This free preview of The Block Genesis is offered to our loyal ...

This free preview of The Block Genesis is offered to our loyal readers as a representation of the valuable journalism & research our team produces and Genesis members receive daily. Want to see more? Join today.

Non-Fungible Tokens

Non-Fungible Tokens are tokenized, blockchain-based provably scarce, non-divisible collectible items. They are commonly found on the Ethereum blockchain.

The process for creating an NFT works as follows: an issuer uploads an image to an NFT-issuance platform, after which a transaction is created on the Ethereum blockchain. This transaction creates and transfers a token uniquely associated with that image to the issuer’s wallet. The transaction is digitally signed by the issuer, which proves the authenticity of the token.

The image itself is distributed to the InterPlanetary File System (IPFS), a distributed file storage network. The IPFS network names the image with a unique code that uniquely matches its content. This means that the same image, even if distributed over several nodes of IPFS, will always have the same name and will be conceptually identified as a single resource.

The Non-Fungible Token standard —ERC-721 — was initially introduced and popularized by Crypto Kitties in late 2017. Since then, the NFT use case has proliferated beyond digitized cartoon kittens to include digital art, digital land, and more traditional forms of collectibles like baseball cards.

NFT use cases

There are three primary, non-mutually exclusive use cases for NFTs:

1. Speculation

The act of buying an NFT asset purely in the expectation of future gains. A recent Formula 1 NFT sold for 415.9 Ether at the end of May, valued at roughly $100,000. The current record for highest priced NFT is a the Dragon CryptoKitty, sold for $170,000 in September 2018.

2. Holding for aesthetic and sentimental purposes

The act of purchasing an asset purely for the subjective value it provides its owner without any explicit intention to sell at a later date or higher price.

3. Using the NFT within supported application

The act of using one’s NFT for productive purposes. In the context of CryptoKitties, this could be to breed new kittens. For Gods Unchained, each NFT card can be used within the game itself.

NFT market structure

Continued experimentation and growing potential within the NFT asset class has led to the development of NFT-specific market structure, primarily in the form of auction listing sites like OpenSea, SuperRare, and R.A.R.E. These sites allow NFT owners to list their assets both at a fixed ‘buy-now’ price and through a first-price continuous bidding structure. In the latter case, prospective buyers submit bids and the artist agrees to any bid that they find attractive.

OpenSea is currently the most popular auction platform, likely due to the platform creators’ decision to list NFT assets across a range of categories. According to DappRadar, Seven day volume sits at 500.26 ETH, worth roughly $100,000, while the platform boasts 575 users and 2,100 transactions over the same period.

SuperRare, a platform directly focused on the digital art market, has performed less well over the same period, with just 19.46 ETH (~$4,000) worth of volume, 65 users, and 375 transactions over the same period.

More recently, the Wrapped Crypto Kitty product has emerged, allowing Crypto Kitty owners to essentially transform their distinct assets into a fungible token class. WCK can then be used to either trade for Ether via a Uniswap ETH-WCK pool or to buy more kitties from WCK-accepting vendors on OpenSea.

State of market

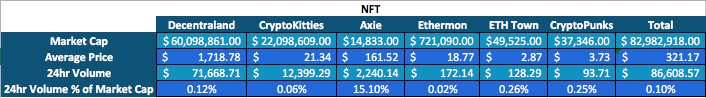

According to data from NFTmarketcap.co, the combined market cap of the top 6 NFT assets is slightly over $83,000,000, while daily average volume sits at just over $86,700. This means that just 0.104% of the value of the asset class’ market cap is being traded on a daily basis. Typically, a liquid asset is one in which roughly 5% of its market capitalization is traded on a daily basis.

The relatively dire state of NFT liquidity relative to market capitalization may be expected due to the very nature of their non-fungibility: the exclusive nature of each item means that the range of willing buyers and sellers is naturally limited.

