is near the $145 level.

The main support is near the $142 area. It is near the 61.8% Fib retracement level of the upward move from the $131 swing low to $158 high. Therefore, a downside break below the $142 support area could reduce chances of another upward move in the near term.

In the mentioned scenario, the price is likely to revisit the $134 and $132 support levels. On the upside, the first key resistance is near the $152 level. The key resistance area is near the $158 and $160 levels.

Thus, a clear break above the $160 level and the 100 simple moving average (4-hours) may perhaps push the price back into a positive zone.

The above chart indicates that Ethereum price is clearly approaching a couple of important supports near $145 and $142. As long as the price is above $142, it could bounce back. If not, the bears are likely to aim $132 or $125.

Technical Indicators

4 hours MACD – The MACD for ETH/USD is currently gaining strength in the bullish zone.

4 hours RSI – The RSI for ETH/USD is currently declining and it is near the 40 level.

Major Support Level – $142

Major Resistance Level – $160

The post Ethereum Price Weekly Forecast: ETH At Potentially Significant Turning Point appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/ethereum-price-weekly-forecast-eth-at-potentially-significant-turning-point-5de355013675c46b4ce215e6

Saturday 30 November 2019

Ethereum Price Weekly Forecast: ETH At Potentially Significant Turning Point @newsbtc #Analysis #Technical #ETH #ethereum

Crypto Tidbits: Bakkt’s Bitcoin Futures Surge, UpBit Hacked for $50 Million in Ethereum, US Arrests Blockchain Researcher @newsbtc #Uncategorized #bitcoin #Crypto Tidbits #cryptocurrency

Another week, another round of Crypto Tidbits. Surprisingly,

Another week, another round of

The past week was an interesting one for the industry at large: an Ethereum Foundation researcher was arrested by the U.S. for purportedly supporting North Korea, Bakkt’s Bitcoin futures saw an absolutely colossal week in terms of adoption and usage, and the chief executive of a Chinese exchange went missing, leaving the company without access to its cryptocurrency holdings.

Related Reading: Crypto Tidbits: Bitcoin Dives Under $8,000, Fidelity Bags Trust License, SEC Takes Second Look at ETF

Bitcoin & Crypto Tidbits

- Bakkt’s Bitcoin Futures See Amazing Week: When crypto exchange upstart Bakkt launched its Bitcoin futures contract in September, few institutional investors were using the product. Bakkt’s market saw less than $5 million worth of daily volumes for weeks on end, with little sign of improvement. Though, over the past few weeks, the futures have seen a strong uptick in adoption. In fact, on Wednesday, Bakkt’s Bitcoin futures saw nearly $40 million worth of volume trade. And while Bakkt’s volumes are a sign of institutional trading interest, Bakkt’s open interest metrics are signs of institutions’ propensity to hold Bitcoin. Cryptocurrency data Twitter page Ecoinometrics recently noted that the open interest in the Bitcoin futures contracts has surged by hundreds of BTC over recent days. This implies that “some people are seeing the price dip as a good occasion to get in long.”

- IDAX CEO Goes Missing, Crypto WIthdrawals Halted: The chief executive of IDAX, a lesser-known cryptocurrency trading platform purportedly in Shanghai, has disappeared off the face of the Earth. The exchange announced this in an announcement published on Friday morning, in which it was written that “since November 24th, IDAX Global CEO have gone missing with unknown cause and IDAX Global staffs were out of touch with him.” The exchange added that as a result of this, it will be halting all deposits and withdrawals as IDAX’s access to its cold wallet, which “stored almost all cryptocurrency balances for IDAX (including Bitcoin, Ethereum, and other assets),” has been “restricted.” Henceforth, the exchange has “drawn up and emergency plan about platform services, including our deposit/withdrawal service.”

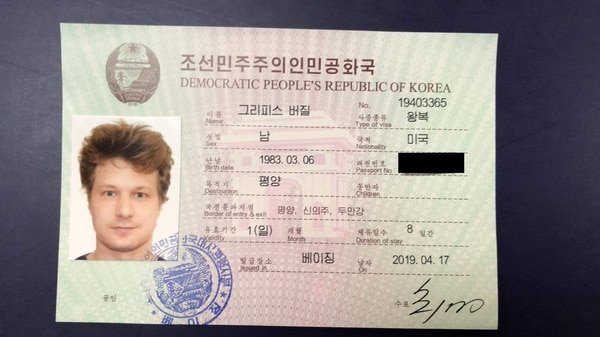

- U.S. Arrests Ethereum Proponent for “Assisting” North Korea: On Friday, the U.S. Attorney of the Southern District of New York State revealed something astounding: it, alongside individuals from the FBI and other authorities of the U.S. government, had arrested Virgil Griffith, a United States citizen at the Los Angeles Airport. As to why the individual was arrested, a press release indicated that the individual had “violated the International Emergency Economic Powers Act (“IEEPA”) by traveling to the Democratic People’s Republic of Korea (“DPRK” or “North Korea”) in order deliver a presentation… [on how to use technology] to evade sanctions.” Griffith, whose LinkedIn claims he is a research scientist for the Ethereum Foundation, was there for a state-sponsored blockchain event. Prominent members of the Bitcoin and cryptocurrency community have mixed reactions to this case.

- HSBC to Use Blockchain to Manage $20 Billion Worth of Assets:According to a report published Wednesday by Reuters, HSBC will be using a blockchain-based custody platform dubbed “Digital Vault” to manage $20 billion worth of assets in “one of the biggest deployments yet of the widely-hyped but still unproven technology by a global bank.” HSBC representatives said that the company intends to have this done by March. This new HSBC platform will effectively bring formerly paper-based records of private placement investments onto a blockchain, reducing the “time it takes investors to make checks or queries on holdings.”

- UpBit Hacked for $50 Million in Ethereum: Earlier this week, blockchain analytics services picked up on an interesting set of transactions from the wallets of UpBit, a Korean exchange. The transactions include multi-million transfers of Ethereum, Tron, EOS, and other top cryptocurrencies (not Bitcoin though) from UpBit-owned wallets to exchanges and “unknown wallets,” addresses left unmarked by these analytics firms. Eventually, UpBit came out to speak on the matter, revealing in an announcement that a 342,000 Ethereum (then valued at $50 million) transaction was suspicious. The translated version of the release does not contain the word “hack,” though many have taken the statement as a sign that the $50 million worth of cryptocurrency has been misplaced and is currently unretrievable. Upbit has confirmed that it will cover the funds with up to $51 million worth of its corporate funds, and has also revealed that it has moved all cryptocurrencies into its cold wallet to protect its customers.

Featured Image from Shutterstock

The post Crypto Tidbits: Bakkt’s Bitcoin Futures Surge, UpBit Hacked for $50 Million in Ethereum, US Arrests Blockchain Researcher appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/crypto-tidbits-bakkts-bitcoin-futures-surge-upbit-hacked-for-50-million-in-ethereum-us-arrests-blockchain-researcher-5de2d6713675c46b4ce215e1

Bitcoin Weekly Forecast: BTC Eyeing Last Line Of Defense @newsbtc #Analysis #Technical #bitcoin #btc

- After a decent recovery, bitcoin price faced resistance near the $7,880 level against the US Dollar.

- The price is currently correcting gains and it is trading near the $7,300 support area.

- There ...

- After a decent recovery, bitcoin price faced resistance near the $7,880 level against the US Dollar.

- The price is currently correcting gains and it is trading near the $7,300 support area.

