- Bitcoin price is struggling to climb above the $11,500 and $11,600 resistances against the US Dollar.

- The price is holding the key $11,200 support, but it remains at a risk of more downsides.

- The...

- Bitcoin price is struggling to climb above the $11,500 and $11,600 resistances against the US Dollar.

- The price is holding the key $11,200 support, but it remains at a risk of more downsides.

- There are two key bearish trend lines forming with resistance near $11,400 and $11,600 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The price could decline heavily if there is a break below the $11,200 support area in the near term.

Bitcoin price is showing bearish signs below $11,500 against the US Dollar. BTC price might soon decline below the $11,200 support and extend losses towards $10,500.

Bitcoin Price Analysis

Recently, bitcoin price traded below the key $11,500 support area against the US Dollar. The BTC/USD pair also settled below $11,600 and the 100 hourly simple moving average. It opened the doors for more downside and the price spiked below the $11,200 support. Finally, a swing low was formed at $11,112 and the price recently settled above the $11,200 pivot level.

Moreover, there was an upside correction above the $11,400 level. However, the recovery was capped by the $11,600 resistance area. More importantly, the 50% Fib retracement level of the decline from the $11,976 high to $11,112 low acted as a resistance. The price is now trading with a bearish angle below the $11,500 level. Besides, it is testing the 50% Fib retracement level of the upward move from the $11,112 low to $11,581 high.

On the downside, there is a strong support near the $11,200 level. The 61.8% Fib retracement level of the upward move from the $11,112 low to $11,581 high might also act as a support. Therefore, a downside break below the $11,200 support could start another drop. The next major support is near $11,000, below which bitcoin price could decline towards $10,500 (as discussed in the weekly forecast).

On the upside, there are many hurdles near the $11,500 and $11,600 levels. Moreover, there are two key bearish trend lines forming with resistance near $11,400 and $11,600 on the hourly chart of the BTC/USD pair. Therefore, a successful close above the $11,500 and $11,600 levels is needed for a fresh upward move.

Looking at the chart, bitcoin price is clearly struggling to recover above the $11,600 resistance and the 100 hourly simple moving average. As long as there is no daily close above $11,600 and $11,800, there is a risk of more losses in the near term.

Technical indicators:

Hourly MACD – The MACD is gaining momentum in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is currently moving lower and is below 50.

Major Support Levels – $11,200 followed by $11,000.

Major Resistance Levels – $11,500, $11,600 and $11,800.

The post Bitcoin (BTC) Price Technical Bias Favors More Downsides appeared first on NewsBTC.

source https://www.tokentalk.co/NewsBTC/bitcoin-btc-price-technical-bias-favors-more-downsides-5d5250f16fe5556e3f9473ac

Monday, 12 August 2019

Bitcoin (BTC) Price Technical Bias Favors More Downsides @newsbtc #Analysis #Technical #bitcoin #btc

Subscribe to:

Post Comments (Atom)

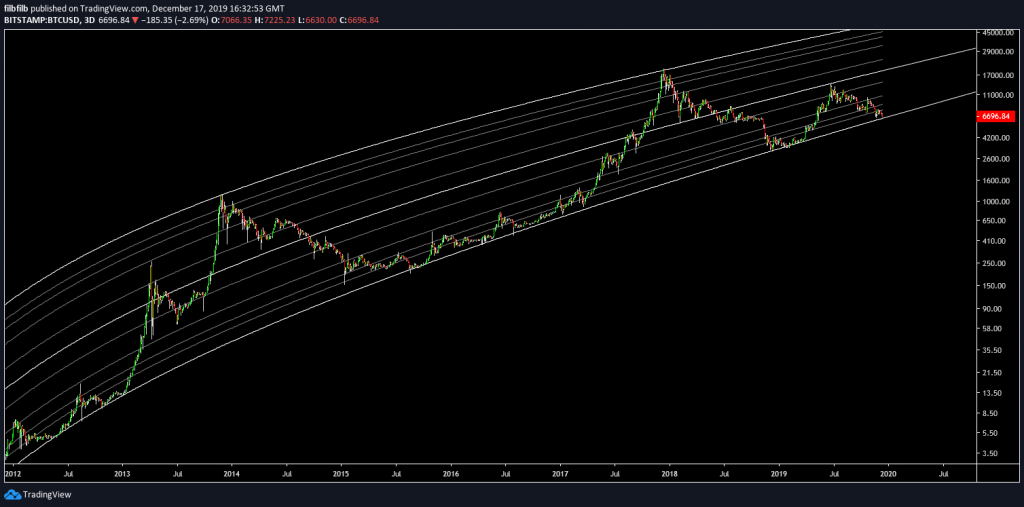

This analyst says there’s a “high chance” Bitcoin may never fall under $5k again @cryptoslate #Analysis #Price Watch

Once Bitcoin (BTC) started to incur strong losses in the second half of 2019, analysts were once again making extremely low price prediction...

-

The Indian Ministry of Commerce and Industry announced yesterday that the Coffee Board in the country is integrating blockchain into the cof...

-

App-enabled cryptocurrency exchange and wallet provider, Zebpay, has announced that it is enabling Lightning Network payments for all its ...

-

Once Bitcoin (BTC) started to incur strong losses in the second half of 2019, analysts were once again making extremely low price prediction...

No comments:

Post a Comment