Weiss Crypto Ratings recently stated that China would never use Weiss Crypto Ratings recently stated that China would never use Bitcoin. The comments come after the nation’s Center for Information and Industry Development published the latest edition of its crypto rankings index.

The Global Blockchain Technology Assessment Index

China’s President Xi Jinping recently revealed that he wants his country to “take the leading position in the emerging field of blockchain.” Following Jinping’s remarks, the Vice Chairman of the Center for International Economic Exchanges Huang Qifan stated that the People’s Bank of China (PBOC) is going to issue the world’s first sovereign cryptocurrency.

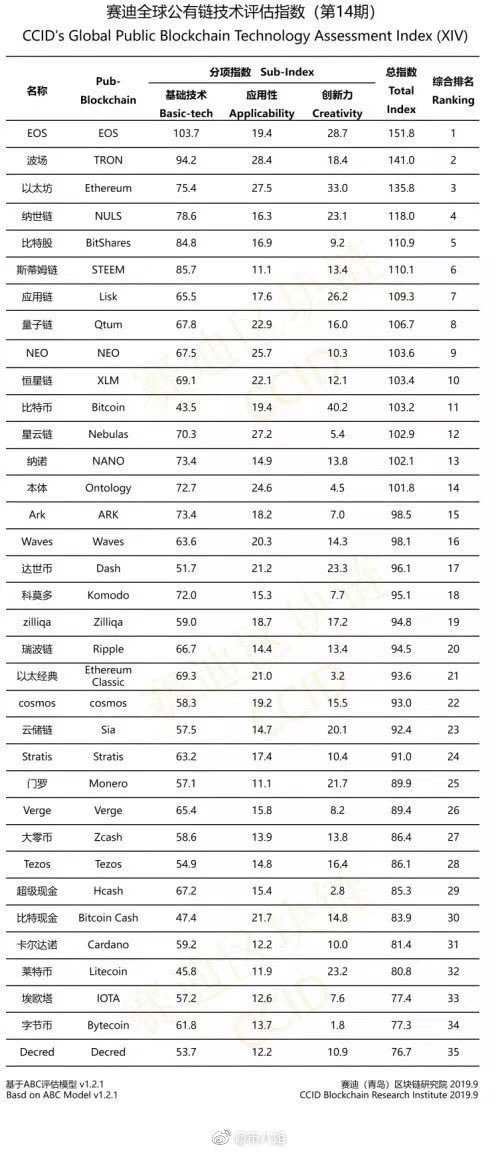

Now, the country’s Center for Information and Industry Development (CCID), a subsidiary of the Ministry of Industry and Information Technology, released the 14th edition of the Global Blockchain Technology Assessment Index. Created in May 2018, the index provides better technical consulting services for government agencies, business enterprises, research institutes, and technology developers, according to the CCID.

The latest assessments took into consideration 35 of the top cryptocurrency projects and ranked them based on the technology behind them, their applicability, and the type of innovation they bring into the world.

The No. 1 spot was taken by EOS, which has been leading the list since the second edition of the rankings. TRON and Ethereum took the No. 2 and No.3 spots, respectively, after the former moved up one place compared to the previous issue. Surprisingly, Lisk moved up to the No. 7 position while Bitcoin remains in the No. 11 spot.

NEM and GXChain, however, were removed from the index in spite of “a dynamic adjustment mechanism [that] were introduced to regulate the general public chain whose code replace fee is just too low,” said a spokesperson for the CCID.

Despite the popularity that the Global Blockchain Technology Assessment Index has in China, Weiss Crypto Ratings dismissed it.