- There is a crucial bearish trend line forming with resistance near $7,678 on the 4-hours chart of the BTC/USD pair (data feed from Kraken).

- The price might test $7,200 or $7,000 before a fresh wave towards the $7,700 resistance.

Bitcoin price is struggling to continue higher above $7,500 and $7,800 against the US Dollar. BTC is approaching the $7,000 support and it could bounce back.

Bitcoin Price Weekly Analysis (BTC)

This past week, bitcoin started a decent recovery wave from the $6,521 low against the US Dollar. BTC price gained pace above the $7,000 resistance area. Moreover, there was a break above the key $7,400 resistance area.

Finally, the price rallied above the $7,600 level, but it struggled to test the $8,000 resistance area. It seems like the price formed a short term top near the $7,880 area and the 100 simple moving average (4-hours).

More importantly, there is a crucial bearish trend line forming with resistance near $7,678 on the 4-hours chart of the BTC/USD pair. Bitcoin price is currently correcting lower below the $7,500 level.

Besides, the price is now trading below the 23.6% Fib retracement level of the recent wave from the $6,521 low to $7,873 high. On the downside, an immediate support is near the $7,200 level.

Additionally, the 50% Fib retracement level of the recent wave from the $6,521 low to $7,873 high is near the $7,197 level to provide support. If there are more downsides, the price could test the main $7,000 support area in the near term.

Therefore, a daily close below the main $7,000 support could start a fresh bearish wave. In the mentioned case, the price is likely to break the $6,500 support in the near term.

On the upside, the price is facing a lot of hurdles near the $7,700 and $7,800 levels. However, the price must settle above the $8,000 resistance area, the trend line, and the 100 simple moving average (4-hours) to start a strong rise in the coming weeks.

Looking at the chart, bitcoin price is facing a fresh round of selling below $7,500. Though, the price is approaching a couple of important supports near $7,200 and $7,000, where the bulls are likely to take a stand.

Technical indicators

4 hours MACD – The MACD for BTC/USD is currently gaining bearish momentum.

4 hours RSI (Relative Strength Index) – The RSI for BTC/USD is now declining and it is well below the 50 level.

Major Support Level – $7,000

Major Resistance Level – $7,700

The post Bitcoin Weekly Forecast: BTC Eyeing Last Line Of Defense appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/bitcoin-weekly-forecast-btc-eyeing-last-line-of-defense-5de346f13675c46b4ce215e5

Party is Over: Bitcoin Slips to $7,400, Making $6,000s a Possibility Again @newsbtc #Bitcoin #bitcoin #cryptocurrency #price

After hitting $6,600, Bitcoin (BTC) saw a strong price bounce, returning to $7,800 just yesterday. This marked an increase of nearly 20% from the bottom, making some convinced that the bottom is in. Though, over the pas...

After hitting $6,600, Bitcoin (BTC) saw a strong price bounce, returning to $7,800 just yesterday. This marked an increase of nearly 20% from the bottom, making some convinced that the bottom is in. Though, over the past 12 hours, the cryptocurrency has started to slip once again, eliciting bearish responses from an array of industry analysts.

Related Reading: Quitting Crypto Now is Akin to Selling Amazon in 2003: Analyst

Bitcoin Slips to $7,400

As of the time of writing this article, Bitcoin is trading for $7,400 on many major exchanges, having shed 3% of its value in the past 24 hours. While this wasn’t a decisively bearish movement that implies new lows are coming, analysts are convinced that it’s a precursor of pain to come.

Popular trader Inmortal Technique recently observed that the uptrend from the $6,600 level has been increasingly bearish, with each impulse higher (of which there were three) having less buying volume, implying bulls were losing momentum. That’s not to mention that the three impulses higher fell short of a clear support zone close to the $8,000s. He thus claimed that the “party is over.”

The party is over $BTC pic.twitter.com/9feMeiFQUP

— Inmortal technique (@inmortalcrypto) November 30, 2019

Jonny Moe noted that the recent price action satisfies a rising wedge he drew out on his chart. Rising wedges are bearish chart patterns seen in financial markets that often reject lower. A loss of the triangle could imply that BTC will reenter the $6,000s.

$BTC watching this possible rising wedge pic.twitter.com/EQ8mVWAuIf

— Jonny Moe (@JonnyMoeTrades) November 30, 2019

Related Reading: “All-Knowing” Bitcoin Fractal That Predicted Drop to $6,600: BTC to Fall 20%

Fundamentals Back Bearish Narrative

It seems that the fundamentals back the bearish narrative, unfortunately enough. Earlier this week, Korean exchange UpBit revealed in an announcement that a 342,000 Ethereum (then valued at $50 million) transaction was suspicious. The translated version of a related release did not contain the word “hack,” though many have taken the statement as a sign that the $50 million worth of cryptocurrency has been misplaced and is currently unretrievable.

Upbit has confirmed that it will cover the funds with up to $51 million worth of its corporate funds, and has also revealed that it has moved all cryptocurrencies into its cold wallet to protect its customers.

Some suggest that the selling pressure from this event could depress the cryptocurrency market in the coming weeks.

Related Reading: Dr. Doom: Ethereum Still a Long Way From $0, Its True “Fundamental Value”

Featured Image from Shutterstock

The post Party is Over: Bitcoin Slips to $7,400, Making $6,000s a Possibility Again appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/party-is-over-bitcoin-slips-to-7400-making-6000s-a-possibility-again-5de302813675c46b4ce215e4

Bitcoin holds critical support level; where will it go from here? @cryptoslate #Analysis #Price Watch

Bitcoin’s bulls have built some serious momentum in the time since the crypto’s capitulatory drop that sent it to lows of $6,500, as they have been able to push its price up towards $8,000, with a break above this level potentially opening t...

Bitcoin’s bulls have built some serious momentum in the time since the crypto’s capitulatory drop that sent it to lows of $6,500, as they have been able to push its price up towards $8,000, with a break above this level potentially opening the gates for further gains.

The recent rally from $6,500 has also been technically positive for Bitcoin, as it marked a strong defense of a key support level that was in jeopardy, and bull’s ability to hold the crypto above this level may signal that significantly further gains are imminent.

Bitcoin surges towards $8,000 as bulls flex their strength

At the time of writing, Bitcoin is trading down just nearly 3 percent at its current price of $7,520, which marks a slight climb from its multi-day lows of $7,000 that was set this past Wednesday when bears attempted to thwart BTC’s momentum.

Buyers quickly prevailed over sellers, however, as they rapidly reversed this momentum and sent the crypto surging towards $8,000, which is where it was met with some strong resistance that halted the rally.

At the moment, it does appear that Bitcoin is on the cusp of incurring another upwards leg, with TraderMayne – a popular cryptocurrency analyst on Twitter, telling his followers that he anticipates BTC to move up to its range EQ at roughly $8,600, which may prove to be a “super key level” for the crypto.

“$BTC: Not trying to call bottom but this structure looks pretty nice. We could move up to the range EQ and then reject and make another low. That said, no reason to be super bearish above the range low. $8.6k is the EQ of the range and of the yearly range, super key level IMO,” he noted.

BTC bulls defend critical support level

Further adding to this potential bullishness is the fact that bulls have defended Bitcoin’s 21-month EMA and reclaimed its 89-week EMA, which are both key levels that analysts have been closely watching.