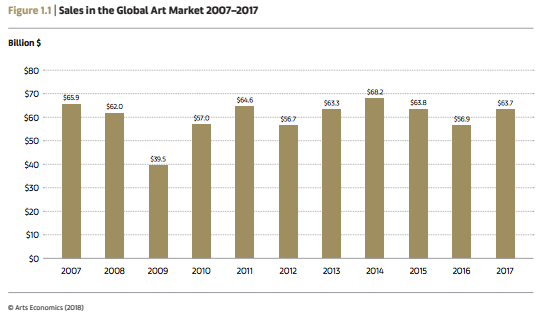

However, estimates from the traditional art world, suggest that there is still room for growth in liquidity. UBS notes that in 2017 global art sales arrived at $63.7bn while art market analysts estimate the size of the total art market to be somewhere in the low trillions of dollars. If we conservatively take the global art market to be valued at $3tn we arrive at a volume as a percentage of market cap of 2.23%, roughly 22 times larger than that of the NFT market.

Source: UBS

The importance of liquidity

Market participants should aspire for liquidity trading venues due to their ability to reduce transaction costs via price discovery. The more buying and selling activity, the more information is gleaned as to how the market is pricing a good. This information provides both prospective buyers and sellers a means of informing their bids and asks, ensuring that neither party grossly overpays or undersells versus fundamental price. The desired endstate of resource allocation mechanisms – i.e. markets – is that assets are distributed to those that value them the most.

Of course, as non-productive and non-yielding goods, NFTs, both in the blockchain and traditional worlds, are inherently resistant to fundamental pricing models. In the traditional art market, this pricing difficulty has spawned an entire industry of appraisers. With value purely subjectively derived there will often by major discrepancies between individual valuations. Nevertheless, in theory, liquid markets can provide insight into how market participants are each individually valuing an asset, and ultimately aggregate these valuations into a single price.

Top Trading Cycle

The deficiencies of existing NFT market structure suggest that an entirely new trading mechanism is required in order to engender more efficient price discovery and ultimately a more efficient allocation of resources.

One appropriate mechanism is the Top Trading Cycle (TTC) algorithm, developed by Professor David Gale and later enumerated upon by Herbert Scarf and Lloyd Shapley in their 1974 paper, On cores and indivisibility. TTC has historically been applied to housing and public school selection, although, due to its ostensible complexity, has largely been relegated to the annals of academic matching theory.

For the following example we will imagine that we have a set of 5 students: Student1, Student2...Student 5, and 5 possible dorm rooms: ‘a’, ‘b’...’e’.

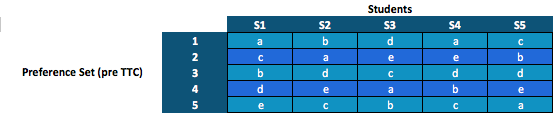

At the beginning of the exercise ,each student lists their set of preferences in descending order.

Student1’s first preference is 'a' and their fifth preference is 'e'.

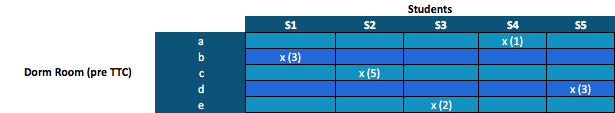

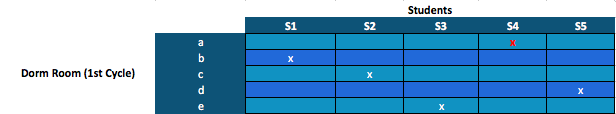

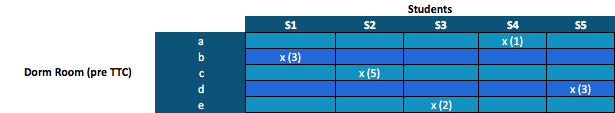

Before the TTC begins, each student is randomly assigned a dorm room. The results are as follows:

Student1 has been assigned dorm room ‘b’, their 3rd preference. Student 2 has been assigned dorm room ‘c’, their 5th preference.

