As Bitcoin (BTC) has entered a launchpad-like state, finding itself in a lull as sentiment is beginning to trend positive again, institutions have started to accrue long positions of the cryptocurrency. This may imply t...

As Bitcoin (BTC) has entered a launchpad-like state, finding itself in a lull as sentiment is beginning to trend positive again, institutions have started to accrue long positions of the cryptocurrency. This may imply that the crypto market is about to see its next leg higher.

Related Reading: Crypto Tidbits: Bitcoin Stuck In $9,000s, Starbucks Cryptocurrency Payments, Canada’s BTC Fund

CME Institutional Users go Long

According to a recent analysis by cryptocurrency analytics firm Skew Markets, institutional longs on the Chicago Mercantile Exchange’s Bitcoin futures market has hit a one-month high, reaching around 1,300 BTC worth of contracts. This is up by over five times from the bottom near 250 BTC seen in late-September.

Skew added that institutions are now net long 880 BTC contracts, compared to 660 BTC the previous week, as short positions have fallen because institutions are likely expecting a breakout in the upward direction.

Institutional longs at CME – one month high

Could we see a breakout soon > 1.5k BTC? pic.twitter.com/y9SmywwVE0

— skew (@skew_markets) November 2, 2019

Institutions, as defined by the CME, are pension funds, endowments, insurance companies, mutual funds and those portfolio/investment managers whose clients are predominantly institutional.

Shortly after Skew revealed that institutional longs are rising, it added that Bakkt’s Bitcoin futures market recently saw total open interest cross $1 million with ramping-up volumes.

While some argue that institutions know no more about Bitcoin’s directionality than retail investors like you or I, some have argued that this is untrue. As reported by NewsBTC previously, popular crypto trader Romano argued that institutions using the CME “have a good track record for the right directional trade,” having shorted BTC ahead of the Bakkt launch and the subsequent crash.

Bitcoin Bull Case Grows

This change in institutional attitude, of course, comes after Bitcoin’s historic rally from $7,300 to $10,500 last month, which rekindled sentiment that crypto is in the midst of a raging bull market.

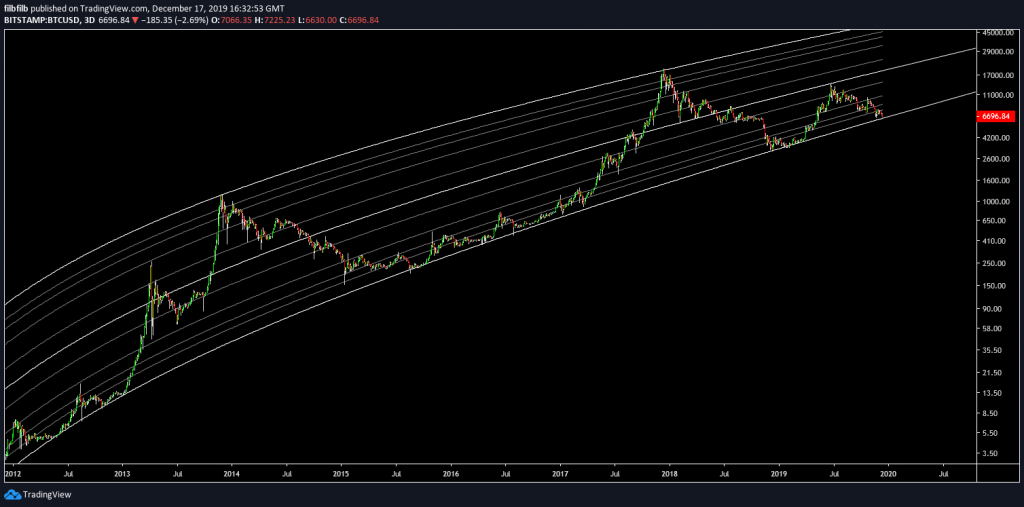

Funnily enough, there are some technical trends that support this. For instance, a Brave New Coin analyst noted that the Alligator indicator, when applied to Bitcoin’s chart, has flashed its first long entry in a while. He added that the cryptocurrency has recently broken above a triangle, implying a measured move to the $11,300 to $12,300 range, where the middle line of one of the analyst’s pitchfork channels lies.

Also, a trader going by HornHairs has found that Bitcoin has closed the month of October extremely strong. He remarked in a recent tweet that with Bitcoin bouncing strong and holding above the one-month bullish breaker, the 0.618 Fibonacci Retracement of the entire cycle, the Point of Control as defined by the volume profile, and the yearly pivot, BTC is leaning rather bullish.

Related Reading: Analyst: Bitcoin May See 30% Rally to $12,000 as Price Breaks Out

Featured Image from Shutterstock

The post Institutions Accrue Bitcoin Long Positions as Price Looks to Break Past $9,300 appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/institutions-accrue-bitcoin-long-positions-as-price-looks-to-break-past-9300-5dbee9913b5a709c14f64bdf

No comments:

Post a Comment