Mr. Anderson, a popular cryptocurrency analyst on Twitter, spoke about this in a tweet, saying:

“$BTC CME FUTURES: Bulls managed to hold onto the all important 21-MO EMA and managed to reclaim the 89-wk EMA. The plot thickens…”

If Bitcoin is able to hold above these levels as the end of the year nears, bulls may lay the foundations for further gains as 2020 kicks off.

The post Bitcoin holds critical support level; where will it go from here? appeared first on CryptoSlate.

source https://www.tokentalk.co/Cryptoslate/bitcoin-holds-critical-support-level-where-will-it-go-from-here-5de2db213675c46b4ce215e2

Ethereum Developers Unanimously Agree to Delay the Difficulty Bomb @trustnodes #Cryptopolitics #Ethereum #News

Ethereum developers have agreed to an emergency hard-fork just weeks after the Istanbul Gas Upgrade goes live next Saturday. In a public discussion of ethereum developers and other non-dev participants,...

The post Ethereum Developers Unanimously Agree to Delay the Difficulty Bomb appeared first on Trustnodes.

source https://www.tokentalk.co/Trustnodes/ethereum-developers-unanimously-agree-to-delay-the-difficulty-bomb-5de2d2b13675c46b4ce215e0

Wall Street Still Doesn’t Get What Bitcoin Might be Used For @bitcoinist #Bitcoin #News #Bakkt #bitcoin #btc #wall street

Despite being one of the most discussed topics in the last few years, Wall Street still can’t figure out the utility of Bitcoin.

Bitcoin Needs Greater Utility, Bakkt CEO Says

Adam White, CEO of Bitcoin futures exchange operator Bakkt, said that “there needs to be greater utility” for Bitcoin. Nevertheless, it didn’t stop Bakkt, a subsidiary of NYSE parent Intercontinental Exchange (ICE), to promote crypto adoption on Wall Street, even though it launched the crypto futures platform after several delays.

Speaking at a conference in New York, White said:

“There’s an argument that Bitcoin is a store of value, and acts like digital gold, and that is its use case. That may be true. It’s our thesis that the size of that pie will never be big enough to justify the aspirations and the opportunities that this technology brings.”

A recent poll involving crypto and blockchain top executives and CEO connected to VC firm Digital Currency Group showed that most leaders of the crypto industry (71%) expect BTC to be used as a store of value over the next year. 7.6% of the surveyed executives said the cryptocurrency wouldn’t be useful for anything.

Besides running the futures platform and custody service, Bakkt is trying to forge a real-world use case for Bitcoin. The company is collaborating with Starbucks to develop a payment system that would allow people to buy with BTC. However, Starbucks won’t store the Bitcoin coming from buyers, as the system will simply convert the cryptocurrency to US dollars. The service will become available next year.

Investors Don’t Care About Utility

Even with no real utility whatsoever, institutional investors are trading Bitcoin like never before. While the Bitcoin quotations have declined by over 17% in November, more investors are willing to buy, probably trying to benefit from the lower price.

Thus, Bitcoin trading volumes on Bakkt hit a record high on Wednesday, to 5,671 BTC or $42.5 million. For comparison, the previous record, which came three days before that, was at $20.3 million.

On Thursday and Friday, Bakkt saw the third and second-best trading days, with volume exceeding $21 million. As for the open interest in Bitcoin, it hit the record high yesterday at $4.6 million.

This demonstrates that institutional investors don’t care about Bitcoin’s utility and regard the cryptocurrency as a great investment instrument.

Do you think Bitcoin will be used for payments with major retailers? Share your expectations in the comments section!

Images via Shutterstock, Twitter: @BakktBot

The post Wall Street Still Doesn’t Get What Bitcoin Might be Used For appeared first on Bitcoinist.com.

source https://www.tokentalk.co/Bitcoinist/wall-street-still-doesnt-get-what-bitcoin-might-be-used-for-5de2cb313675c46b4ce215de

B2C2 founder: unregulated crypto businesses “will keep doing well,” but the 2020 election might change that @TheBlock__ #Bitcoin #Blockchain #Podcasts #Regulation #2020 presidential election #B2C2 #regulation

Low regulatory risk has incentivized cryptocurrency businesses to not play by the book and still be very successful, but the 2020 U.S. presidential election may make a difference, according to B2C2 founder Max Boone...

Low regulatory risk has incentivized cryptocurrency businesses to not play by the book and still be very successful, but the 2020 U.S. presidential election may make a difference, according to B2C2 founder Max Boonen.

In a recent The Scoop podcast, Boonen said cryptocurrency businesses that decide to avoid regulations and have relaxed KYC have been “extremely successful” due to low regulatory risk, mentioning EOS and Bitfinex as examples. In September, Block.one, the company behind the EOS blockchain, settled with the Securities and Exchange Commission (SEC) for conducting an unregistered initial coin offering (ICO). While the company would pay $24 million in penalties for the settlement, it raised $4.1 billion from the ICO. In 2016, Bitfinex was ordered to pay a $75,000 fine to the U.S. Commodity Futures Trading Commission (CFTC) for offering illegal off-exchange financed retail commodities trading.

“I would think that based on history, the regulatory risk is not that high,” said Boonen. “Because at the end of the day, if you don't touch the mighty U.S. dollar at any point, you know, what can they do to you?”

However, Boonen noted that the 2020 presidential election may increase the cost of running illegal cryptocurrency businesses. As other countries like Singapore and China are pushing for more blockchain-friendly policies, the U.S. may feel pressured to retain their cryptocurrency businesses within the country, according to Boonen.

“We know one of the main contenders on the Democratic side is very pro-regulation. You know, I'm sure for proper reasons. I'm not saying it's a bad platform, but that might actually have consequences in terms of industry,” said Boonen.

In 2018, presidential candidate Elizabeth Warren warned in a Senate Banking Committee hearing the prevalence of scams in the cryptocurrency space. “The challenge is how to nurture productive aspects of crypto with protecting consumers,” she said at the time.

Meanwhile, China's president Xi recently applauded the blockchain technology in a high profile government meeting. This is followed by local governments in several major Chinese cities initiated crackdowns on cryptocurrency-related activities.

source https://www.tokentalk.co/The Block/b2c2-founder-unregulated-crypto-businesses-will-keep-doing-well-but-the-2020-election-might-change-that-5de2a6a03675c46b4ce215d8

Ethereum Foundation Throws Virgil Griffith Under The Bus @trustnodes #Cryptopolitics #Ethereum #News #USA

The Ethereum Foundation has fully distanced itself from one of their key employee who was arrested for giving a conference presentation in North Korea. “The Foundation is aware of the...

The post Ethereum Foundation Throws Virgil Griffith Under The Bus appeared first on Trustnodes.

source https://www.tokentalk.co/Trustnodes/ethereum-foundation-throws-virgil-griffith-under-the-bus-5de2b7823675c46b4ce215dc

US Government Arrests a Blockchain Expert For the First Time @trustnodes #Blockchain #Crypto #Ethereum #News #Politics #USA

The United States government has announced a researcher at the Ethereum Foundation has been arrested ostensibly for delivering “a presentation and technical advice on using cryptocurrency and blockchain technology to...

The post US Government Arrests a Blockchain Expert For the First Time appeared first on Trustnodes.

source https://www.tokentalk.co/Trustnodes/us-government-arrests-a-blockchain-expert-for-the-first-time-5de29e324bac230c3026ef7d

IMF Calls on Georgia to Evaluate Crypto Income for Trade Balance @bitcoinist #Bitcoin Mining #News #bitcoin mining #crypto mining #Georgia #IMF

The International Monetary Fund (IMF) recommends that Georgia include the income from crypto trade and mining in its foreign trade balance reports.