The Top Trading Cycle begins once the initial allocation has concluded and the preference sets have been submitted. The rules of TTC note that there must be at least one match each cycle.

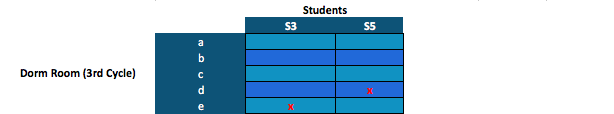

In this instance, the first cycle produces the following outcome:

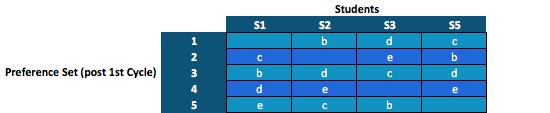

Student 4’s first preference is dorm room ‘a’ and their random assignment was also ‘a’. Resultantly, Student4 keeps their allocation and is removed from the set of participants. Now that dorm room ‘a’’ has been removed from the set of assets, the updated preference sets for the remaining students are as follows:

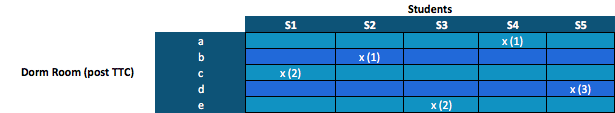

Based off this updated preference set, the 2nd cycle commences, producing the following outcome:

A match is found between Student1, who was initially allocated room ‘b’, and Student2, who was initially allocated room ‘c’. Student1’s second preference is room c, while Student2’s first preference was room b. Considering the assets remaining in the pool, it is most mutually beneficial for the two to swap. While Student5’s first and second preferences were ‘c’ and ‘b’, as the current tenant of dorm room ‘d’ there is no immediate match to be found between either Student1 or Student2.

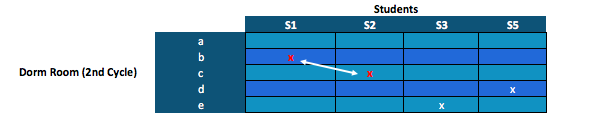

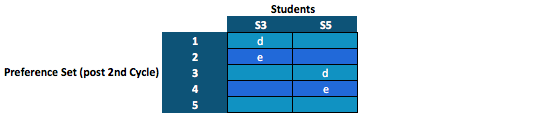

After this second cycle just Student3 and Student5 remain. Their updated preference set is as follows:

The table above illustrates that Student3’s first preference is dorm room ‘d’, while Student5’s top remaining preference is also ‘d’. As the present tenant of dorm room ‘d’, Student5 is given priority over its allocation. Student3 is then left with dorm room ‘e’, their originally allocated dorm room.

Comparing the initial random allocation and the final allocation based on intersecting preference sets produces the following results:

That is, students 1 and 2 both benefited from the TTC process, switching out their 3rd and 5th preferences for their 2nd and 1st preferences, respectively. The TTC process was neutral for the remaining students, with Student4 assigned their 1st preference and students 3 and 5 assigned their 2nd and 3rd preferences respectively. It is crucially important to note that no student was assigned a dorm room that was subjectively worse than their randomly assigned allocation.

At first the TTC process may seem confusing and unfair – how can we justify the fact that, say, Student1 was assigned dorm room ‘c’, their second preference, over Student5, where ‘c’ was their first preference? Indeed, it is this apparent complexity and injustice that forced school administrators to stop using the TTC in New Orleans.

Although perhaps non-obvious, the TTC has two unique properties that make it a particularly helpful matching algorithm.

The first is Pareto Efficiency: TTC treats the participant as a whole, finding the optimal allocation that will satisfy all preference sets. A state is said to be Pareto Efficient if there is no way of changing the ultimate allocation without decreasing net welfare.

The second property of TTC is that it is said to be Strategy Proof. An asymmetric game is strategy proof when truthfully revealing private information either maximizes welfare or is neutral to the outcome, regardless of other agent behaviour. This is beneficial from a user experience perspective as revealing truthful preferences is the most intuitive course of action. Research from Shengwu Li of Stanford University demonstrates that TTC is not ‘Obviously Strategy-Proof’ – i.e. there may be advantages to not publicly revealing preference sets – but it is good enough for the purposes of this exercise: users cannot ‘lose’ from participating and revealing their true preferences.

