- The total crypto market cap is currently placed nicely above the $162.5B and $164.0B supports.

- Litecoin (LTC) price is currently trading below $70.00, but it could recover in the short term.

- Bitc...

- The total crypto market cap is currently placed nicely above the $162.5B and $164.0B supports.

- Litecoin (LTC) price is currently trading below $70.00, but it could recover in the short term.

- Bitcoin cash price declined below $250 and it remains at a risk of more losses.

- EOS price is under pressure and it could face sellers near $4.65 or $4.70 in the coming sessions.

- Stellar (XLM) price is likely to make an attempt to regain the $0.1000 pivot level.

The crypto market cap is forming a breakout pattern, with range moves in bitcoin (BTC) and Ethereum (ETH). Altcoins such as litecoin (LTC), ripple, bitcoin cash, EOS, tron (TRX), and stellar (XLM) could correct higher.

Bitcoin Cash Price Analysis

Bitcoin cash price declined heavily in the past two days and broke the $260 and $250 support levels against the US Dollar. The BCH/USD pair even traded below the $235 level and recently recovered above $240. On the upside, there are many hurdles near the $245 and $250 levels.

A close above the $250 level could start a decent upward move towards the $265 and $270 resistance levels. On the downside, there are many supports near $235, $230 and $222.

Litecoin (LTC), EOS and Stellar (XLM) Price Analysis

Litecoin price settled below the key $75 support area and declined below $70. LTC price is currently correcting higher towards $71 and $72. Above the mentioned levels, the price is likely to correct higher towards the $75 resistance level in the near term.

EOS price declined below the $4.60 and $4.55 support levels. It found support just above $4.50 and it is currently correcting higher. An initial resistance is near the $4.65 level, above which the price may perhaps rise towards the $4.72 and $4.75 resistance levels. On the downside, the main supports for the bulls are $4.55 and $4.50.

Stellar price settled below the key $0.1000 support level and traded below $0.0950. XLM price is currently correcting higher and it is likely to make an attempt to regain the $0.1000 pivot level. On the upside, the next resistances are near $0.1040 and $0.1050.

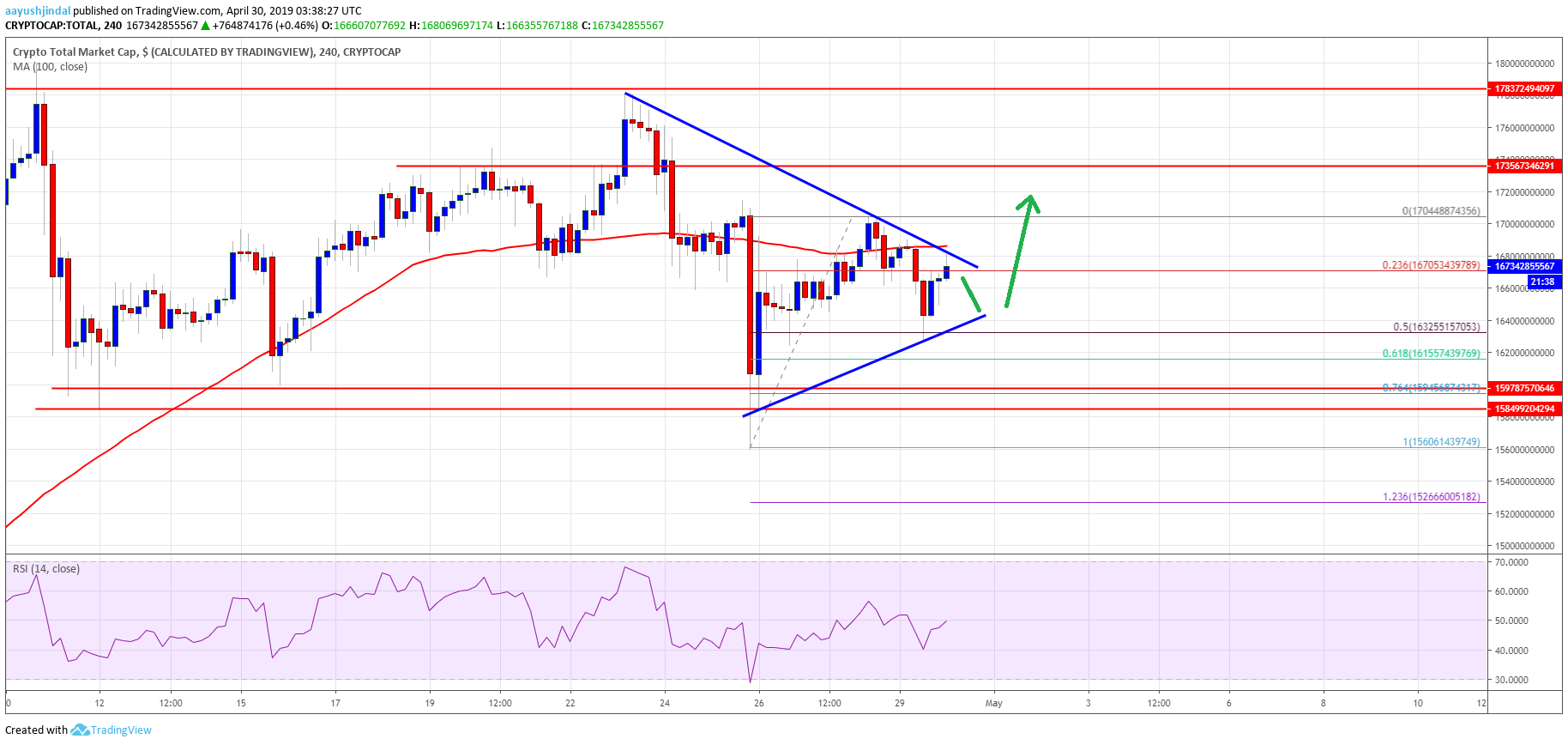

Looking at the total cryptocurrency market cap hourly chart, there was a break above the $168.0B level, but the $170.0B resistance prevented further upsides. The market cap is currently consolidating and trading inside a contracting triangle with resistance near the $168.0B level. If there is an upside break above $168.0B and $170.0B, the market cap could rebound higher towards the $175.0B resistance level. Conversely, a downside break below the $164.0B support might spark more bearish moves in bitcoin, Ethereum, EOS, litecoin, ripple, XLM, BCH, ADA, BNB, TRX, ICX, and other altcoins in the short term.

The post Crypto Market Approaching Next Break: Bitcoin Cash, Litecoin, EOS, XLM Analysis appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/crypto-market-approaching-next-break-bitcoin-cash-litecoin-eos-xlm-analysis-5cc7e461c7fba5022fe85ab4

Tuesday, 30 April 2019

Crypto Market Approaching Next Break: Bitcoin Cash, Litecoin, EOS, XLM Analysis @newsbtc #Analysis #Technical #BCH #Binance Coin #Bitcoin Cash #btc #eos #Litecoin #ltc #stellar #XLM

Subscribe to:

Post Comments (Atom)

This analyst says there’s a “high chance” Bitcoin may never fall under $5k again @cryptoslate #Analysis #Price Watch

Once Bitcoin (BTC) started to incur strong losses in the second half of 2019, analysts were once again making extremely low price prediction...

-

The Indian Ministry of Commerce and Industry announced yesterday that the Coffee Board in the country is integrating blockchain into the cof...

-

App-enabled cryptocurrency exchange and wallet provider, Zebpay, has announced that it is enabling Lightning Network payments for all its ...

-

Once Bitcoin (BTC) started to incur strong losses in the second half of 2019, analysts were once again making extremely low price prediction...

No comments:

Post a Comment