IMF Welcomes More Transparency on Crypto Mining

The IMF’s suggestion is quite relevant, given that Georgia is currently the 4th largest producer of digital currencies from mining operations. Thus, the government should take into account the income from this kind of activity.

The media reported that representatives of the IMF had already met with leaders of large crypto-oriented companies working in the mining sector. Miners were told to account for foreigners who buy cryptocurrencies like Bitcoin from local producers. In other words, Georgia is an exporter of Bitcoin. Yet, no-one seems to know how much US dollars this activity brings to the economy.

The IMF said:

“Along with existing programs, the IMF is working with Georgia on other matters, including on improving statistics. We are consulting on improving the methodology for calculating the foreign trade balance, and in particular, we are actively discussing the possibility of introducing accounting for cryptocurrency mining.”

Georgia’s Trade Balance Should Reflect Crypt Exports and Contribution to GDP

The IMF experts agree that crypto mining accounts for a decent share of Georgia’s economy. Therefore, the government should watch the industry closely. Now the international organization is trying to figure out the real contribution of crypto mining to the country’s gross domestic product (GDP).

Mercedes Vera-Martin, Deputy Division Chief at IMF, commented:

“Cryptocurrency mining has both positive and negative effects on the country. If cryptocurrency is sold abroad in large quantities, then why should this not be taken into account in the foreign trade balance?”

She stressed that mining Bitcoin requires the import of goods, probably hinting to specialized equipment like ASICs along with materials for building the facilities. However, given that the import materials are physical, they are taken into account in official trade balance statistics. Thus, reporting on imports and ignoring exports significantly distorts the general picture.

Last year, the National Bank of Georgia calculated the number of digital wallets registered in the country. The discovered 5,300 wallets by then, which held the equivalent of $708,000. The IMF recommended that the National Bank measure the number of wallets registered by non-residents.

The IMF has also prepared a special questionnaire that should guide Georgia’s official departments to estimate the total volume of Bitcoin produced in the country and sold abroad.

On a side note, Georgia is the home of Bitfury – one of the largest Bitcoin miners in the world. At one point, Bitfury accounted for 15% of all mined BTC, though this figure has declined.

As of 2017, Georgia’s top exports were Copper Ore ($518 million), Ferroalloys ($318 million), Cars ($195 million), Wine ($172 million) and Gold ($137 million).

Crypto Mining Accounts for Over 10% of Georgia’s Electricity Consumption

Earlier in November, David Chapashvili from Green Energy said in a BBC podcast that Georgia’s Bitcoin mining generated an annual revenue of $0.5 billion. According to him, miners use a lot of electricity. For example, Bitfury alone consuming about 4% of the total power produced in Georgia, which translates into 389.7 million kilowatt-hours. However, there are many micro-miners that should be taken into account. Considering all miners operating in the country, Chapashvili said:

“I think it goes more than 10%. It consumes more electricity than big industries that Georgia has and is beating all direct consumers.”

Georgia has been attracting tons of miners thanks to its cheap hydro-electricity costs and friendly taxes. For Chapashvili, Georgia is only behind China and Venezuela when it comes to mining.

Nevertheless, not everyone is happy with the situation. The huge power consumption by miners sparked local protests here and there, mainly because of power outages in Northwest.

Do you think other countries should also report on the crypto activity inside their territory? Share your thoughts in the comments section!

Image via Shutterstock

The post IMF Calls on Georgia to Evaluate Crypto Income for Trade Balance appeared first on Bitcoinist.com.

source https://www.tokentalk.co/Bitcoinist/imf-calls-on-georgia-to-evaluate-crypto-income-for-trade-balance-5de2b3c13675c46b4ce215db

Horizen (ZEN) ranked first by active nodes, while Bitcoin (BTC) second @cryptoslate #Analysis

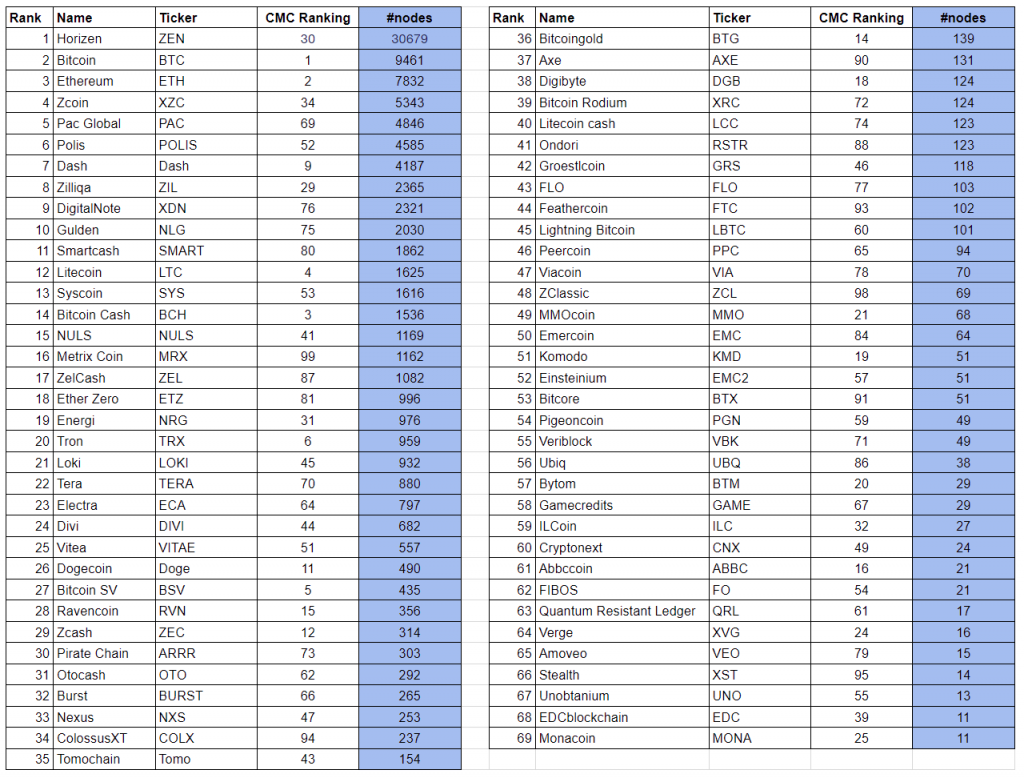

A renowned analyst is making a compelling case for ranking cryptocurrencies. Instead of taking into account their market capitalization, he puts emphasis on the number of nodes instead.

CoinMarketCap rankings are “nonsense”A renowned analyst is making a compelling case for ranking cryptocurrencies. Instead of taking into account their market capitalization, he puts emphasis on the number of nodes instead.

CoinMarketCap rankings are “nonsense”

Aat de Kwaasteniet, a former electrical designer at Vialis, explained in a Medium post that the way CoinMarketCap ranks cryptocurrencies is “highly questionable.” He specified that the price of a given crypto should not be the only factor to consider when raking these assets.

Under CoinMarketCap’s gauge, the higher the price of a digital asset in combination with the higher the number of tokens in circulation, the better positioned they would be. Kwaasteniet maintains that the industry puts a lot of weight on a “high market cap quotation,” but this value is “very fictitious.”