Weiss Crypto Ratings

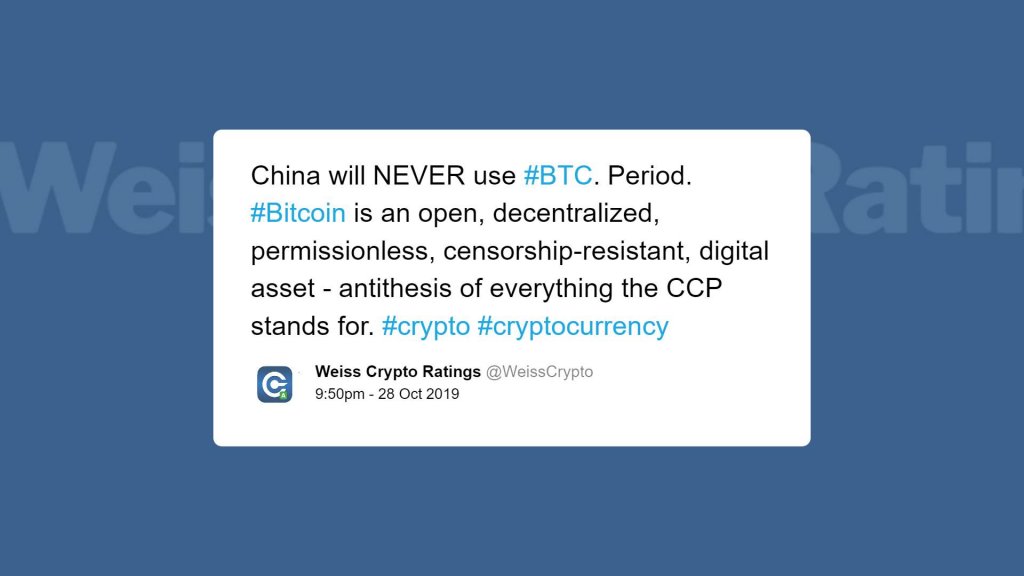

In a tweet, Weiss Crypto Ratings questioned the veracity of CCID’s blockchain index. The firm claimed that the only way EOS could be ranked No. 1 when compared to other cryptocurrencies is by the high levels of centralization it presents.

Weiss went as far as to suggest that “China will never use Bitcoin” since this is an “open, decentralized, permissionless, censorship-resistant” cryptocurrency. And, these attributes do not align with what the CCID stands for.

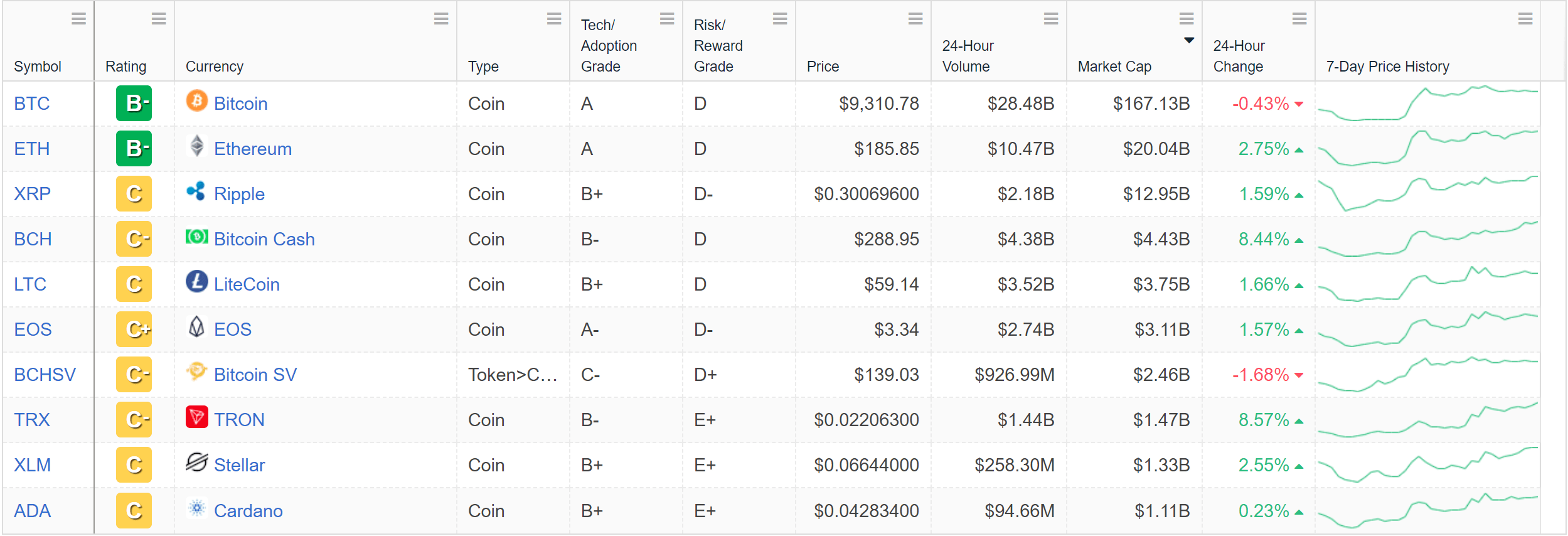

Weiss also offers cryptocurrency ratings that are published every week. The company’s grading scheme takes into consideration a model that analyzes multiple data points on each crypto’s investment risk and reward, technology, and adoption in the real world.

Under Weiss criteria, Bitcoin and Ethereum have a B- rating while EOS has a C+. Other cryptocurrencies such as TRON and Lisk have a C- and D+, respectively.

The ratings provided by both the CCID and Weiss Crypto Ratings aim to help investors make the right choice when deciding whether to invest in any given cryptocurrency. But, the assessments are not financial advice.

As China continues to push the adoption of blockchain technology, Weiss remains skeptical. Weiss Crypto Ratings said:

“Chinese take on blockchain is a perversion of the intended use-case for the technology.”

The post Weiss Ratings: China will never use Bitcoin, EOS is number one rated crypto appeared first on CryptoSlate.

source https://www.tokentalk.co/Cryptoslate/weiss-ratings-china-will-never-use-bitcoin-eos-is-number-one-rated-crypto-5db8f082a76ca7d120e8eac4

No comments:

Post a Comment