Applying TTC to NFTs

TTC is aptly suited for goods without obvious reference prices and where value is subjectively derived. Although it is theoretically possible to use TTC to allocate assets with obvious reference prices — e.g. a set of Bitcoin, Ether, Litecoin, XRP, Bitcoin Cash — this will be an unproductive exercise as preference sets will likely always be ordered by decreasing value: as such no trades take place.

The existing state of the NFT market is inefficient, characterized by insurmountable bid-ask spreads. TTC provides a means for NFT owners to trade their inherently subjectively valued assets without a common medium of exchange. If a match takes place we can be sure that it was mutually beneficial to both parties based on their respective subjective valuations.

Despite not requiring a monetary medium of exchange, analysis of order of preferences can be used to assign some relative value rank to each participating item. In this sense the TTC is symbiotic with regular auction market places in that it helps surface latent relative value, which can then be translated into reserve money-denominated prices.

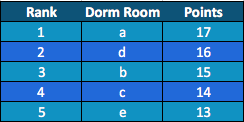

Using the above student dorm example: we can use a preference point system, assigning 5 points to a dorm if it a student’s first preference, 4 points for a second preference and so on.

This produces the following rank:

If this process is repeated over multiple cycles using the same available assets, one can start to collect large preference set data sets and use that in explicitly-priced markets. By example, if dorm room ‘d’ has accrued more points than dorm room ‘a’ after 100 cycles it may be prudent for the owner of dorm room ‘d’ to set their ask price higher than that of dorm room ‘a’ on an auction platform. Meanwhile, dorm room ‘e’, which has underperformed alternative assets over 100 cycles, should presumably be priced lower than both dorm room ‘a’ and ‘d’.

ttcX

The Top Trading Cycle algorithm can be implemented as a non-custodial exchange using Ethereum smart contracts. Various developers estimate implementation time for the single TTC contract to range from one to two weeks worth of work. Further audits may extend this to one month. The purpose of this piece is to introduce the TTC concept and its applicability to the NFT ecosystem and, hopefully, inspire ecosystem members to collectively build a minimum viable ttcX product.

Similarly to Tornado Cash, a recently deployed on-chain mixer, users would deposit their NFT assets into a single pool and wait for either a minimum threshold participant set or a certain period of time to elapse before the sorting process starts. Intuitively, the larger the participant set the higher the user cognitive overload. As such, I suggest a maximum threshold should be set at 10 NFTs.

The Top Trading Cycle algorithm protocol, tentatively dubbed ttcX, would serve as a public utility for the Ethereum ecosystem. Like Uniswap, ttcX is non-rent seeking, with zero fee necessary to participate aside from gas costs. A liquidity provider fee, levied in Uniswap as a means of incentivizing pool liquidity, is not explicitly necessary as, by definition, participants cannot be left worse off than they started. However, some scheme whereby the first, say, 5 users to deposit NFTs into the pool are paid 1 DAI by the remaining 5 users may prove to be useful in order to incentivize a base level of participation at the outset of ttcX’s life cycle.

A simple user interface will also be necessary, guiding users through the process of depositing their NFTs and selecting the descending order of preferences. The ttcX protocol could also be directly integrated into wallet providers, both mobile and desktop, serving as an ancillary feature for wallet users wishing to exchange their NFT holdings in a provably Pareto Efficient manner.

For further discussion of the benefits of ttcX and implementation details, please visit the ttcX Telegram group.

ttcX is largely a product of conversations with Kristoffer Josefsson and River Keefer.

source https://www.tokentalk.co/The Block/ttcx-applying-the-top-trading-cycle-algorithm-to-nft-exchange-5d574ce1258d9c984bf85b70

No comments:

Post a Comment