Kwaasteniet explained:

“Let’s say, John launches and cryptocurrency and calls it JohnDoeCoin. He sets up the blockchain in such a way that at the beginning there are 100 million JohnDoe’s (the so-called pre-mined tokens). Then, he goes to his friend William and asks if he wants to buy one JohnDoe from him for €10. According to the market cap definition, JohnDoeCoin now has a market cap of €1 billion and CoinMarketCap ranks it around the 10th place.”

The analyst believes that this way of raking cryptocurrency is “nonsense.” He suggests that instead, cryptos should be ranked based on the “nodes/peers that are active in the network and are involved in checking/approving the transactions.”

Rankings by number of nodes

Kwaasteniet stressed that for some tokens the only data available was provided on their own blockchain explorer. But, not all nodes in the network are counted in most cases.

On Nov. 24, for instance, the top 10 cryptocurrencies by the number of nodes/peers that were connected to their networks were: Horizen (ZEN), Bitcoin (BTC), Ethereum (ETH), Zcoin (XZC), PAC Global (PAC), Polis (POLIS), Dash (DASH), Zilliqa (ZIL), DigitalNote (XDN), and Gulden (NLG).

It is worth noting that this list represents a snapshot of how many nodes were connected on Nov. 24. And, these values can vary at any time. Kwaasteniet believes that this way of ranking cryptocurrencies is “fairer” and serves the purpose of Bitcoin’s developer, Satoshi Nakamoto.

He concluded:

“It is fairer to make a comparison between [cryptocurrencies] that have made more or less the same start and that have obtained and enlarged their circulation supplement through mining as Satoshi Nakamoto intended.”

The post Horizen (ZEN) ranked first by active nodes, while Bitcoin (BTC) second appeared first on CryptoSlate.

source https://www.tokentalk.co/Cryptoslate/horizen-zen-ranked-first-by-active-nodes-while-bitcoin-btc-second-5de2b0f13675c46b4ce215da

Cisco patent brings blockchain authentication to 5G networks @decryptmedia #Business #Blockchain #cisco #crypto #mobile

5G networks promise ultra fast mobile data speeds. Now blockchain could help to secure them

The post Cisco patent brings blockch...

5G networks promise ultra fast mobile data speeds. Now blockchain could help to secure them The post

source https://www.tokentalk.co/Decrypt/cisco-patent-brings-blockchain-authentication-to-5g-networks-5de274014bac230c3026ef77

The Bitcoin “halvening” is coming in 2020; what does it mean? @decryptmedia #Long Reads #bitcoin #bitcoin hashrate #bitcoin mining #bitcoin price #Halvening

Every four years or so, the reward for mining Bitcoin is halved. The next “halvening” is due next year; here’s how it’ll impact on Bitcoin’s price.

The post The Bitcoin “halvening” is coming in 2020; what does it mean? appeared first on Decrypt.

source https://www.tokentalk.co/Decrypt/the-bitcoin-halvening-is-coming-in-2020-what-does-it-mean-5de282124bac230c3026ef7c

Why Jack Dorsey is right about Bitcoin’s future in Africa @decryptmedia #Business #Africa #Binance #ghana #Kenya #nigeria #paxful #south africa #Tunisia #twitter #twitter cofounder jack dorsey #twitter's jack dorsey #Uganda

From peer-to-peer Bitcoin marketplaces to state-backed digital currencies, Africa’s crypto market is booming.

The post Why Jack Dors...

From peer-to-peer Bitcoin marketplaces to state-backed digital currencies, Africa’s crypto market is booming. The post

source https://www.tokentalk.co/Decrypt/why-jack-dorsey-is-right-about-bitcoins-future-in-africa-5de27f424bac230c3026ef7a

Bitcoin, murder and mafia on “Blockchain Island” Malta @decryptmedia #Business #bitcoin #crime #Daphne Caruana Galizia #malta

The assassination of journalist Daphne Caruana Galizia and the web of corruption she exposed threatens to topple the nation’s crypto-friendly administration.

The post Bitcoin, murder and mafia on “Blockchain Island” Malta appeared first on Decrypt.

source https://www.tokentalk.co/Decrypt/bitcoin-murder-and-mafia-on-blockchain-island-malta-5de263224bac230c3026ef74

Quitting Crypto Now is Akin to Selling Amazon in 2003: Analyst @newsbtc #Crypto #amazon #blockchain #crypto #dotcom #market

There is no doubt that the crypto industry hasn’t been doing too hot over recent months.

Since topping in June, Bitcoin (BTC) has collapsed by over 40%, falling from $14,000 to $7,800, where the cryptocurre...

There is no doubt that the crypto industry hasn’t been doing too hot over recent months.

Since topping in June, Bitcoin (BTC) has collapsed by over 40%, falling from $14,000 to $7,800, where the cryptocurrency sits as of the time of writing this. This price collapse has been marked by a capitulation in investors and other industry participants, with many throwing in the towel as they believe that Bitcoin’s price qualms are a sign that the future of blockchain and cryptocurrency remains in disarray.

Related Reading: Dr. Doom: Ethereum Still a Long Way From $0, Its True “Fundamental Value”

A former partner at Indus Capital and Goldman Sachs, however, believes that this harrowing sentiment is irrational, quipping that quitting crypto now is ” akin to selling Alibaba and other internet startups in 2000-2003.”

Don’t Quit Crypto, Analyst Asserts

A partner of The Spartan Group, a blockchain advisory and investment firm, recently released an extensive Twitter thread regarding their latest thoughts on the crypto industry.

The thesis of the individual, who goes by “SpartanBlack” on Twitter, is that there is a growing sense of despondency spreading amongst industry members, and is “putting crypto’s long-term growth” trajectory at risk.

0/ I used to think that crypto people are crazily optimistic, but lately a sense of despondency seems to be spreading. Even some of the early crypto diehards are sounding the industry’s death knells. This gloomy narrative is wrong and puts crypto’s long term growth at risk.

— SpartanBlack (@SpartanBlack_1) November 29, 2019

Indeed, he went on to explain that there are clear reasons for the pessimism spreading among the market: 1) despite 10 years of development, people within Bitcoin and cryptocurrency are still waiting on the “killer app that brings the industry and technology mainstream; and 2) funding for blockchain startups has collapsed due to a confluence of factors.

Related Reading: Going to Talk Bitcoin at Thanksgiving? Here’s a Good Strategy

Although what Spartan said may induce anxiety in investors, the analyst asserted that what is going on is healthy and that there remains an opportunity for much growth in crypto.

“Many projects are either dead or dying a slow death… This is the law of natural selection and is a healthy development. Investors now play a critical role in identifying who will be the long term winners. Our job is to find the Amazon and Alibaba of crypto out of the wreckage, rather than write-off the whole industry,” Spartan wrote in a seeming bid to reassure his followers.

Spartan continued by likening the current state of the crypto industry to that of the Dotcom industry in the wake of the blow-off top seen at the turn of the millennia, during which Internet stocks shed a majority of their value, projects died, and funding from external entities neared zero.

Should history repeat, the next cycle of innovation, which the analyst claimed will be driven by institutional investors looking to implement crypto into their portfolios, will identify killer use cases for this industry at long last.

Related Reading: Why Bitcoin Price May Soon Jump 15% to $8,500: Trader Who Foresaw Decline to $6,600

Featured Image from Shutterstock

The post Quitting Crypto Now is Akin to Selling Amazon in 2003: Analyst appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/quitting-crypto-now-is-akin-to-selling-amazon-in-2003-analyst-5de257e14bac230c3026ef72

No Bitcoin Capitulation This Year Could Indicate BTC Bottom Is In @newsbtc #Bitcoin #bitcoin price #bottom #capitulation #predictions

Bitcoin continues to crank higher as we end the weekend rounding out a week of gains. The move has led analysts to question whether the dump to $6,500 was the bottom and a trend reversal has finally begun.

Bitco...

Bitcoin continues to crank higher as we end the weekend rounding out a week of gains. The move has led analysts to question whether the dump to $6,500 was the bottom and a trend reversal has finally begun.

Bitcoin Edges Towards Resistance

There is still a long way to go before any measurable trend reversal can be confirmed. Today has been another of gains as BTC topped out at $7,850 a few hours ago. Glancing at the five day chart would paint a very bullish picture.

Zooming out to look at the whole month however tells a completely different story. Bitcoin has dumped almost 30% in November to bottom out in the mid-$6k zone. Since that trough on Monday it has recovered almost 20% but still has a lot of work ahead.

The next significant resistance zone is around $8,200 and beyond that it needs to push above $9k for technical indicators to start turning bullish.

Analysts have noted that unlike in 2018 when BTC dumped 50% in a matter of days, there has been no capitulation this time around, just a steady sell off over five months.

“Bitcoin has been down 50% since June, but there has not been any type of capitulation (like what we saw last November/December)”

Bitcoin has been down 50% since June, but there has not been any type of capitulation (like what we saw last November/December)

That’s something to always be prepared for in the back of your mind

Even another 40% down would set BTC up for a really nice higher low on weekly

— Crypto Capital Venture

(@cryptorecruitr) November 29, 2019

A further 40% down from these levels would put Bitcoin in the $4,600 area which is still higher than the 2018 bottom. This would entail a total correction of 67% however and cause a lot of anxiety within the industry.

Still, this correction would not be as heavy as last year’s when BTC dumped 84%. The crypto winter instilled a stronger sense of hodling which may be why the asset will not repeat those lows and could well have been at the bottom already for this bear run.

Day traders are enjoying these short term pump and dumps but those in it for the long run are looking for accumulation areas.

Elsewhere on Crypto Markets

Since Monday’s seven month low, total crypto market capitalization has grown by $30 billion, or 17%. While this sounds impressive, the overall trend is still bearish since markets have lost 24% since the beginning of November.

Since the beginning of the year things are still in the positive zone but that is largely due to Bitcoin. Most of the altcoins have lost all of their gains this year falling back to January levels. Some, such as XRP are at their lowest levels for two years.

Ethereum is another lack luster crypto asset as it fails to gain any independent momentum despite a network upgrade next weekend and a growing DeFi ecosystem. ETH prices are still low at $155 which is where they were back in early January during the depths of crypto winter.

This year’s bottom could have been in this week, but Bitcoin’s next direction will confirm it.

Image from Shutterstock

The post No Bitcoin Capitulation This Year Could Indicate BTC Bottom Is In appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/no-bitcoin-capitulation-this-year-could-indicate-btc-bottom-is-in-5de1edf14bac230c3026ef6c

Ethereum Researcher Arrested by FBI but ETH Price Unfazed @bitcoinist #Ethereum #News #News teaser #crypto #North korea #Virgil Griffith

Ethereum Foundation member Virgil Griffith was arrested on Thursday for traveling to North Korea to hold presentations regarding crypto and blockchain technologies and their use for evading sanctions. ETH price, however, has remained unaffected by the news.

Manhattan U.S. Attorney’s office released an announcement about arresting Virgil Griffith. Griffith is a US citizen and an Ethereum researcher, who allegedly provided the North Korean government with what was described as ‘highly technical information,’ knowing that it could and would be used for helping the country evade sanctions and launder money.

USA Berman: As alleged, Virgil Griffith provided highly technical information to North Korea, knowing that this information could be used to help North Korea launder money and evade sanctions. (1 of 2)

— US Attorney SDNY (@SDNYnews) November 29, 2019

The announcement adds that Griffith’s actions jeopardized the measures that were enacted by the US Congress, as well as the president himself, in order to put pressure on North Korea’s dangerous regime. The Ethereum foundation member did so after receiving several warnings against going to North Korea, according to Assistant Attorney General, John Demers.

Details of the Transgression

According to the authorities, Griffith went to North Korea back in April 2019, and he was finally arrested for his violation of the US laws on Thursday, November 28th, at the Los Angeles International Airport.

The FBI Assistant Director-in-Charge also added that,

We cannot allow anyone to evade sanctions, because the consequences of North Korea obtaining funding, technology, and information to further its desire to build nuclear weapons put the world at risk. It’s even more egregious that a U.S. citizen allegedly chose to aid our adversary.

Despite being the US citizen, Virgil Griffith (36) is actually a resident of Singapore, according to the announcement. The main charge against him revolves around conspiring to violate the IEEPA, which is a crime punishable with 20 years of imprisonment. Of course, Griffith’s sentence will be determined by the judge after his trial.

ETH Price Unfazed

For the moment, ETH’s price does not appear to be negatively affected by the news. In fact, the coin’s price sits at $155.81 at the time of writing, after seeing 1.59% growth in the last 24 hours.

What do you think about Virgil Griffith’s actions? Let us know your thoughts in the comments below.

Image via Shutterstock, Twitter: @SDNYnews

The post Ethereum Researcher Arrested by FBI but ETH Price Unfazed appeared first on Bitcoinist.com.

source https://www.tokentalk.co/Bitcoinist/ethereum-researcher-arrested-by-fbi-but-eth-price-unfazed-5de245214bac230c3026ef71

Bitcoin Price to ‘Trade Again at $8000 Soon’: Analyst @bitcoinist #Bitcoin Price #bitcoin price #btc #bullish #market bottom

Bitcoin price has had a very positive week on the back of probably its worst one this year. Since Monday’s dip, BTC has gained 18% to current prices. Chart patterns and the lack of a major capitulation could indicate that the bottom is in and the only way is up from here.

Bitcoin Price Closing on $8k

Bitcoin has ended a week of gains on a high note, pushing towards $8k again following a plunge to $6,550 on Monday. According to Tradingview.com BTC topped out at around $7,850 a few hours ago before pulling back to $7,750 where it currently trades.

The move marks the third significant upside push this week and an overall gain of 18% since the six month low. Hopium is starting to return to the scene following a 30% dump this month for bitcoin.

Its next targets on the upside are $8,100 and $8,500 beyond that. From there, things may start turning bullish again if this really has been the local bottom.

Trader and analyst Alex Krüger called that $8k will trade again this time last week when BTC was starting to crumble. He added that a bear market was descriptive of current events, rather than predictive of what comes next.

In a follow-up tweet yesterday Krüger added that the bottom has been ‘textbook perfect’ and things are about to turn positive again.

“Should be obvious why I believed $8000 “will trade again soon”, it’s where downtrend accelerated. The bottom is textbook perfect, many people quit in rage, Bitmex funding about to turn positive.”

My current $BTC roadmap. Should be obvious why I believed $8000 "will trade again soon", it's where downtrend accelerated.

The bottom is textbook perfect, many people quit in rage, Bitmex funding about to turn positive.

Nothing to chase if not long IMHO. pic.twitter.com/uPzJpKqd6f

— Alex Krüger (@krugermacro) November 29, 2019

Since mid-month BTC dominance has also started to creep back up as it closes on 70% again. The fear and greed index is moving out of the extremities and things are slowly starting to show signs of improvement.

There has been no major capitulation this year and the $6k zone may well have been the last higher low compared to 2018’s $3k zone. The long term trend is still up regardless of these wild price swings which those familiar with crypto markets should be used to by now.

Crypto Markets Moving

The bitcoin price lift has had similar effect on crypto markets today as total capitalization tops $210 billion. In five days over $30 billion has been poured back in but that has largely gone into BTC.

Ethereum has made a minor move to reach $155 and is eyeing further gains to $160. ETH is still very low however and has failed to break free of the movements of its big brother. There has also been an inordinate amount of FUD and tribalism from the crypto community which tarnishes the entire ecosystem.

Most altcoins are in the green at the time of writing though they still have a long way to go before any of them can be considered bullish.

Will bitcoin price reach $8,000 this weekend? Add your comments below.

Images via Shutterstock, BTC/USD charts by TradingView, Twitter: @krugermacro

The post Bitcoin Price to ‘Trade Again at $8000 Soon’: Analyst appeared first on Bitcoinist.com.

source https://www.tokentalk.co/Bitcoinist/bitcoin-price-to-trade-again-at-8000-soon-analyst-5de22ae14bac230c3026ef6f

Why is Russia Mirroring China’s Anti Crypto Stance? @bitcoinist #Bitcoin Regulation #News #crypto #Crypto ban #Ruble #Russia

Reports are emerging that Russia’s stance on crypto has turned negative. The news comes in the wake of a week of FUD stemming from another ‘bitcoin ban’ in China. It is no surprise that central banks do not favor decentralized currencies in a world where they’re racing to launch their own ones.

Russian Central Bank Negative on Crypto

Crypto markets are slowly showing signs of recovering from a six month low when another round of FUD has hit the media. According to local reports from state media, the Russian central bank would support a move to prohibit crypto assets being used for payments.

Reiterating that the Ruble is the only legal tender in the country the bank rehashed the tired old comments regarding money laundering and terrorism financing concerns (translation):

“We continue to believe that cryptocurrencies carry significant risks, including in the field of laundering of proceeds from crime and financing of terrorism, as well as in conducting exchange transactions due to sharp exchange rate fluctuations,”

The Bank of Russia continued with the negative rhetoric adding that it would support any move made by regulators to ban cryptocurrencies as a means of payments as confirmed by the deputy head of the banking regulation department of the Ministry of Finance, Alexey Yakovlev.

According to Izvestia, crypto-assets can currently be used for payments in some retail outlets and are accepted by freelancers as salaries.

There have been delays in legislation regarding the legal status of smart contracts, ICOs and crypto mining in Russia. Three bills were submitted to the State Duma in 2018 but only two have been adopted which address changes to the civil code regarding digital rights, as well as a law on raising funds using crowdfunding platforms.

Stifling Innovation

As yet there has been no official move towards a crypto ban in Russia but as in previous instances, the central bank has tendencies to reaffirm its status as financial overseer from time to time. These threats are not limited to Russia and have been issued by central banks across the world.

The reports continue to state that the Russian crypto community is preparing itself for a potential tightening of restrictions which could lead to a situation similar to China’s where the majority of trading goes underground or OTC.

Industry experts say a blanket crypto ban is not the answer but a regulatory framework would be the way forward if Russia is to remain competitive in the blockchain technology field.

Will Russia completely ban bitcoin and crypto? Add your thoughts below.

Image via Bitcoinist Media Library

The post Why is Russia Mirroring China’s Anti Crypto Stance? appeared first on Bitcoinist.com.

source https://www.tokentalk.co/Bitcoinist/why-is-russia-mirroring-chinas-anti-crypto-stance-5de219114bac230c3026ef6e

Why Expiry of CME Bitcoin Futures Suggests BTC Price to Soon Pass $8,000 @newsbtc #Bitcoin #bitcoin #CME #cryptocurrency #futures #luke martin

On Friday, the Chicago Mercantile Exchange’s cash-settled Bitcoin futures contract for the month of November was reported to...

On Friday, the Chicago Mercantile Exchange’s cash-settled Bitcoin futures contract for the month of November was reported to have expired by a number of analysts. While these financial derivatives are cash-settled, analysis by a top cryptocurrency trader suggests that the expiry of the monthly futures means that BTC has a positive price trajectory into the coming two weeks.

CME #bitcoin futures expiry today expecting volatility

— Cryptoboy

(@Crypto_Boy1) November 29, 2019

Related Reading: Eerie Bitcoin Fractal Suggests Bottom in at $6.6k, Surge to $8k Likely

Why BTC Price Likely to Surpass $8,000 Next Week

Popular CNN-featured trader Luke Martin recently released an analysis about the expiry of CME monthly futures and their effect on the BTC price. He found in his research (which factored in data going back to the June 2018 expiry) that BTC largely trends positively in the one or two weeks after the expiry of a future; Bitcoin sees a 2.9% average gain one week after expiry, and a 3.9% average gain two weeks after expiry.

Next $BTC CME expiration is on Friday 11/29.

I charted out price returns before & after expiration since the contracts started trading.

Takeaway: Generally experience selling pressure before and positive returns after. pic.twitter.com/bK6gp2h4sH

— Luke Martin (@VentureCoinist) November 25, 2019

Yes, an average 2.9% gain in a week isn’t that much by cryptocurrency standards, but these statistics show that Bitcoin’s directionality in the coming weeks should be positive should history repeat itself.

Martin’s analysis of the CME expiries corroborates other bullish analyses that have been proposed by investors in the industry. For instance, Velvet, a trader who partially foresaw the decline of BTC to under $8,000, then $7,000, wrote that he thinks Bitcoin is looking extremely bullish right now.

Per previous reports from NewsBTC, he remarked that BTC has finished a five-phase wave pattern, has bounced off the golden Fibonacci Retracement level at the 50-day moving average, and is in the midst of a giant falling wedge — all telltale signs that the cryptocurrency is about the surge higher. His chart implies a move to $8,600 in the coming days.

CME Futures Net Negative for Bitcoin?

While the expiry of the futures may be a net positive in the short term for the price of Bitcoin, some analysts are certain that the CME’s contracts are actually suppressing BTC from a long-term perspective.

Speaking to popular industry content creator Ivan on Tech, renowned Bitcoin educator Andreas Antonopoulos, said that the CME futures market likely has much to do with the decline in the price of BTC over the past two years:

“We know for a fact that when the Bitcoin bubble started to go up really fast in 2017, the U.S. Treasury decided to fast-track the deployments of futures markets in order to stop that bubble.”

The post Why Expiry of CME Bitcoin Futures Suggests BTC Price to Soon Pass $8,000 appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/why-expiry-of-cme-bitcoin-futures-suggests-btc-price-to-soon-pass-8000-5de211914bac230c3026ef6d

Friday 29 November 2019

Gladius Fails to Pay SEC Fines @securitiesio #Regulation #Gladius #gladius network llc #ICO news #security token

The blockchain-based cybersecurity firm, Gladius announced that the company dissolved this week. Unfortunately for Gladius token holders, the company chose to ignore the $12.7 million settlement payment the SEC imposed earlier in the year. Now, Gladius token holders are left holding the bag.

In what seems to be a growing trend, another SEC charged ICO dissolved before repaying investors. In this instance, Gladius received $12.7 in fines after self-reporting to the SEC in February. Understandably, the SEC showed some leniency towards the firm for their decision to self-report.

A Lenient Approach

As part of the SEC settlement, regulators didn’t impose any additional penalties on the firm. However, they did make the company executives agree to compensate investors fully. Also, the company was to register the tokens as securities. Gladius agreed to the terms but asked for multiple extensions on the repayment date. Rather than repaying investors, the company chose to dissolve.

Gladius Founder Max Niebylski

News of the Dissolution

Investors first received the bad news via a November 22 telegram post. In the post, the company’s co-founder and chief technology officer, Alex Godwin described the decision. He explained that the firm “ceased operations effective immediately.” He also stated that the firm “no longer has funds to continue operations.”

Rektiers

As you could imagine, investors are furious over the turn of events. Investors feel as if the SEC’s approach lacked enforcement. Investors have even formed a Telegram chat group called the Gladius Rektiers to organize another strategy to reclaim lost funds.

Gladius

Gladius entered the market in April 2017. The firm planned to utilize a combination of blockchain-based technologies to protect users. Specifically, the firm employed decentralized CDN and DDoS protection on the Ethereum Blockchain. Additionally, Gladius platform users could rent out unused bandwidth and computational power.

Gladius Website

Interestingly, Gladius executives did decide to leave their open-source code available on GitHub. The team even welcomed developers to further their protocol on their now deceased website’s homepage.

Dipping on the Bill

While the Gladius dissolution is bad news, it joins a host of other SEC charged ICOs who skipped out on their deadlines. For example, AirFox missed an October deadline this year. Airfox entered the market as a mobile banking solution before the SEC charged the firm with selling unregistered securities.

Additionally, Paragon Coin missed its investor repayment deadline. As part of Paragon Coin’s SEC settlement, the company agreed to offer to repay investors and pay $250,000 in fines. For their cooperation, the SEC withheld fraud charges. Also, the company agreed to register their tokens as securities and adhere to all relevant regulations moving forward.

The Paragon Coin saga received premier coverage as it involved a well-known beauty pageant winner and the rapper – The Game. Currently, the Paragon Coin website tells investors that want a refund to submit before November. Notably, their SEC repayment settlement date already pasted back in July.

The Gladius Saga Continues

The decision to dissolve prior to adhering to the SEC’s demands could prove to be a costly one for Gladius. For now, investors are culminating their outrage to organize their next maneuver. Many expect to see additional charges in some shape or form against the company’s owners as regulators decide how to handle the news and investor outcry.

The post Gladius Fails to Pay SEC Fines appeared first on Securities.io.

source https://www.tokentalk.co/Securities/gladius-fails-to-pay-sec-fines-5de1bc414bac230c3026ef6b

Overstock Shareholders Compete to Lead Class Against tZERO’s Parent @bitcoinist #Companies #News #News teaser #blockchain #overstock #Patrick Byrne #tZero

E-commerce giant Overstock faces a difficult period as several former and current shareholders fight for the status of lead plaintiff in a class action against the company.

Overstock’s tZERO Project Created to Be Used Against Short Sellers

The investors filed motions earlier this week in an effort to consolidate the five cases against Overstock and the appointment of a lead class counsel. So far, eight parties shared their intentions to lead the suit, including Cohen Milstein Sellers & Toll PLLC, Levi & Korsinsky LLP, Pomerantz LLP, Bernstein Liebhard LLP, Block & Leviton LLP, Bragar Eagel & Squire PC, Glancy Prongay & Murray LLP, and Kahn Swick & Foti LLC

The first complaint came from Benjamin Ha from Block & Leviton LLP. He claims that Overstock’s tZERO was established to punish short sellers who got rid of their Overstock shares, as the company was struggling with a declining dominance in the home goods e-commerce market.

The suit, filed on September 27 of this year, charges Overstock of securities fraud. Benjamin Ha proposes himself to represent any investor who bought company stock in the period between May 9 and September 23 of this year. The suit claims that Overstock hadn’t reported any profit in about three years because of its “hopeless struggle for market share” against Wayfair.com. Thus, the e-commerce giant invented a blockchain strategy to reorganize its business.

Overstock is charged with creating tZERO to artificially inflate its stock price by creating a “short squeeze.” In May, Overstock reported that it had doubled its revenue outlook for 2019. In parallel, it announced the launch of tZERO.

According to the suit, in September, investors discovered that the company “had engineered the tZERO offering as revenge upon short sellers and tried to create a short squeeze by offering a digital token dividend that would not be registered and could not be resold for at least six months.”

Stock Price Tumbled After Updated Projections

In the summer, short sellers couldn’t hand off their stock when they sold their shares because of tZERO’s digital token dividend lock. At one point, the price rose by over $10 to almost $27 and then deflated after investment banks announced they would accept cash instead of a cryptocurrency dividend. Thus, Overstock said it would register the stock to end the lockup.

Former Overstock CEO Patrick Byrne resigned in August and liquidated his stake, which was worth over $90 million at the time. Meanwhile, CFO Gregory J. Iverson left the company too, with Overstock investors being confused about the exit.

When Overstock presented its financial reports in September, which included insurance costs, the stock price tumbled over 50%. Investors then figured out that the company had misrepresented its operations and financial prospects over the summer, Ha claims.

Mangrove Partners Likely to Lead Counsel

While all shareholders compete to lead the counsel, Mangrove Partners Master Fund alleges much higher losses than the rest of investors. It claims it had lost a total of $27.5 million as a result of Overstock’s actions. Other class members alleged losses that don’t exceed $325,000.

The motion reads:

Since Mangrove Partners possesses the largest financial interest in the outcome of this litigation, it is presumed to be the ‘most adequate’ plaintiff.

The Mangrove Partners is represented by Cohen Milstein Sellers & Toll PLLC. The fund asked the court to appoint the firm as lead counsel, with Clyde Snow & Sessions PC serving to act as local liaison counsel.

Byrne Sold All His Overstock Shares

Patrick Byrne sold all his Overstock shares in September. The former CEO said that he had sold his remaining 13% stake but was still bullish on the company’s blockchain strategy.

Byrne left the company in August after media reported he had an affair with a Russian agent and offered important information to the US Justice Department about Russian involvement in the US 2016 election.

He then explained that the “Deep State” was behind Overstock’s struggle as it couldn’t secure decent corporate insurance. Byrne explained:

The proximate cause for my departure was, in fact, the impossibility of our getting corporate insurance with me still at the helm. Just as we learned in Game of Thrones that behind the scenes the Iron Bank makes the big decisions, in Corporate America insurance companies get the last say.

What is the future of tZERO under these circumstances? Share your thoughts in the comments section!

Images via Shutterstock

The post Overstock Shareholders Compete to Lead Class Against tZERO’s Parent appeared first on Bitcoinist.com.

source https://www.tokentalk.co/Bitcoinist/overstock-shareholders-compete-to-lead-class-against-tzeros-parent-5de12eb14bac230c3026ef4f

This analyst says there’s a “high chance” Bitcoin may never fall under $5k again @cryptoslate #Analysis #Price Watch

Once Bitcoin (BTC) started to incur strong losses in the second half of 2019, analysts were once again making extremely low price prediction...

-

App-enabled cryptocurrency exchange and wallet provider, Zebpay, has announced that it is enabling Lightning Network payments for all its ...

-

The Indian Ministry of Commerce and Industry announced yesterday that the Coffee Board in the country is integrating blockchain into the cof...

-

The pharmaceutical industry is one of the world’s few (almost) trillion-dollar verticals, worth more than $900 billion annually, according t...